Many developing countries are considering developing a Life Sciences industry as a means of driving growth given the breakneck levels of investment pouring into new innovations. Whereas traditionally multinational pharmaceutical companies (based in the developed countries) executed all their R&D projects in house, the market dynamics have been changing over recent years and this could open opportunities for new entrants in developing countries as well.

An Opportunity in the Making: Biotech Development

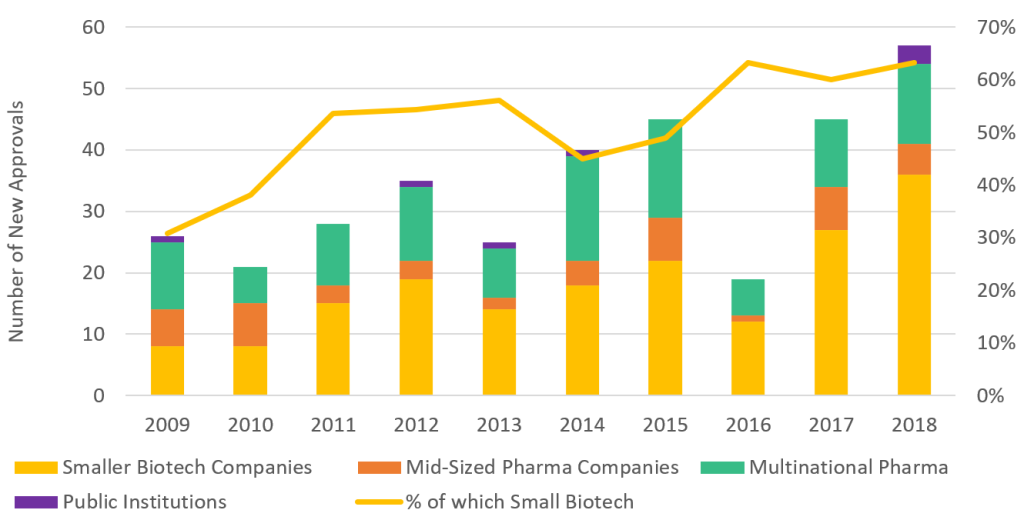

Multinational pharmaceutical companies have been increasingly sourcing new IP from a variety of small biotech firms that specialize in drug discovery (the very early stages of R&D). Small biotech firms are responsible for nearly 70 percent of new drug approvals in the US (figure 1) and are much better at seeing results from it. A Deloitte report suggests that they can generate a return of 9.3 percent on R&D compared to 1.9 percent for multinational pharmaceutical firms; this shows an obvious comparative advantage over Big Pharma.

These biotech firms are typically small (often upstart) companies that employ scientists and engineers that will work on pushing the frontiers of applied science, advancing their research to the point where it can be licensed or sold to Multinational Pharmaceutical firms, which have better expertise at bringing products through clinical trials, gaining regulatory approval, and then taking it all the way into the market. Successful biotech firms that have reached maturity can have turnover anywhere from $50 million – $500 million per year. However, there have been very notable recent cases where the reward has been even much higher than that. For such small companies, this is big money!

There is a lot of money to be made in this business, and the changing industry structure means that you no longer need to be a large multinational to take part. This opens the door for small biotechs in developing countries to flex their own intellectual muscle. In fact, biotech companies have started to pop up in many emerging markets. An explosion of biotechnology publications in Eastern Europe, Asia, Latin America, and even Africa starting from the early 2000’s is indicative of the talent that is waiting to be further cultivated. In the next decade such trade in IP could become increasingly prevalent as Multinational Pharmaceutical companies continue to scour the globe for the most innovative research teams and their assets.

However, private firms in developing countries are finding it difficult to participate for a number of reasons that are structural to the industry itself. Biotech firms need seed financing typically between $500k and $1 million in the first couple of months to get them started. Studies on cost of discovery suggest that a full research project can take more than 4 years and up to $400 million (or $1 billion using capitalized costs); however often it is much less. This is just to get to a stage where a drug can be eligible for a clinical trial…meaning the product isn’t even on the market , and so there are no revenues yet. That can take another 5-7 years on average (figure 2). So there is a particularly large ‘valley of death’ for this industry as compared to other technology based sectors. With the industry becoming increasingly de-vertically integrated, firms have to be creative in how they bridge this valley by finding investors and making technology licensing deals with other biopharmaceutical firms to generate revenues before the products are brought to market.

Raising this type of capital is challenging in developing countries. Because only 5–10 percent of projects make it to product approval, it is too risky for traditional forms of capital. So many international biotechs have looked for funding in the US or Europe, where the industry is supported by specialized venture capital that can bankroll early stages of the product lifecycle. Venture capital often comes with the type of advice that these young scientists – particularly those in developing countries – need to navigate the international market. But many biotech firms often feel the need to reincorporate in more developed countries (like the US or Western Europe) in order to better access capital and enabling regulatory structures. Unless developing countries improve their business environment, their own biotech firms will offshore their taxable profits to the developed world. So there is a lot to lose if developing country governments do nothing.

Governments – and dynamic ministers like the fictional Ms. Ivanova – are increasingly interested in easing the costs of investment for new biotech startups. For the countries that have an existing base of medical science researchers, it will be important to support a specialized and vibrant domestic venture capital network that can take risks to support healthcare innovations. Raising capital will not be enough. In addition, governments can utilize a robust innovation policy to create an enabling biotech ecosystem in their domestic market. For instance, they could work on:

- Establishing specialized technology transfer offices that can commercialize applied research from public universities and institutes.

- Financing cutting-edge R&D through partnerships with biotechnology and medical technology startups (e.g. NIH Small Business Innovation Research Grants) and

- Supporting the creation of specialized biotech incubator labs, where new startups can be born.

- Facilitating clinical trials, regulatory modernization, and fair and balanced intellectual property protections that help companies bring new treatments to market.

Many of our government partners are working on programs that facilitate startup growth in biotech. One World Bank project in particular – Innovate in India for Inclusiveness – is facilitating innovation in biopharmaceutical products and medical devices. While still ongoing, it has already helped advance over 50 products at least one step on the product development pathway.

Without structured public support, progress can be slow, because of the industry’s risk profile and the market failures that are inherent in it. For countries that are ready, involved government that harnesses the innovative capacity of the private sector will be key to the success of new biotech innovations. In time, developing nations could create innovative new therapies that rival the best technologies of the developed countries!

Join the Conversation