This is the eleventh in our series of posts by students on the job market this year

Researchers, policymakers and aid organizations have devoted lots of attention to improving access to credit and, increasingly, insurance for small firms and farms in developing countries. Yet some recent papers find puzzlingly weak effects of insurance and credit on growth and profits (Cole et al. 2014, Banerjee et al. forthcoming).

One potential explanation may be that in developing countries, it’s not just financial markets that have imperfections, but that other key markets, such as markets for labor and land, have problems, too. In particular, high costs of supervising or finding trustworthy employees may make it expensive to add labor (Eswaran and Kotwal 1986, Fafchamps 2003, Foster and Rosenzweig 2011). For farms specifically, missing land markets may further constrain expansion (Goldstein and Udry 2008, Adamopoulos and Restuccia 2014).

It is easy to see how these factor market constraints have the potential to mute the impact of not just financial interventions, but any attempt to relax barriers to firm or farm growth. However, so far, there is little research on whether this interaction exists. In my job market paper, I address this gap by answering the question: Do constraints in labor and land markets weaken the impact of relaxing financial constraints?

A new look at two experiments

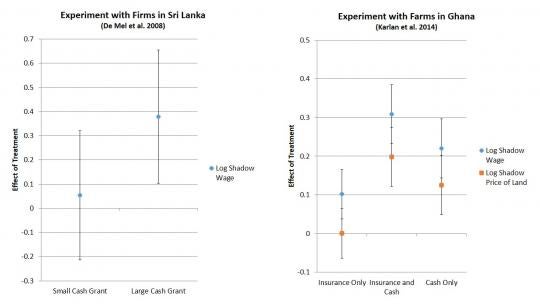

To answer this question, I use two randomized experiments that relaxed financial frictions alone. The first comes from De Mel et al. (2008), who provided cash grants to small firms in Sri Lanka. The second comes from Karlan et al. (2014), who provided rainfall insurance and cash grants to small farms in Ghana. In Sri Lanka, De Mel et al. find credit constraints limit firm investment. In Ghana, Karlan et al. find that an inability to insure against rainfall is the primary financial constraint. In both settings, the treatments relax these financial constraints.

In my paper, I re-examine the data from these experiments in order to understand whether constraints in the factor markets interacted with and potentially distorted the effects of these treatments.

A test

I start by developing a test. The idea is the following: Suppose that factor markets work perfectly so that firms or farms can freely buy and sell factors of production like labor, land and other inputs at some price. Relaxing financial constraints like uninsured risk or credit constraints increases investment in inputs. Since financial constraints affect all inputs, relaxing these constraints with the treatments should cause firms or farms to increase all inputs “in proportion” so that their input mix doesn’t change.

Now, suppose there are factor market frictions, such as supervision costs for hired labor or transaction costs in land markets. These frictions limit firms’ and farms’ ability to increase labor and land in response to relaxed financial constraints. As a result, relaxing financial constraints causes firms and farms to shift their input mix away from labor and land toward inputs that don’t face factor market frictions. In Sri Lanka, these inputs are raw materials and equipment (like small tools and machinery). In Ghana, these inputs are tractor rental and chemical inputs like fertilizer. These inputs are purchased in well-functioning markets and, as a result, are not likely to be subject to factor market frictions.

The test, then, is to see how firms and farms change their input mix in response to the treatments. Formally, I do this by estimating the effect of the treatments on the ratios of the marginal revenue products of the different inputs.

The ratio of the marginal revenue product of labor or land to the marginal revenue product of inputs that do not face factor market frictions gives the shadow price of labor or land. This is the price the firm or farm would be willing to be pay for an additional unit of labor or land, taking into account financial constraints. An increase in the shadow price of, say, labor as a result of the treatments suggests there are frictions in labor markets that prevent firms or farms with relaxed financial frictions from buying labor from firms or farms without relaxed financial frictions. Furthermore, this increase in shadow prices should be greatest when financial frictions are relaxed the most, since firms or farms will be more likely to run into factor market frictions in this case.

Results

In both the Sri Lanka and Ghana experiments, I find evidence that factor market frictions indeed weakened the impact of relaxing financial constraints—and that, consistent with my predictions, the distortions are especially pronounced in the strongest treatments. The results are summarized in the figure, which shows the effect of the different treatments on the log of shadow prices.

In the Sri Lanka experiment, I find that the smaller cash grant had no effect on the shadow wage. However, the larger cash grant, which was twice as big and relaxed financial constraints by much more, led to a 46 percent increase in the shadow wage, suggesting firms hit constraints on labor.

In the Ghana experiment, I find that insurance alone led to an 11 percent increase in the shadow wage but had no effect on the shadow rental price of land, suggesting that farmers were able to acquire enough additional land. The cash only treatment also had relatively weak effects on shadow prices. However, the combination of insurance and cash, which provided the biggest relaxation of financial frictions, led to a 22 percent increase in the shadow price of land, suggesting farms hit a constraint on land. This treatment also led to an even greater increase in the shadow wage (36 percent).

Testing a key assumption

Implementing my test requires a way to compute the ratio of marginal revenue products. To do this, I assume a Cobb-Douglas production function, in which case the ratios of the marginal revenue products are proportional to the ratio of inputs.

I test this assumption using a novel production function estimation approach and overidentification test: In each setting, I estimate a Cobb-Douglas production function using a version of the dynamic panel approach described in the industrial organization literature on firm production function estimation. This approach assumes unobserved productivity follows an AR(1) process, in which case lagged inputs are valid instruments. I then note that the treatments from the experiments provide additional instruments. These additional instruments permit overidentification tests that I use to test the appropriateness of the Cobb-Douglas functional form assumption. In both cases, I fail to reject the overidentification test. (This approach provides one example of combining industrial organization techniques with development research.)

Takeaways and policy implications

My results suggest that programs that only address financial constraints may have diminished effects, and resources spent on them will have a lower return, when there are frictions in labor and land markets. In these environments, insurance and credit may be more effective if combined with other interventions, such as land tenancy reforms or programs that improve firms' or farms' ability to screen and monitor employees. My findings also provide a lesson on external validity: Finding large effects of insurance and credit in one setting may not translate into large effects in another where factor market frictions are more severe.

These results have implications beyond the realm of financial intervention as well. Increasing market access (e.g., through trade liberalization or infrastructure improvements) or exposure to new technologies that raise productivity will affect firms or farms in roughly the same way as a relaxation of financial frictions. Factor market constraints may similarly weaken the impact of these improvements as well.

Alex Cohen is a Ph.D. candidate at Yale University and is on the job market this year.

Join the Conversation