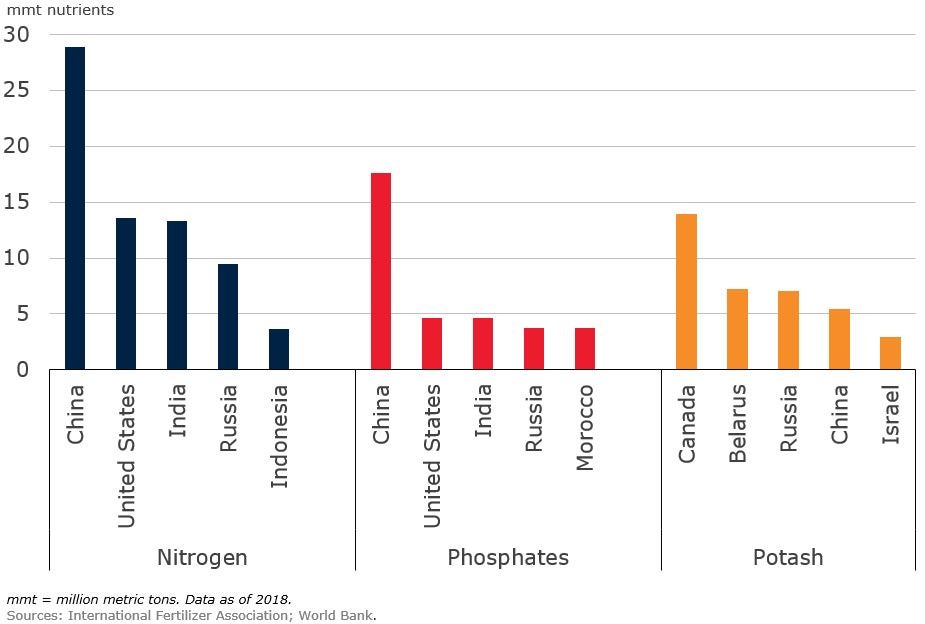

Most fertilizer prices soared in 2021, particularly phosphates and urea, driven by strong demand and higher input costs. Potash prices remained broadly stable on ample supply. Fertilizer prices are projected to average more than one quarter higher in 2021 than last year, before easing in 2022. Risks to the forecast include the pace of capacity expansions, geopolitical tensions, and, in the medium term, environmental policies on fertilizer use.

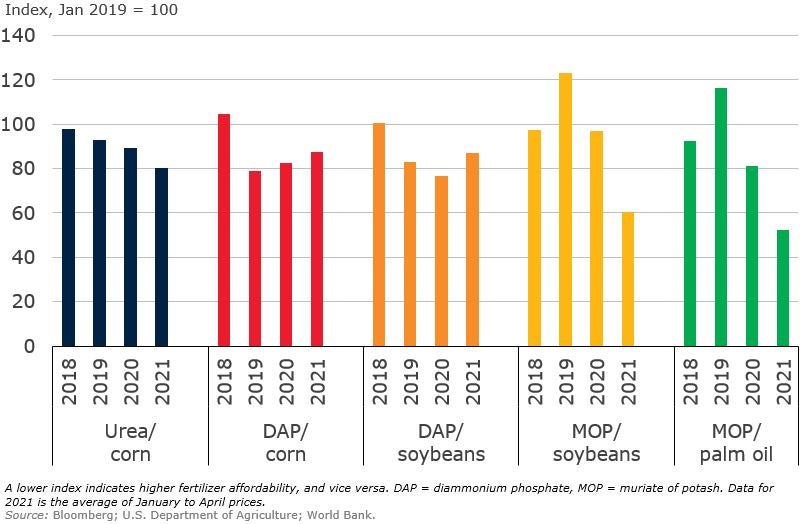

Global demand strengthens. Strong demand from key crop-growing regions has been the driving force behind high fertilizer prices. Agriculture commodity prices, such as corn and soybeans, have rallied amid tighter supplies and strong demand. Higher farm revenue has increased crop acreage and application rates of key nutrients like phosphates and potash. Yet most fertilizer-to-crop price ratios are expected to be lower in 2021 compared to the past few years.

Fertilizer-to-crop price ratios

Higher input costs. Fertilizer prices have also been bolstered by higher input costs. Phosphates raw material costs, particularly sulfur and ammonia, have increased sharply as refinery curtailments due to COVID-19 restrictions limited supplies. Urea feedstock costs have also risen, including natural gas prices which jumped in early 2021 due to unusually cold weather. Spot Asian LNG and European and western U.S. natural gas prices hit record highs in early 2021.

Phosphates raw material costs

Risks to the outlook. Although there is ample capacity to respond to strong demand, it may take some time to ramp up output, which could provide continued short-term price support. Countervailing duties imposed by the United States on phosphates imports from Morocco and Russia have disrupted trade flows. Furthermore, there are indications that similar trade actions could be applied to alleged unfair subsidies for urea and ammonium nitrate. Geopolitical tensions in Belarus and Russia could lift potash prices, but stringent environmental policies in China may slow potash imports.

Join the Conversation