This is the 10th in this year’s series of posts by PhD students on the job market.

Informal labor — work that is not registered, regulated, or protected by existing legal or regulatory frameworks — is the name of the game for most workers in developing economies. In low- to lower-middle-income countries, the share of informal labor in total employment hovers around 70 to 80%. Workers in the informal sector tend to earn less and experience shocks and uncertainty in their earnings. Informal firms, where much of the informal work happens, are also less productive than their formal counterparts. As such, policymakers may be interested in intervening in the informal labor market to improve workers' outcomes. The problem is that informal labor is hard to regulate directly, almost by definition, as it mostly happens outside of the regulatory framework.

One exception, however, is the app-based "gig economy," where a lot of informal labor in developing countries now occurs. Ridesharing, especially, has taken off in developing economies: In Indonesia, 50% of internet users use ridesharing apps to order rides (Nikkei Asia, 2019). Governments can potentially regulate the platforms' pricing, which the firms implement via algorithms, creating an opportunity to study what happens when governments regulate informal labor directly. And we know a thing or two about price-control policies in labor markets from the minimum wage literature, such as their mixed results on overall employment, redistributive effects for lower earners, and potentially positive effects on productivity.

In my job market paper with Rizki Siregar, we take the insights and tools from the minimum wage literature to a new context. We explore what happens when policymakers regulate informal and casual (meaning occasional and piece-rate) labor markets through price floors in a place with a lot of potential labor supply. What would the consequences be on transaction volume, driver earnings, distributional outcomes, and productivity?

Price floor policy for app-based ridehailing markets in Indonesia

To answer these questions, we collaborate with one of Indonesia's two largest ridesharing platforms that operates popular app-based bike taxi ("ojek") services. We access their data on all transactions conducted by bike-taxi drivers across all cities in which they operate, with deanonymized IDs of drivers and customers. Unlike standard transactions or employment data, our data also include "supply hours," the duration drivers are active on their app each day, including idle time. This measure allows us to construct measures of excess supply and labor productivity.

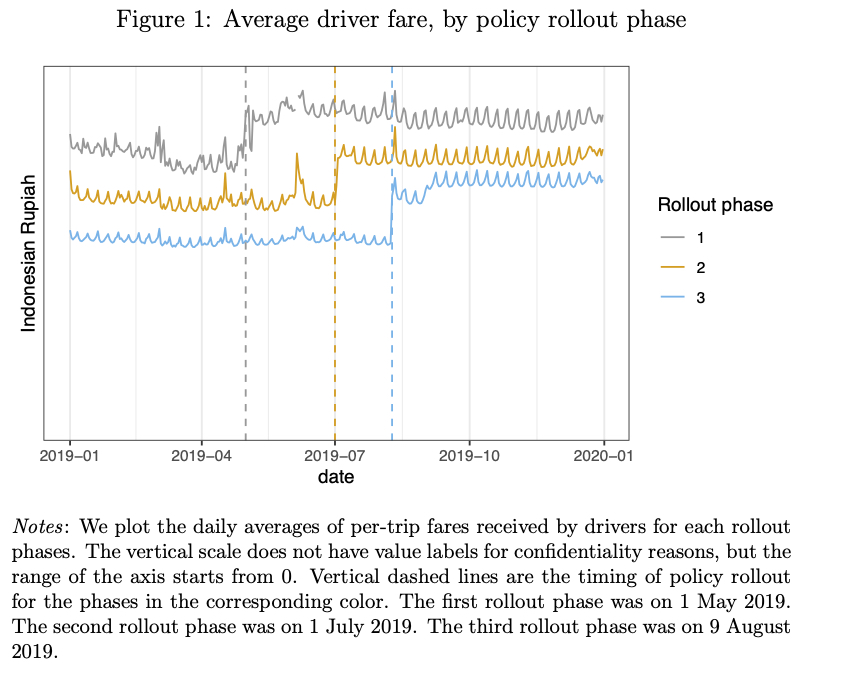

We evaluate the effects of introducing a price floor policy by the Indonesian Ministry of Transportation in 2019. The regulation required that drivers be paid at least 8,000 Rupiah (approximately 50-60 US cents) per trip on all app-based platforms, along with other restrictions on fees. We call the regulation the minimum fare policy based on its binding aspect. It was implemented between May and August in three batches of cities, allowing us to implement difference-in-differences (DiD) and synthetic control-based inference methods. For analysis, we use a policy variation that lasts for five weeks.

Increased excess supply drives results on earnings productivity

We present our estimates from the DiD analysis. Our analysis reveals the following findings:

Result 1: The minimum fare policy, while binding, does not result in a statistically significant impact on transaction volume, driver earnings, or wages.

We find that the minimum fare policy increases the average payment to drivers per trip by 12.9% for taxi services, which the regulation targets, and 4.6% for all services, including unregulated services like food and other delivery. Despite the fare increase, the policy does not statistically significantly reduce overall transaction volume (estimate: 0.2% increase for all services henceforth). Yet, we do not find statistically significant effects on average drivers' daily earnings (-1.7%) or wages (-6.7%). These results show that the minimum price per transaction did not achieve the policy objective of increasing driver earnings, a puzzle that we try to solve by studying the demand- and supply-side mechanisms.

Result 2: The policy increases excess supply, crowding out the effect of higher per-trip prices on driver earnings.

The policy induces a large response in driver hours. This response is met with limited demand-side responses, leading to an insignificant effect on overall transaction volume. We find that total supply hours go up by 8.7% – driven by increased idle hours up by 24.3%. Combined, increased driver competition reduces the number of trips allocated per driver by 6.3%. The reduced number of trips per driver undoes the effect of higher per-trip prices on daily earnings.

Result 3: The policy had limited redistributive impact at the cost of driver productivity.

The minimum wage literature also tells us that price floors may have distributional and productivity implications. To identify such effects, we estimate the policy impact separately for each decile of pre-policy driver earnings and productivity. We also construct driver-day level productivity measures based on the quantity (distance driven, duration, number) of trips conducted per supply hour.

We find that increased supply comes from drivers who earned less from the platform, increasing the total supply for the bottom 40% of drivers in terms of their pre-policy platform earnings by 20 to 40%. This increase in supply, however, does not lead to increased earnings per driver for them. We also find that drivers are 8 to 10% less productive on average, coming from an increased supply of less-productive drivers and the crowd-out effects reducing the productivity of inframarginal drivers.

Toward a broader understanding of informal and casual labor

Our analysis provides evidence that price regulation in the informal and casual labor market, at least in its current form, does not increase driver earnings on average or for lower earners in sectors with low entry barriers. We find that the policy lowers driver productivity, suggesting potential labor misallocation. Our results highlight the importance of adjustment mechanisms and potential unintended costs of regulation for policymakers considering if and how to regulate the informal labor markets through price controls.

We also speculate that the large labor-supply response may be a result of the under-employment in developing cities and the ease of entry into this particular type of work. We compare our effect sizes with a similar paper by Hall, Horton, and Knoepfle (2021), who use variation in Uber's base fare in the US. We find that our labor-supply response is more than five times larger in our case in Indonesia than in the Uber case in the US. Many other factors differ, such as the policy design (price floor vs. level shift), the implementer (government vs. platform), and the market condition (50-50 split and fierce competition in Indonesia vs. dominance of Uber in the US at the time). But our results add diversity to the policy and geographical contexts, as most studies on ridesharing platforms focus on the US context and their data.

This study has some limitations that we hope to improve in future extensions. First, our productivity and earning measures are limited by what we can observe from the platform data and do not account for activities outside. We hope to address this by estimating drivers' reservation wages and welfare effects in a future extension. Second, our estimates are short-term (five weeks) and may not capture longer-term market adjustments. We plan on estimating longer-term effects using a new policy shock in 2022. So stay tuned!

Shotaro Nakamura is a Ph.D. student at the University of California, Davis.

Join the Conversation