Agnieszka Chłoń-Domińczak, guest blogger, is Assistant Professor at Warsaw School of Economics and previously Poland’s Deputy Minister of Labour and Social Policy

Population ageing is a phenomenon that affects virtually all populations in the world. Over the next few decades, the consequences of this demographic change will be particularly visible in Central and Eastern European countries, who face at the same time a significant drop in fertility levels and increasing life expectancy. These developments were, among others, one of important reasons behind the multi-pillar pension systems reforms at the end of 1990s and at the beginning of the century. These reforms were slowed down and partially or fully reversed after the financial and fiscal crisis of 2008. In our recent study of this retreat from mandatory pension funds in Central and Eastern European countries, we look at the causes and consequences of these recent changes.

How will changes in pension systems affect pension wealth?

In the study we look at the consequences of the recent changes on individual pension wealth for workers in different age groups in six countries: Estonia, Latvia, Lithuania, Poland, Romania and Slovakia. The scope of the changes in the split of pension contribution between pay-as-you-go and funded pillars differs between countries. A permanent reduction of contributions to mandatory pension funds happened in Latvia, Poland and Slovakia. Changes in Estonia, Lithuania and Romania are temporary. In the long run, the split of contributions between pay-as-you-go and funded parts of pension systems should return to the initial design.

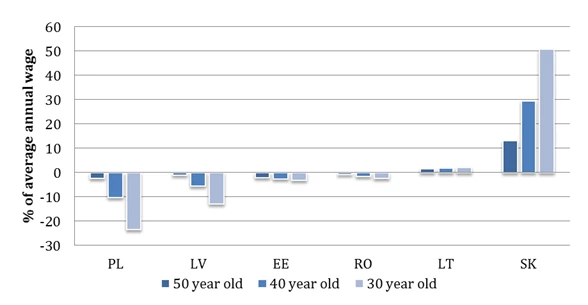

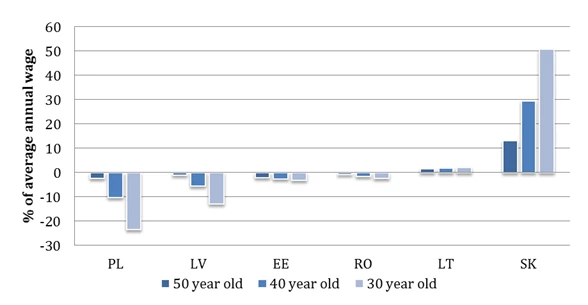

Depending on the design of the pay-as-you-go system, future workers can expect different changes of pension wealth (see below).

The permanent reduction of funded pension contribution leads to the reduction of pension wealth in Poland and Latvia, but to an increase of expected pension wealth in Slovakia. This outcome depends on the design of the pay-as-you-go pension schemes.

In the case of higher pension expectations in Slovakia, the change leads to higher level of implicit liabilities, which means that the reversal led to improved (explicit) public finance indicators in the short term at the expense of higher overall public liabilities in the future. In Poland, there is little impact on future pension liabilities, but there is a potential efficiency loss, particularly for higher wage earners.

Our study shows that the design of the matching part of the pay-as-you-go system affects the potential pension wealth, which may have influenced some of the individual decisions (in those countries which left a choice to pension system participants).

These findings should be seen only as one of the outcomes of the recent wave of pension systems changes. One should not forget that the change in the proportion of contributions affects the risk diversification of financing future pensions.

Were countries persistent in reforms implementation?

The study also reveals that the initial reform agenda related to the financing of transition costs of pension reforms was not followed. As a result, the gap in the current financing of the pay-as-you-go pension expenditure, caused by transferring the part of workers’ contributions to funded pension accounts, was financed to a large extent from the increase of public debt - in particular in Hungary and Poland, where the retreat from mandatory pension funds was the greatest.

Policy implications

The changes in the structure of pension systems in Central and Eastern Europe have further implications. The reduction of the role of funded systems increased the reliance of future pension income on wage-based financing, which will be more difficult to achieve given projected labor supply shortages due to the population ageing in the future. The changes also have an impact on the level of societal trust towards state-organized pension system and the reliability of accumulated pension savings. Last but not least, recent retreats show that pension reforms (in general all systemic reforms) require long-term commitment from governments. Launch of the reform is just the beginning and diversions from initial plans can lead to retreats when more difficult times come.

Population ageing is a phenomenon that affects virtually all populations in the world. Over the next few decades, the consequences of this demographic change will be particularly visible in Central and Eastern European countries, who face at the same time a significant drop in fertility levels and increasing life expectancy. These developments were, among others, one of important reasons behind the multi-pillar pension systems reforms at the end of 1990s and at the beginning of the century. These reforms were slowed down and partially or fully reversed after the financial and fiscal crisis of 2008. In our recent study of this retreat from mandatory pension funds in Central and Eastern European countries, we look at the causes and consequences of these recent changes.

How will changes in pension systems affect pension wealth?

In the study we look at the consequences of the recent changes on individual pension wealth for workers in different age groups in six countries: Estonia, Latvia, Lithuania, Poland, Romania and Slovakia. The scope of the changes in the split of pension contribution between pay-as-you-go and funded pillars differs between countries. A permanent reduction of contributions to mandatory pension funds happened in Latvia, Poland and Slovakia. Changes in Estonia, Lithuania and Romania are temporary. In the long run, the split of contributions between pay-as-you-go and funded parts of pension systems should return to the initial design.

Depending on the design of the pay-as-you-go system, future workers can expect different changes of pension wealth (see below).

The permanent reduction of funded pension contribution leads to the reduction of pension wealth in Poland and Latvia, but to an increase of expected pension wealth in Slovakia. This outcome depends on the design of the pay-as-you-go pension schemes.

In the case of higher pension expectations in Slovakia, the change leads to higher level of implicit liabilities, which means that the reversal led to improved (explicit) public finance indicators in the short term at the expense of higher overall public liabilities in the future. In Poland, there is little impact on future pension liabilities, but there is a potential efficiency loss, particularly for higher wage earners.

Our study shows that the design of the matching part of the pay-as-you-go system affects the potential pension wealth, which may have influenced some of the individual decisions (in those countries which left a choice to pension system participants).

These findings should be seen only as one of the outcomes of the recent wave of pension systems changes. One should not forget that the change in the proportion of contributions affects the risk diversification of financing future pensions.

Were countries persistent in reforms implementation?

The study also reveals that the initial reform agenda related to the financing of transition costs of pension reforms was not followed. As a result, the gap in the current financing of the pay-as-you-go pension expenditure, caused by transferring the part of workers’ contributions to funded pension accounts, was financed to a large extent from the increase of public debt - in particular in Hungary and Poland, where the retreat from mandatory pension funds was the greatest.

Policy implications

The changes in the structure of pension systems in Central and Eastern Europe have further implications. The reduction of the role of funded systems increased the reliance of future pension income on wage-based financing, which will be more difficult to achieve given projected labor supply shortages due to the population ageing in the future. The changes also have an impact on the level of societal trust towards state-organized pension system and the reliability of accumulated pension savings. Last but not least, recent retreats show that pension reforms (in general all systemic reforms) require long-term commitment from governments. Launch of the reform is just the beginning and diversions from initial plans can lead to retreats when more difficult times come.

Join the Conversation