This is the tenth in our job market paper series this year.

In developing countries, the high costs of credit along with varied impediments to saving, make it challenging for people to raise large sums of liquidity needed for large and indivisible, or “lumpy,” expenditures. An emerging body of evidence has shown how these constraints push people towards second-best strategies to address their financial needs (Collin et al. 2009 and Banerjee and Duflo 2007). My job market paper, “Gambling, Saving, and Lumpy Expenditures: Sports Betting in Uganda”, looks at the behaviors of 1,715 bettors in Kampala, Uganda and provides evidence that unmet liquidity needs push people towards sports betting as an unexpected alternative method of liquidity generation.

Over the last decade, sports betting has exploded into new markets across Africa as international investors have leveraged recently developed technologies to offer internationally calibrated odds to local participants (PWC 2015). 23 betting companies operate in Uganda, with over 1,000 branches spread throughout the country. These companies offer bets on a wide range of international sporting events, although betting on international soccer matches is the most popular. A recent policy report found that over 36% of men in Kampala, Uganda’s capital, had placed bets in the last year, devoting an average of 12% of their income to betting (Ahaibwe et al. 2016). Despite expected losses of 35-50%, more than 75% of these bettors cited “a way to get money” as their top reason for betting. While many factors likely affect demand for betting, this paper takes respondents’ stated motivation seriously and tests whether, consistent with long-standing economic theory, liquidity needs and inability to save affect demand for sports betting (Friedman and Savage 1948 and Kwang 1953).

Findings

I designed and conducted a study from August 2015 to July 2016 to look at sports betting behavior in Kampala. Respondents were randomly chosen from a pool of regular bettors identified during a listing exercise of young men (18-40), working informally in selected commercial areas around Kampala. 1,003 participants were included in a full study consisting of five bi-weekly visits, while an additional 712 participants were included in a complementary, single-visit study. Using a natural experiment, a randomized field experiment, and two lab-in-the-field experiments, this paper contains four main empirical findings:

- Winnings from sports betting increase the size and likelihood of making large expenditures, particularly for people with limited ability to save.

Winnings depends on the number and types of bets that an individual chooses to place. However, conditional on those choices, realizations of winnings should be effectively random. I look at the effect of winnings on large, lumpy expenditures and find that winnings increase both the size of an individual’s biggest purchase as well as the likelihood of making a large purchase above a given threshold. Notably, the effect is driven by people who, relative to others of similar income, were more constrained in the amount of money they could use for saving, and for whom a key alternative method of liquidity generation is therefore more challenging. There is no effect on those with relatively high saving ability.

- The randomized provision of a basic commitment saving technology reduces demand for bets.

Like many saving technologies, a sealed saving box offers a way to commit to saving and to insulate cash holdings from personal temptation and social pressure. In a visit one month prior to the endline, randomly selected respondents were offered a saving box. Improving ability to save should affect betting in two ways: first, by improving the relative appeal of an alternative method of liquidity generation, and second, by reducing all present day expenditures. At the endline, participants were offered a choice between cash and betting tickets in a revealed preference measure of betting demand. Recipients of the saving box were 26% less likely to demand the full amount of tickets offered.

Distinguishing Mechanisms

The previous results add credibility to the hypothesis that betting is being used as a method of liquidity generation in competition with saving. I conduct an additional pair of lab-in-the-field experiments to isolate this mechanism.

- A randomized priming dialog increasing the salience of a desired lumpy expenditure raises demand for bets.

- A randomized budgeting exercise lowers demand for betting among people who learn that they can save more than previously believed.

Discussion and Policy Implications

These reduced form results tell a consistent story. Sports betting demand is affected by underlying demand for liquidity and the feasibility of saving as an alternative strategy of liquidity generation. Whether betting is a strictly rational strategy for liquidity generation (setting fun aside) depends on its expected return relative to alternatives. Available bank credit is expensive and unavailable for the needs of most respondents, while standard 50% six-month interest rates on money lender loans are no better than expected losses from betting.

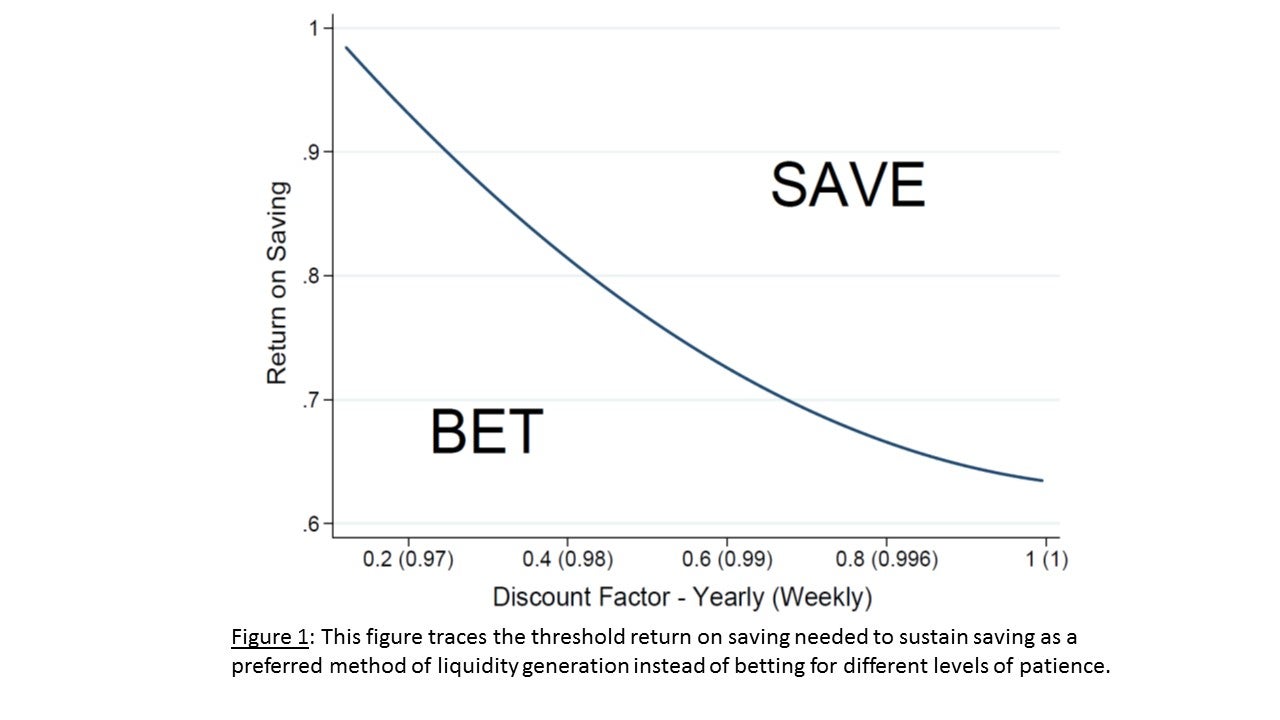

Saving could potentially have lower nominal losses but also requires patience in order to be preferred to betting. To compare these two alternatives, I build a simple model relating return to saving and discount rates. I establish the returns to each strategy and set them equal in order to solve for the critical threshold return on saving that makes an individual indifferent between betting and saving for each level of patience. The full locus of patience and threshold levels of return on saving are traced in Figure 1, whereby people with saving and patience levels above the line will prefer to save and those below it will prefer betting.

Although we might think that return on saving should be no lower than one for someone willing to store money under his mattress until use, in practice, many factors, including temptation, social pressure, risk of theft or loss, transaction costs, and inflation can all push down an individual’s expected return on saving in practice. For people with reasonable levels of patience, with yearly discount factors around 0.64 (as estimated by Mbiti and Weil in neighboring Kenya), betting will be preferred for those with a return on saving below 0.7.

Together, my findings suggest that betting demand is increased by unmet liquidity needs and the challenges associated with alternative strategies of liquidity generation. Betting in pursuit of liquidity comes at a high cost and reflects the severity of the financial constraints facing this population. My results suggest that if policy-makers are concerned by the proliferation of sports betting, improving financial services and alternative liquidity generation strategies for this population may be an effective means of reducing demand for betting.

Sylvan is a Ph.D. Candidate in the Department of Agricultural and Resource Economics at the University of California, Berkeley. His webpage can be found here.

Join the Conversation