This is the tenth in this year's series of posts by PhD students on the job market.

When seeking a loan, individuals and households can encounter many obstacles when they do not possess the right types of assets to pledge as collateral. In developing countries, banks prefer to use immovable assets, such as land, as security interests. However, land property rights in low-income countries are often not secure. In many developing countries, especially in Sub-Saharan Africa, a large share of land is undocumented and there is a widespread use of communal land, which means that there are no formal property rights and land use is governed by customs. These customs include the “use it or lose it” principle: whoever farms a given plot can continue using it, but if in a given year they do not farm the land, they can lose their customary rights and the land is reallocated to someone else. As a result, land cannot be rented out or sold; it is subject to expropriation risk; and it cannot be used as collateral.

In the countries with a low level of financial inclusion, the inability to use land as collateral worsens the problem of limited access to credit, especially for the poorest. In my job market paper, I study the interaction between land property rights and access to finance, as well as their effect on the allocation of resources and the process of economic development. To quantify the aggregate and distributional impact of land and financial market imperfections, I use a heterogeneous-agent dynamic macro model.

Using a macro model is essential for understanding the full effects of land and financial market distortions. For example, the ability to use land as collateral affects entrepreneurs’ ability to borrow, which in turn affects the demand for labor by entrepreneurs and, hence, wages. In turn, change in the wage affects occupational choices and so on. It takes a general equilibrium model to characterize such effects.

Empirical evidence: How do land and financial markets affect economic outcomes?

To answer this research question with the model, I need to match it to the data. To do that, I exploit longitudinal microdata from Tanzania, which has a special focus on agricultural production. I use a dynamic panel approach to estimate the agricultural production function. My results show that agriculture in Tanzania is still mainly labor- and land-intensive and exhibits decreasing returns to scale. I then use these estimates to obtain farmer-level total factor productivity measures. Combining these productivity measures with the variation in land property rights and access to credit both across households and across time, I test for the efficiency of resource allocation. I find that substantial frictions in both the land and credit markets affect resource allocation and economic efficiency in agriculture in Tanzania. I argue that these distortions reduce aggregate productivity in the economy by affecting the allocation of i) factors of productions across households and sectors; ii) households across different occupations. I explore those mechanisms in more detail with my quantitative model.

A model with incomplete land and financial markets

To understand how the combination of financial frictions with land market imperfections affects the process of economic development, I use a heterogeneous-agent incomplete-markets model that incorporates endogenous saving decisions, occupational choice, and communal land evolution. Agents are heterogeneous in their financial wealth, productivity levels in agriculture and entrepreneurship, and land holdings, which can be either private or communal. The following land market imperfections are assumed for communal land: i) it cannot be rented out, ii) it is subject to expropriation risk if it is not used, and iii) it cannot be used as collateral. On the financial side, borrowing is subject to a limit, which is a function of a household's financial wealth, land holdings, and land property rights. Specifically, the presence of financial market frictions and the inability to use communal land as collateral prevents households without legal land titles that are poor in terms of financial assets from getting access to credit. I use this model to perform three sets of policy experiments.

General equilibrium impact of land reform

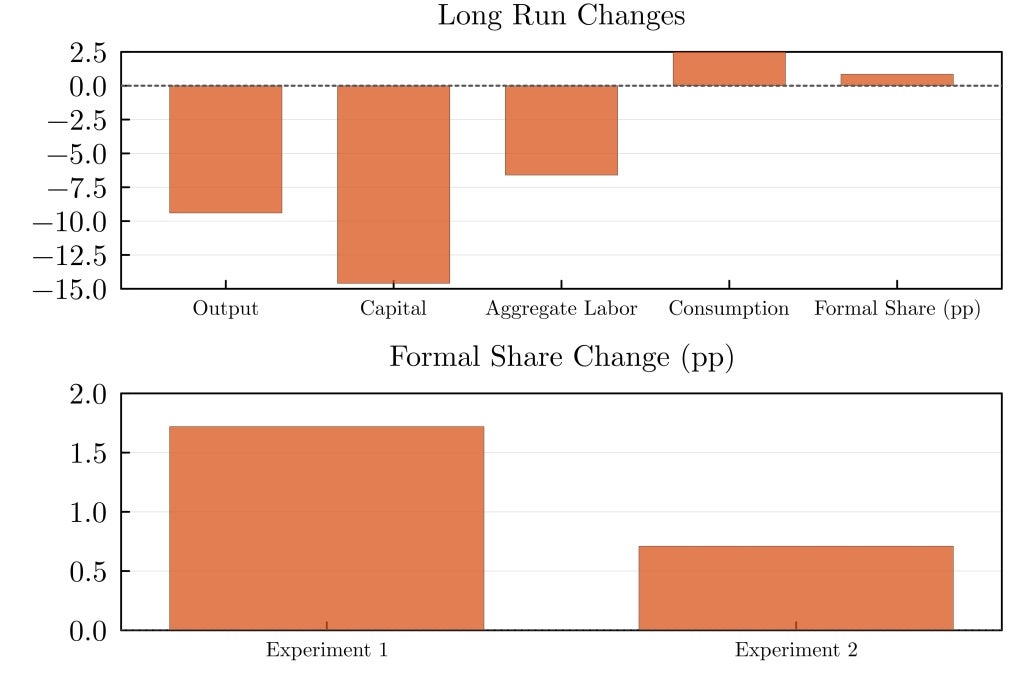

First, I look at the aggregate impact of an economy-wide land property rights reform, which eliminates communal land and results in all land being under a strong property rights regime (Figure 1). Not surprisingly, I find that this reform increases agricultural output by 7.4%. This result is mostly driven by higher land utilization and more efficient allocation of land across farmers. I also find that non-agricultural output increases substantially (8.2%). This result is a consequence of better credit access and more efficient allocation of households across occupations. Land reform changes the composition of labor in favor of the non-agricultural sector. In fact, agricultural employment declines by 8.6%. Moreover, stronger property rights lead to a higher level of financial inclusion, especially among the poorest households with limited financial assets but positive land holdings.

I find that land reform leads to substantial welfare gains for the economy as a whole. However, these gains are not evenly distributed. Welfare gains, measured in consumption equivalent changes, are the highest for those belonging to the communal part of the economy before the reform, and particularly for those with a low level of assets, large land holdings, and a high level of entrepreneurial ability. At the same time, large private land holders are the main losers of the reform, suggesting that political economy aspects might prevent or slow the progress of land reform in many poor countries, despite its potential benefits.

Decomposing the impact of land reform

Second, I perform a decomposition analysis of the different channels by which land reform affects the economy. I do so by evaluating the general equilibrium impact of removing only one type of land market imperfection at a time. As shown in Figure 2, I find that the increase in agricultural output is mostly driven by the ability of communal land holders to rent out their unused land. Instead, the increase in non-agricultural output is a result of eliminating the risk of land expropriation and the ability to use land as collateral.

Land Reform vs Financial Reform

Third, I compare the aggregate impact of land reform with the impact of financial reform. To compute the effect of financial reform, I relax financial constraints such that the loan to collateral value is equal to the level of an advanced economy. The qualitative impact of this financial reform on economic outcomes is the same as the impact of a collateral channel of land reform but differs from land reform as a whole. Moreover, the associated distributional impacts are quite different. In the case of the financial reform, those who are marginal entrepreneurs and large assets owners do benefit the most, while those operating communal land do not benefit as much as in the case of land reform. Finally, land reform leads to a lower level of consumption inequality compared to financial reform, as a large share of welfare winners of land reform is among the poorest part of the population.

What is the main takeaway?

My study suggests that land market frictions amplify the effects of financial markets imperfections. It also points to the large potential gains from land property rights reform. Not only do stronger land property rights lead to higher welfare and more efficient allocation of resources, but also help to create a more financially inclusive society. However, it is important to keep in mind that additional credit market imperfections (e.g., extremely high costs of enforcing a foreclosure) might dampen the positive effects of land reform. Despite this, my results highlight the potential of land property rights reforms in the context of limited policy space.

Kristina Manysheva is a PhD student at Northwestern University.

Join the Conversation