This is the second in the series of papers from graduates on the job market this year.

Public-works programs have long been one of the most popular policy tools for governments in developing countries, but recent years have seen a resurgence of interest in such schemes as anti-poverty programs among policymakers and researchers. The World Bank alone funded public-works programs in 24 countries between 2007 and 2009, and a number of governments have introduced their own initiatives. The idea behind using public-works programs as anti-poverty measures is to use them as conditional cash transfer programs that provide employment and income opportunities for households willing to do public-sector manual work at a specified program wage. This means that households can self-select into employment when they need it, abolishing the requirement for governments to have accurate information on eligible households as in many traditional transfer programs. Additionally, the program wage can be set low enough to be unattractive for rich households. Taken together, the goal of public-works programs is therefore to provide more flexible and better targeted income and job opportunities than other types of anti-poverty programs (see Subbarao et al. 2013 for an extensive overview of recent public-works programs in developing countries).

The causal labor-market impacts of these programs are usually difficult to estimate, however, so as of now we still know little about how public-works programs affect local labor markets in practice (see Berhane et al. 2011 and Subbarao et al. 2013 for examples of recent work on public-works programs). Public-works programs are usually rolled out non-randomly, and high-quality data on labor-market outcomes is often unavailable. One of the few programs where a rigorous analysis is possible is the Indian government’s National Rural Employment Guarantee Scheme (NREGS), whose labor-market impacts I study in my job market paper. NREGS is the largest public-works program in the world and one of the flagship schemes of the new type of public-works programs in recent years. The program legally guarantees every rural household (about 70% of India’s population) 100 days of public-sector manual work per year at the minimum wage, and annual expenditures are typically around one percent of Indian GDP. Public-sector employment under NREGS can be requested at any point during the year, and in most areas the program wage is substantially higher than the casual private-sector wage.

Given this structure of the employment guarantee scheme, a program like NREGS can affect households through two channels: First, it provides a predictable safety net that households know they have access to when they experience a negative economic shock. Second, the scheme can also provide an additional source of income for underemployed workers even in the absence of adverse shocks. Both of these functions have the potential to reduce poverty by ensuring a larger and less variable stream of income for the poor.

A household time-allocation model in my paper illustrates the different implications these channels have for local labor-market outcomes. In the absence of the government program, a household can choose to allocate the time of its members between casual private-sector employment and self-employment activities, with self-employment being the riskier occupation. Once the employment guarantee scheme is introduced, households can take advantage of the program either as a safety net or as an alternative form of employment. If NREGS predominantly works through providing a new source of employment, then public employment crowds out the time spent in other occupations and, depending on the structure of local labor markets, may put upward pressure on private-sector wages. If the program predominantly works as a safety net, this implies that program take-up should be higher after bad economic shocks. Even in the absence of a shock, self-employment is now a relatively less risky occupation than before, however, because households know they have access to a safety net. This means that households should substitute away from casual private-sector work and towards self-employment.

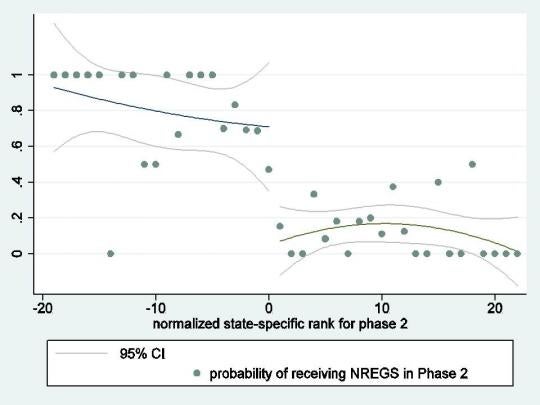

These predictions can be tested empirically. The Indian employment guarantee scheme was rolled out to districts in three rounds between 2006 and 2008. I uncover the algorithm that the Indian government used to assign districts to implementation phases by combining information from a number of government documents, and reconstruct the poverty index variable used to rank districts on their poverty status. The government algorithm generates state-specific treatment cutoffs in the poverty rank variable. As the figure shows, there is a statistically significant discontinuity in treatment status when the state cutoffs are pooled and re-centered to 0, with poor districts (with negative normalized ranks) having a higher probability of treatment than richer districts. The rank variable can therefore be used as a running variable in a fuzzy regression-discontinuity design. I combine this information with representative household survey data on employment and wages collected before the last implementation phase extended the program to remaining control districts to analyze the labor-market impacts of the employment guarantee scheme.

The empirical results suggest that NREGS is primarily used as a safety net rather than as an alternative form of employment. The introduction of NREGS does not lead to an overall increase in public-sector employment or the casual private-sector wage. The program also does not create any additional jobs in the local economy and has no substantial impact on household expenditures or income. Consistent with the safety net channel, however, take-up is about 3 percentage points higher in areas that experienced a negative rainfall shock during the past monsoon season than in other treatment areas where public employment is not statistically significantly different from that in control areas. Workers also substitute away from private casual employment, leading to a 4 percentage point decrease in private employment (about a 10% decline relative to the outcome mean), with some evidence that they are moving into self-employment instead.

Taken together, the theoretical model and the empirical results point to NREGS functioning as a safety net, but being unable to fulfill a broader role of creating more jobs in local labor markets or enforcing the often ignored minimum wage laws by putting upward pressure on casual wages. Researchers need to keep in mind that public-works programs may induce occupational changes even when no adverse shocks occur by changing the relative riskiness of different types of jobs. This is true despite growing evidence of implementation problems with NREGS like rationing, which reduce the availability of public-works jobs and attenuate the program effects (see e.g. Dutta et al. 2012). Attention to occupational changes is especially important for understanding the welfare benefits of public-works programs if the time-allocation impacts affect household income and expenditures in the longer run: while I do not find any such effects in my analysis, NREGS was introduced in the control districts about a year after the previous phase. If it takes longer than a year for impacts on household expenditures to materialize, my analysis therefore does not capture these medium-run effects.

Overall, the empirical patterns suggest that a more comprehensive household time-allocation model that allows households to substitute between different forms of non-public employment is necessary to understand the impacts of public-works programs. This has typically been neglected in the academic and policy debate on the net benefits of public-works programs in developing countries. The broader framework for thinking about public-works programs and the regression-discontinuity approach used in my paper are also contributions to the very recent literature on the impacts of NREGS (see e.g. Azam 2012, Berg et al. 2012, and Imbert and Papp 2013).

Laura Zimmermann is a Ph.D. candidate in the economics department at the University of Michigan. http://www-personal.umich.edu/~lvzimmer/

Join the Conversation