Much of my research over the past decade or so has tried to help answer the question of why there are so many small firms in developing countries that don’t ever grow to the point of adding many workers. We’ve tried giving firms grants, loans, business training, formalization assistance, and wage subsidies, and found that, while these can increase sales and profits, none of them get many firms to grow.

These interventions typically assume that firms face enough demand that if they produce more, or more efficiently, they can sell their products. This might be a reasonable assumption in many urban areas, but in more remote areas, the biggest constraint might just be limited effective market size. A very cool new paper by Rob Jensen and Nolan Miller proposes this explanation in the context of the Kerala boat-building industry, and shows that the introduction of cellphones allowed consumers to learn more about non-local firms, enabling high quality firms to start expanding and gaining market share, while low quality firms exit.

Setting

The setting is coastal fishing villages in two districts of Kerala, where the authors conducted a complete census of all boat-building firms every 6 months for 6 years between January 1998 and January 2004. At baseline, there were 143 boat-building firms. These firms were small, with an average of 2.2 workers and a maximum size of 4 workers. No firm supplied more than 1.3% of the whole market across the two districts, but each firm had a very large share of their local market – basically there was a single boat-builder in each village, from whom almost everyone purchased their boats.

The main dimension of quality is life expectancy of the boats. The authors convincingly argue that this is hard for potential buyers to easily ascertain when considering new suppliers – they can learn about the quality of the boat builder in their village from personal experience and that of other fisherman in the village, but would find it hard to tell whether a boat would last 4 years versus 5 years just on sight when considering non-local builders.

The authors are very thorough in measuring quality – they use 4 different measures, including surveys of fisherman on previous boats owned, the use of independent auditors that worked for a government boat insurance program, surveying fisherman on how long their local builder’s boats last, and a regression-based skill residual measure. They show there is much more variation in quality than in price – the average boat lasts 4 to 5 years, and the best boats last 3 to 4 years more than the worst, whereas there is only a 15% price difference between the least and most expensive boat.

The natural experiment

The authors use the same natural experiment as used by Jensen (2007) in his paper on how the spread of mobile phones led fishermen to start searching for better prices for their catches and so selling outside of their local markets for the first time. It uses the gradual roll-out of cellphone coverage in this part of India at the turn of the century to provide an exogenous reduction in information costs.

The causal chain from mobile phone introduction to changes in firm size and productivity

The authors set out a clear causal chain, and show very clearly the correlation between mobile phone roll-out and each of these links. What is particularly nice is that these can be seen very clearly graphically, as well as in the regressions.

Step 1: when mobile phones come in, fisherman start selling their catch non-locally. This was established in Jensen’s previous paper, and is shown here. Before, 95% of fisherman sell their catch in the local market, and this falls to around 60% when mobile phones come in.

Step 2: Fisherman visiting different markets learn more about the non-local boat market. The authors survey fisherman about boat builders they know of, and how long they think the boats last. They are more accurate for their local builder than for non-local builders. But when mobile phone comes in, their average error on non-local builders declines, and their estimates converge to those of locals in these markets.

Step 3: Fisherman start to buy boats non-locally. This is not directly shown - I guess because boats are rare purchases for fisherman and they only take a sample of 15 fisherman each time period, they don’t have enough information on the consumer side to document this. Rob confirmed to me that data frequency is an issue here, but thinks there may be more they can say on this.

Step 4: High quality builders gain market share and grow, and low quality builders lose market share, and possibly exit.

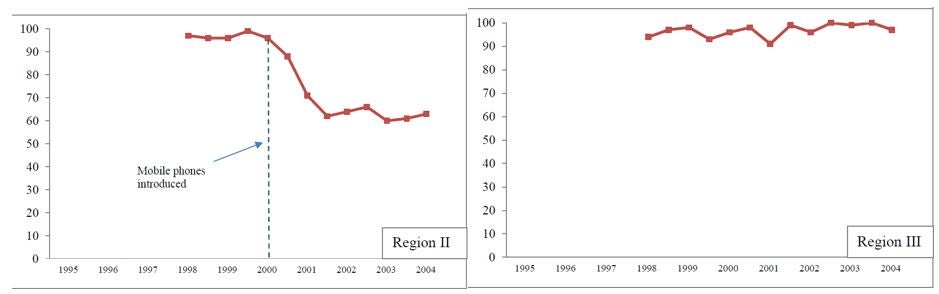

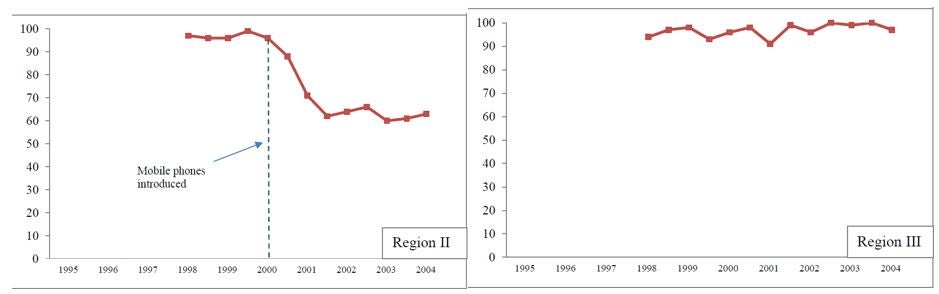

Boat-building runs in families, and the authors claim the number of firms had been stable over time in the run-up to mobile phone introduction. Then when mobile phones came in, the number of boat building firms fell from 59 to 23 in region I, and from 48 to 19 in region II, whereas they stayed the same in region III where phones weren’t introduced (see Figure).

Exert from Figure 3: the number of boat-building firms falls after mobile phones are introduced in region II, but stay stable over time in region III where cellphones weren’t introduced.

They show this exit is concentrated in low-quality firms – each additional year of baseline quality reduces the likelihood of exit by 6 percentage points.

Market share then grows for the good firms, and falls for the bad. By the final survey round, several firms had captured 4 to 7 percent of the total market, and a firm at the 75 th percentile of quality had gained 2 percentage points in market share. These firms with higher baseline quality then grow in size, with the mean employment per firm at the end of 5 workers greater than the maximum of 4 workers observed in any firm at baseline.

Step 5: greater firm size allows specialization and productivity growth

The number of boats being produced in the region was fairly constant over time – better quality here did not lead to an increase in total demand. However, this same number of boats is now produced by fewer firms, using 28-40 percent fewer workers, and 34-35 percent less capital, meaning a dramatic increase in productivity. In another example of nice measurement, the authors asked about worker’s time allocation to the 11 most time-intensive tasks in these firms. At baseline, the average worker performed about 7-8 of these tasks. Within two years of the phones entering, the average worker is only performing about three tasks – the owners focus more on the most skill-intensive tasks of finishing and fastening, as well as customer relations and management and supervision, while newer employees specialize in less skilled tasks such as cutting, obtaining inputs and cleaning up.

Consumers also gain – the price of boats increases 12%, but boat life expectancy increases 1.3 years (31%), so the cost per boat year falls.

Summing up

This is a very clearly argued and convincing paper. As well as contributing to the gains from opening up to trade literature, it is a nice example of how “demand-led” growth can be an effective way of helping firms to grow (see also Atkin et al, 2017). However, while it shows that consumer information can be a barrier to growth, it does raise questions about why better marketing efforts can’t solve these problems. The authors have several footnotes about how the lack of warranties, guarantees, and consumer review websites like Yelp or companies like Consumer Reports make it hard for firms to signal quality. Rob notes to me that it may be much harder to overcome this information barrier for infrequently purchased expensive durable products than for less expensive goods where quality can be noticed relatively quickly upon purchase. Thinking about market interventions that can help solve these problems seems an important area for future work.

These interventions typically assume that firms face enough demand that if they produce more, or more efficiently, they can sell their products. This might be a reasonable assumption in many urban areas, but in more remote areas, the biggest constraint might just be limited effective market size. A very cool new paper by Rob Jensen and Nolan Miller proposes this explanation in the context of the Kerala boat-building industry, and shows that the introduction of cellphones allowed consumers to learn more about non-local firms, enabling high quality firms to start expanding and gaining market share, while low quality firms exit.

Setting

The setting is coastal fishing villages in two districts of Kerala, where the authors conducted a complete census of all boat-building firms every 6 months for 6 years between January 1998 and January 2004. At baseline, there were 143 boat-building firms. These firms were small, with an average of 2.2 workers and a maximum size of 4 workers. No firm supplied more than 1.3% of the whole market across the two districts, but each firm had a very large share of their local market – basically there was a single boat-builder in each village, from whom almost everyone purchased their boats.

The main dimension of quality is life expectancy of the boats. The authors convincingly argue that this is hard for potential buyers to easily ascertain when considering new suppliers – they can learn about the quality of the boat builder in their village from personal experience and that of other fisherman in the village, but would find it hard to tell whether a boat would last 4 years versus 5 years just on sight when considering non-local builders.

The authors are very thorough in measuring quality – they use 4 different measures, including surveys of fisherman on previous boats owned, the use of independent auditors that worked for a government boat insurance program, surveying fisherman on how long their local builder’s boats last, and a regression-based skill residual measure. They show there is much more variation in quality than in price – the average boat lasts 4 to 5 years, and the best boats last 3 to 4 years more than the worst, whereas there is only a 15% price difference between the least and most expensive boat.

The natural experiment

The authors use the same natural experiment as used by Jensen (2007) in his paper on how the spread of mobile phones led fishermen to start searching for better prices for their catches and so selling outside of their local markets for the first time. It uses the gradual roll-out of cellphone coverage in this part of India at the turn of the century to provide an exogenous reduction in information costs.

The causal chain from mobile phone introduction to changes in firm size and productivity

The authors set out a clear causal chain, and show very clearly the correlation between mobile phone roll-out and each of these links. What is particularly nice is that these can be seen very clearly graphically, as well as in the regressions.

Step 1: when mobile phones come in, fisherman start selling their catch non-locally. This was established in Jensen’s previous paper, and is shown here. Before, 95% of fisherman sell their catch in the local market, and this falls to around 60% when mobile phones come in.

Step 2: Fisherman visiting different markets learn more about the non-local boat market. The authors survey fisherman about boat builders they know of, and how long they think the boats last. They are more accurate for their local builder than for non-local builders. But when mobile phone comes in, their average error on non-local builders declines, and their estimates converge to those of locals in these markets.

Step 3: Fisherman start to buy boats non-locally. This is not directly shown - I guess because boats are rare purchases for fisherman and they only take a sample of 15 fisherman each time period, they don’t have enough information on the consumer side to document this. Rob confirmed to me that data frequency is an issue here, but thinks there may be more they can say on this.

Step 4: High quality builders gain market share and grow, and low quality builders lose market share, and possibly exit.

Boat-building runs in families, and the authors claim the number of firms had been stable over time in the run-up to mobile phone introduction. Then when mobile phones came in, the number of boat building firms fell from 59 to 23 in region I, and from 48 to 19 in region II, whereas they stayed the same in region III where phones weren’t introduced (see Figure).

Exert from Figure 3: the number of boat-building firms falls after mobile phones are introduced in region II, but stay stable over time in region III where cellphones weren’t introduced.

They show this exit is concentrated in low-quality firms – each additional year of baseline quality reduces the likelihood of exit by 6 percentage points.

Market share then grows for the good firms, and falls for the bad. By the final survey round, several firms had captured 4 to 7 percent of the total market, and a firm at the 75 th percentile of quality had gained 2 percentage points in market share. These firms with higher baseline quality then grow in size, with the mean employment per firm at the end of 5 workers greater than the maximum of 4 workers observed in any firm at baseline.

Step 5: greater firm size allows specialization and productivity growth

The number of boats being produced in the region was fairly constant over time – better quality here did not lead to an increase in total demand. However, this same number of boats is now produced by fewer firms, using 28-40 percent fewer workers, and 34-35 percent less capital, meaning a dramatic increase in productivity. In another example of nice measurement, the authors asked about worker’s time allocation to the 11 most time-intensive tasks in these firms. At baseline, the average worker performed about 7-8 of these tasks. Within two years of the phones entering, the average worker is only performing about three tasks – the owners focus more on the most skill-intensive tasks of finishing and fastening, as well as customer relations and management and supervision, while newer employees specialize in less skilled tasks such as cutting, obtaining inputs and cleaning up.

Consumers also gain – the price of boats increases 12%, but boat life expectancy increases 1.3 years (31%), so the cost per boat year falls.

Summing up

This is a very clearly argued and convincing paper. As well as contributing to the gains from opening up to trade literature, it is a nice example of how “demand-led” growth can be an effective way of helping firms to grow (see also Atkin et al, 2017). However, while it shows that consumer information can be a barrier to growth, it does raise questions about why better marketing efforts can’t solve these problems. The authors have several footnotes about how the lack of warranties, guarantees, and consumer review websites like Yelp or companies like Consumer Reports make it hard for firms to signal quality. Rob notes to me that it may be much harder to overcome this information barrier for infrequently purchased expensive durable products than for less expensive goods where quality can be noticed relatively quickly upon purchase. Thinking about market interventions that can help solve these problems seems an important area for future work.

Join the Conversation