This is the sixth in our series of posts by PhD students on the job market this year.

E-commerce is quickly gaining popularity in many emerging economies. In 2019, e-commerce sales grew by 32% in India and 35% in Mexico. Lowered entry costs and extended market access make e-commerce especially appealing for small and medium enterprises (SMEs). However, merely lowering the barriers to entry might not be enough. New entrants might lack the skills to operate online businesses, and they need to overcome sizable search and information frictions to grow. Then, how can we help new entrants to grow in the competitive e-commerce markets? What are the consequences of such supports on their competitors, the consumers, and the platform?

In my job market paper, my coauthor and I implemented a business training program as a randomized controlled experiment on a leading e-commerce platform in China to answer these questions. From early May 2019 to June 2020, our training program reached over two million new entrants, thanks to the close to zero marginal dissemination costs. The training focuses on practical knowledge of online business operations and marketing skills rather than managing finance, personnel, and supply. We also borrowed successful lessons from the past, incorporating customization and rule of thumb style tutorials that provide actionable suggestions. Most of the sellers on the platform are retailers. We randomly assigned access to the training when new sellers first register on the platform. In our study cohorts with 712,118 sellers, 24.9% of new sellers have access to the training, and 24.1% of sellers with access took up the training.

The training consists of sequences of customized tasks that the platform assigns to the sellers daily with an algorithm. Each task tackles a specific challenge that new sellers face, such as posting products or attracting visitors to their sites. The platform matches the tasks to sellers based on sellers' performance. Once taking up a task, the seller will have a designated period to reach the goal with the aids of online tutorials, webinars, and Q&A forums. Figure 1 shows the user interface of the tasks on the official sellers' portal app. If the seller completes the task, she can earn free short-term access to tools that assist business operations. Average participants took up 3.7 tasks and completed 1.6 tasks.

Figure 1: Example of training widget

Training helps new sellers overcome growth barriers

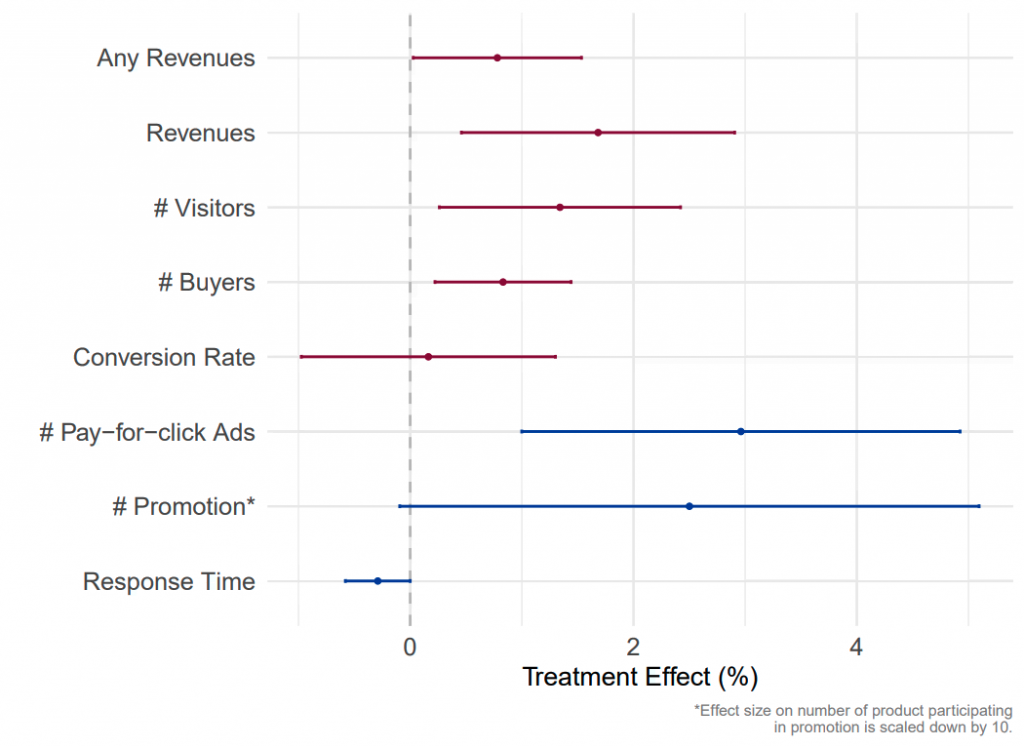

Does the training help new sellers? Compared to new sellers in the control group, new sellers with access to the training earn 1.7% higher revenues. Using random assignment of the training as the instrument, we find that sellers who participate in the training make 6.6% higher revenues. Figure 2 shows the treatment effect on the primary outcomes in percentage. The estimated total revenue gains for all the participating new sellers are $4.7 million, at least ten times more than the program's operation and development costs. Treated new sellers attract more visitors to their stores, but they do not have a significantly higher average purchase probability among visitors than the control new sellers.

Figure 2: Summary of Treatment Impacts (in %)

How training helps new sellers earn higher revenues?

We find that treated new sellers attract more consumers to their sites as they improve their marketing skills. To be precise, treated new sellers participate more in pay-for-click ads and promotional events. Besides marketing, treated new sellers also have better customer service quality since they follow the training's suggestions to adopt more supplementary services such as AI assistants to answer customers' inquiries. Most of the strategies treated sellers take involve additional costs. Without data on actual spending on the related services, we cannot tell if the sellers are making higher profits because of the training.

Nevertheless, treated new sellers attracting more consumers to their sites means that consumers are more likely to encounter these sellers on the platform. The consumers' attention that new sellers acquire could come at their competitors' costs since sellers always compete for better rankings in the search outcomes. What does this mean for consumers when they are now more likely to encounter treated new sellers?

Consumers benefit from better matches when they encounter new sellers

To analyze the impacts on consumers, we leverage detailed consumer-seller matched search and browsing records to identify the sets of sellers that consumers choose from when they search for specific keywords. Consumers have a higher overall purchase probability when they encounter a new seller regardless of the treatment status. Encountering one extra new seller in a search session increases overall purchase probability by 1.6% and spending by 1.1%. The results hold when we control for consumer, search keyword, and search effort specific effects.

To make sure encountering new sellers is the cause of higher purchase probability, we check who consumers choose if they make purchases and confirm that consumers are 5.9% more likely to choose treated new sellers over incumbents. Reassuringly, we do not find adverse effects on the quality of purchases: consumers are no more likely to request returns or refunds, while they are as likely to make repeat purchases when they purchase from either treated or control new sellers.

Training increases consumer surplus and sellers' total revenues

We use a discrete choice model to characterize consumers' demand, allowing us to estimate sellers' underlying quality. We find that both treated and control new sellers have higher underlying quality than incumbents. Thus, consumers could have better matching outcomes when they encounter high-quality new sellers. We quantify the training's welfare by limiting training participants' likelihood to be discovered by consumers in a counterfactual exercise. Without the training, consumer surplus and total sellers' revenues will decrease by 0.1%. The platform's sheer size implies that even a small percentage change of welfare means the absolute gains are considerable. The revenue drop occurs because consumers are making fewer purchases when they interact with fewer new entrants. Yet the impacts on the reallocation of revenues between new sellers and incumbents are small.

Takeaways: SMEs, Platform and Experiment at Scale

E-commerce, like other digital technologies, presents new opportunities for entrepreneurs in developing countries. However, many challenges remain after the adoption. Our study shows that closing new entrants' knowledge gap on the online business operation skills benefits the new entrants, the consumers, and, importantly, the platforms. In contrast to traditional marketplaces, the e-commerce marketplaces are operated by the platform companies that take more proactive roles. In our case, the platform develops a training program with the explicit goal of supporting SMEs it hosts. Yet doing so aligns with the platform's profit-maximizing goals in both the short and the long run. In the short-run, the platform directly benefits as new entrants make more sales and engage in more marketing. In the long-run, the platform gains since a better experience helps retain consumers and promising new sellers. Because the platforms have incentives to maintain the marketplace's prosperity, developing a private-public partnership between the platforms and the governments might be promising, especially when both parties share the same end goal. Supporting promising SMEs is an example.

However, supporting SMEs with training is only a promising proposal if we can provide concrete support for its effectiveness. Yet it could be challenging to assess the impacts of interventions with main outcomes that have large variances such as revenues, profits, and return on investment. We are able to detect a relatively small treatment effect on revenues despite significant heterogeneity thanks to the large sample size, but other interventions may not enjoy the same luxury. Increasing penetration of digital technology and online platforms gives rise to the possibility of implementing interventions at a large scale and collecting data at low costs.

Zhengyun Sun is a Ph.D. candidate in Economics at Harvard University. More details about her research can be found on her webpage.

Join the Conversation