To rectify these problems, in 2014 the Ministry of Finance presented a new proposal known as a health insurance allowance. This frees minimum wage employment contracts from paying health insurance contributions. The ministerial proposal came into effect from 2015. The goal is to increase the motivation to work for low wages and thus to help decrease unemployment. Early indications suggest that it will increase the net income of more than 500,000 people and cost €146 million in 2015, although its overall impact on unemployment is so far unclear.

There are three types of non-standard contracts, besides the standard employment contracts in Slovakia:

- agreements to work up to 10 hours per week (40% of all agreements);

- agreements to perform specific work up to 350 hours in one year (34% of all agreements);

- agreements to work up to 20 hours per week for students up to 26 years of age (26% of all agreements).

Firms and individuals started to use the agreements more intensively after the crisis in 2009, in an effort to cut costs. Indeed, the number of agreement workers increased by around 40% in 2009. Compared to standard employment contracts the agreements offered more flexibility; they had relatively easier hiring and firing procedures as well as limited regulations protecting workers. For example the minimum wage rule or paid leave rules did not apply to agreements. Moreover the agreements enjoyed a much lower tax rate.

In 2013, the government decided to reform the system, to give more worker protections and tackle tax evasion. The government applied the minimum wage rule to all agreements. They increased the social and health contributions to the same level as employment contracts, from 1.05% to 48.6% of the gross income paid by both workers and employers. There remained several exceptions for service and old-age pensioners, disability pensioners and students.

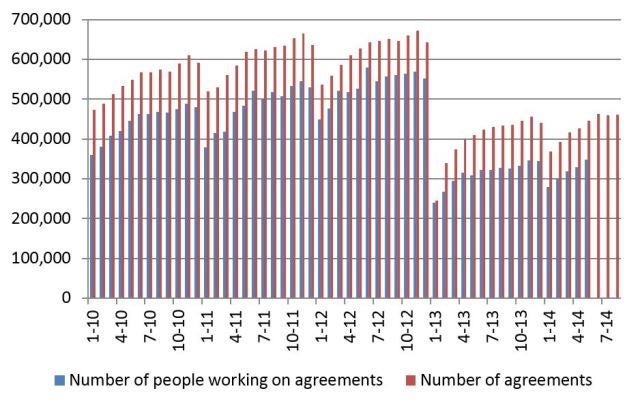

The reform came into effect from January 1 st, 2013 and had an immediate impact. The number of people working on agreements decreased by almost 60% in January 2013 compared to December 2012. The year-on-year decrease was almost 40% in December 2013. This meant a reduction from 552,000 agreements in December 2012 to 344,000 thousand in December 2013.

Number of agreements and people working of agreements

Source: INEKO based on data from the Social Insurance Agency

What happened to the people who ceased to work on agreements? There was no significant change in the total number of employees: 1.96 million both in 4Q 2012 and 4Q 2013. The number of registered unemployed likewise stayed the same: 0.39 million both in 4Q 2012 and 4Q 2013. Also the number of self-employed was static: 0.36 million both in December 2012 and December 2013.

Even so, there were 111,000 fewer people working both on the agreement and on the standard employment contract or as self-employed in December 2013 compared to December 2012. So what happened to remaining 97,000? We do not have specific data but we assume that probably most of them moved to the informal sector. Some of them may also have become pensioners.

In a survey among 25 firms employing 15,000 people (Source: Adecco, July 2013) two thirds of firms reported that they had to react to the changes to the agreements. From those impacted, 75% of firms restricted agreement contracts, 25% changed agreements for personal leasing, 22% changed the organization of work, 22% reacted by firing people, 16% reported decreased profits, 16% increased prices of their products and just 4% reported they changed agreements for the standard employment contracts.

The ministerial proposal came into effect in 2015. It is estimated that it will increase the net income of more than 500,000 people and cost €146 million in 2015. The goal is to increase motivation to work for low wages and thus to help to decrease unemployment. However, the 8% hike in the minimum wage will probably limit any positive effects on employment. In fact the seasonally adjusted unemployment rate decreased slightly in January 2015 (from 12.22% in December 2014 to 12.06% in January 2015) and the number of free jobs went up signaling a further decrease in unemployment.

Peter Golias is Director at the Bratislava based think-tank INEKO – Institute for Economic and Social Reforms.

Join the Conversation