Why are petroleum prices dropping so fast anyway? Have they reached rock bottom yet? Should we be worried if they continue to fall? These are questions that probably every finance minister in either oil-rich or oil importing nations is trying to answer.

Not long ago, when the Arab Spring revolution was unravelling in the Middle East in 2011, oil prices were at their highest levels in decades topping US$100 a barrel. Fast forward to January 2015 and what we see are low and falling oil prices that have dropped by more than 50 percent reaching US$48 a barrel. For the moment, falling energy prices can be seen as a tax break for the average household and as an unexpected windfall gain for many countries, especially those that rely heavily on oil for energy generation, like in the Caribbean, for example. But oil exporters may face a few challenges with the oil price plunge.

What is behind the drop?

To be sure, oil prices were on a declining trend already in the second half of 2014 as the US and Canada pumped up their production contributing to an increase in global output and helping prices fall. But the big dive was triggered by OPEC’s decision to keep its global supply constant at 30 million barrels per day in November 2014. In a single day, the price of the Brent dropped by more than 8 percent. OPEC’s decision is believed to be heavily influenced by Saudi Arabia, the world’s largest oil producer within OPEC, which appears to be playing a “game of chicken” with oil producers in the US, Canada and Russia. The underlying Saudi strategy would be to let the prices stabilize at a level where it would become unprofitable for new producers to stay in the market.

Have oil prices hit rock bottom?

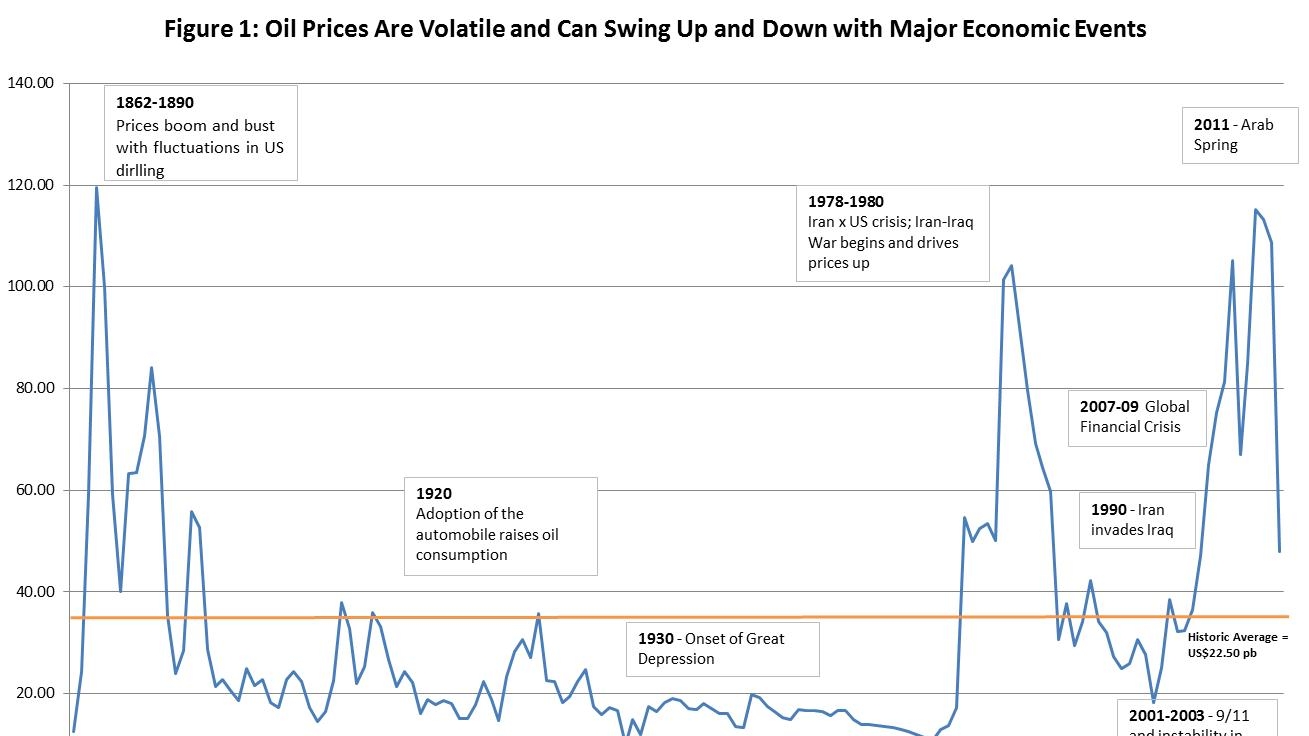

The only thing one can safely say about oil prices is that they are very volatile; and they are very difficult to predict. A simple examination of the accompanying chart illustrates this point. The volatility can be gauged by the number of ups and downs in the price of oil since the beginning of the historic series in 1861. If one considers how far we are now from the historic average oil price since that date when it reached US$22.50 per barrel, there should be no doubt that further price drops are possible. In fact, not long ago, in 2001, a barrel of oil was traded at US$20 in the New York stock exchange.

Should we be concerned with low oil prices?

In the short term, cheap oil is a blessing for those who import oil. Oil importers among industrialized economies, and even more so emerging economies, should witness improvements in household income, their fiscal and external accounts, and a reduction in input costs. But oil exporters will see their main source of revenues decline, and will face pressure on their budgets and external balances. If prices continue to fall, there could be reasons for concern. First, consider this. If oil prices drop too much, they may discourage new investments and at the same time stimulate demand; in simple economic terms this would trigger a price shock at some point in the future. Most importantly, cheap oil is also likely to affect businesses’ willingness to switch to energy-saving technology and may curb any urgency to reduce fossil fuel emissions slowing down global efforts to improve climate change. Second, history shows that extremely low oil prices have been associated with extreme events, such as the Great Depression of 1929, instability in the Middle East in the late 1990s, and the 9/11 terrorist attacks and the subsequent Iraq war in 2001-03 (see Chart). Third, think of the Arab Spring – civil unrest could be triggered in oil-rich nations that become financially stressed and cannot maintain their social programs. Those with a history of precarious macroeconomic management and which have not built significant fiscal buffers during good times are likely to suffer the most.

What should the Latin American and Caribbean countries expect in the near future?

In the Latin American and Caribbean region (LAC), there is fear that because of the falling oil prices and the pressures that this could add to an already ailing economic environment in Venezuela, the PetroCaribe arrangement could be disrupted. The PetroCaribe arrangement was created in 2005 to provide preferentially financed Venezuelan oil to Central America and Caribbean members. Nicaragua, the Dominican Republic, Guyana, Jamaica and Haiti are the countries in the region most exposed to PetroCaribe because of the amount of oil they import under the arrangement and the size of their debt to Venezuela. Under the terms of the arrangement, Venezuela typically offers financing of up to half of the oil bill at 1-2 percent interest rate repayable in up to 25 years and with a grace period of 2-3 years. The biggest challenge will be if oil prices start to increase again in a scenario in which PetroCaribe has been disrupted. But this remains to be seen.

Oil price swings will always create winners and losers. In the current environment, the oil price plunge could benefit both. Oil importers stand to benefit the most. Oil exporters will certainly suffer, but have an opportunity to address difficult economic policy and political economy issues. They might find it easier, for example, to create the necessary incentives for diversifying their economies away from oil, and to reduce or phase out subsidies to fossil fuel, as these are hard to address when oil prices are high. To mitigate possible impacts of plunging oil prices on the environment, fuel taxes could be modified to reduce the incentive for increased consumption. Last but not least, oil importers should not miss the opportunity to buffer up and make provisions for rainy days. After all, everything that goes up, comes down, and eventually finds its way back up again.

Join the Conversation