This is the second in this year’s series of posts by PhD students on the job market.

What causes low levels of adoption of household technologies that are predicted to generate significant welfare improvements? Is it that the returns are not as large as predicted? Or do market failures or behavioral biases prevent widespread adoption? We implement a randomized controlled trial with 1,000 households in Nairobi to quantify each of these drivers in the case of energy efficiency.

The benefits of energy efficient technologies

Almost all growth in global energy demand in the next several decades is expected to come from low- and middle-income countries (IEA 2017). Energy efficient technologies are often cited for their potential to meet sustainable development goals by slowing greenhouse gas emissions and generating financial savings for households. Despite this, adoption of energy efficient technologies remains low. Why is this?

We study this question in the context of many Kenyan households’ primary energy-using technology: a charcoal cookstove. Traditional cookstoves contribute to growing deforestation, generate greenhouse gas emissions, and cause millions of deaths each year. But the most salient feature of an improved cookstove for many households living in poverty is savings in energy costs. The average household in our study sample in Nairobi spends more than USD 1 per day on energy expenditures; up to 20% of household income. We study the energy efficient Jikokoa cookstove, which advertises a reduction in charcoal use of more than 40%.

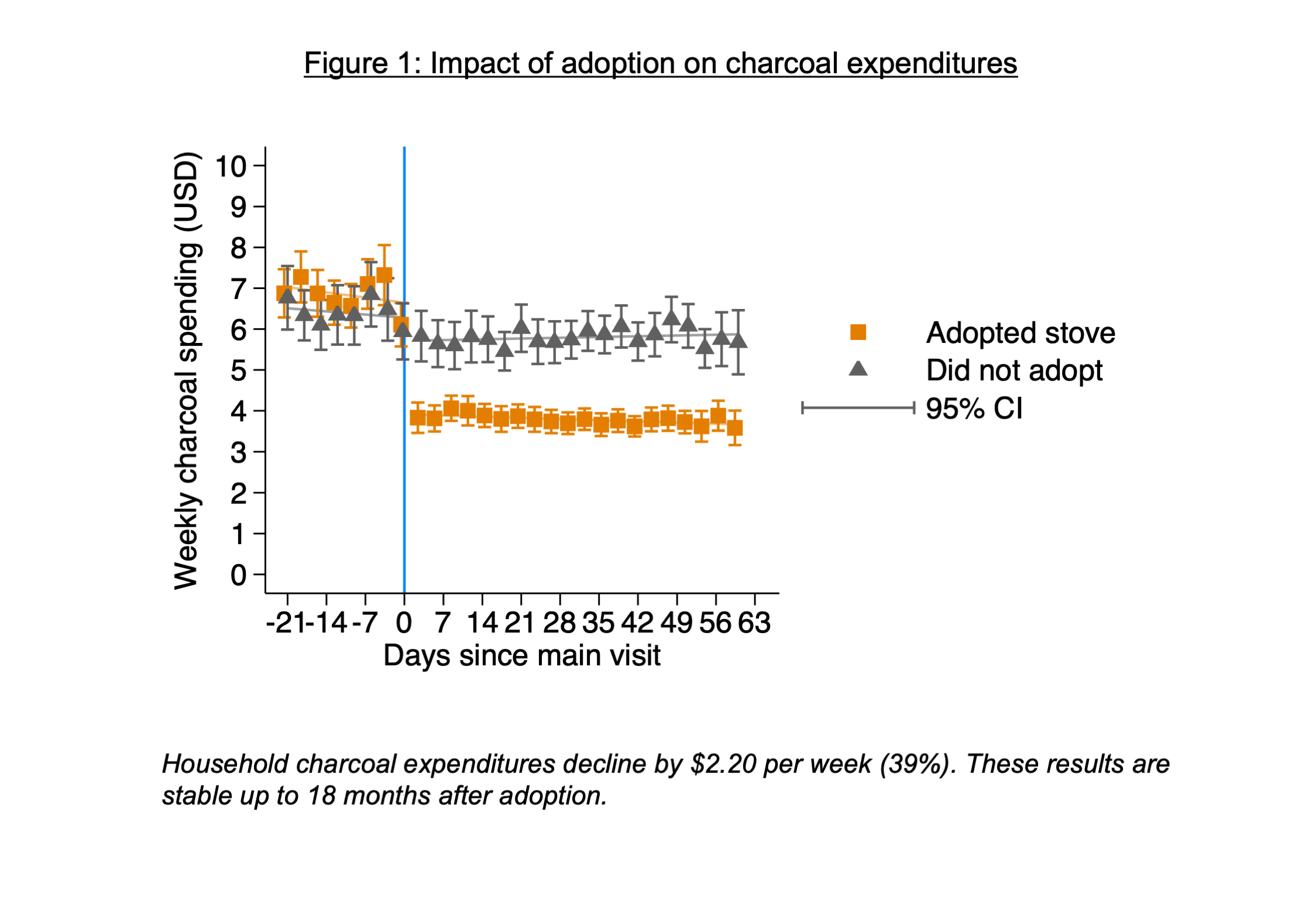

The energy efficient technology has high returns: $120 in fuel savings per year, or 300% rate of return

We document that the energy efficient cookstove is highly profitable. We use an incentive compatible Becker-DeGroot-Marschak (1964) (BDM) mechanism to elicit willingness-to-pay (WTP) and randomize adoption of the Jikokoa. Using an instrumental variables approach with the randomly assigned price as an instrument for adoption, we find that the stove reduces charcoal spending by 39%, saving on average $120 per year. This is around one month of income for the median household. Respondents report spending these savings on essential household items, such as food or school fees.

Given the stove's market price of $40, this implies an annualized internal rate of return of 300% per year. This is significantly larger than most studies of investments in agriculture, business, or health in low-income contexts, which often range between 10-150%. Recent studies of energy efficient technologies in the U.S. and Mexico in fact found negative returns.

Credit constraints prevent households from adopting high-return technologies

In spite of these large savings, households' average WTP is only $12.

To understand why, we cross-randomize access to credit with an intervention designed to increase attention. Respondents in the credit treatment are allowed to pay for the stove in instalments over 3 months. Respondents in the attention treatment fill in an attention sheet, writing down the amount of money they think they will save each week for the next year if they owned an energy efficient stove, and what they would do with the savings each month (for example, buy more food, or pay school fees). They then write down the total amount they will have saved after one year. They also participate in a recurring SMS survey about charcoal spending for one month prior to adoption, designed to make potential savings more salient.

We find that credit doubles WTP. In fact, credit alone is sufficient to fully close the energy efficiency gap over the 3-month period of the loan. The credit constraints faced by low-income households prevent them from adopting technologies that have the potential to significantly improve their well-being. Increased access to affordable credit would allow households to exploit cost-saving opportunities and help policy-makers to curb poverty and improve environmental outcomes.

On the other hand, the attention treatment has no impact. Households appear to already be attentive to their future energy savings. This suggests that nudges or other behaviorally-driven interventions may not be effective in this context.

The psychology of credit

The large impact of loans may operate in part through psychological channels. Credit moves costs into the future, so time-inconsistent behavior would therefore also affect WTP. To test this, we cross-randomize credit with a treatment designed to increase attention to the costs of adoption. We find that encouraging respondents to pay attention to future loan payments reduces the impact of credit significantly.

We find that around one-third of the total impact of credit can be attributed to inattention to the future, or myopia. This has important implications for the interpretation of a large literature that interprets the impacts of credit largely as relaxing credit constraints alone.

We also measure time-inconsistency through an effort-task allocation exercise (Augenblick et al., 2015). We find that agents exhibiting time-inconsistent behavior have significantly lower WTP at baseline and respond more strongly to credit. This is in line with theory: an agent exhibiting time-inconsistency may overvalue costs when these are incurred in the present rather than in the future and may therefore choose to borrow more (O’Donoghue and Rabin 1999). We find suggestive evidence that attention reduces this difference, suggesting time-inconsistent behaviour may not necessarily reflect innate time-inconsistent preferences. These may instead be founded simply in diminished attention to the future rather than present biased preferences or changing marginal utility.

Policy implications for addressing environmental externalities: Pigovian taxes or technology subsidies?

Charcoal usage contributes significantly to global climate change. Global production and use of firewood and charcoal contribute between 1-2.4 gigatons of CO2-equivalent greenhouse gases annually, which is 2-7% of global anthropogenic emissions (FAO 2017). Kenya in particular is expected to lose 65% of its forest cover to charcoal production and use by 2030 (Onekon 2016).

The reduction in charcoal usage achieved by the energy efficient cookstove reduces the large negative environmental externalities of charcoal. In a first-best world where the only market failure is the environmental damages externality, the efficient solution for a policy-maker is to set a Pigovian tax on charcoal equivalent to these damages (Pigou 1920). In the case of greenhouse gas emissions, this is commonly known as a carbon tax.

Our results suggest that credit market failures will push the level of adoption of energy efficient technologies under a Pigovian tax to below the socially optimal level. The first-best policy would be to improve credit markets, but this may be difficult due to fundamental market failures such as information asymmetry and moral hazard, as well as administrative costs. Such a tax would also be regressive, as taxes would be costliest for households that are the most credit constrained.

A carbon tax alone, which is still the preferred tool to address climate change for many environmental economists, may therefore not be the efficient tool to address climate change in contexts with large credit market failures. We argue that subsidies for energy efficient technologies will correct environmental externalities more efficiently than Pigovian taxation alone in these settings.

Susanna B. Berkouwer is a PhD Candidate at the University of California at Berkeley. More details about Susanna’s research can be found on their personal webpage. This paper is co-authored with Joshua T. Dean who is at the University of Chicago.

Join the Conversation