Although fertilizer prices have been resilient amid the pandemic, they have followed different paths. Phosphate and urea prices surged in the second of half of 2020 following losses earlier in the year, reflecting robust demand and higher input costs. Potash prices remain subdued due to oversupply. Fertilizer prices are projected to increase modestly by 3% in 2021, according to the October 2020 edition of the World Bank’s Commodity Markets Outlook.

Phosphate DAP prices jumped 23% in 3rd quarter of 2020, supported by strong demand from key crop-growing regions. A depreciation of the Brazilian real led to higher domestic crop prices, which has driven demand. Early monsoon rains in India boosted the Kharif (summer or monsoons) plantings, while precipitation in Australia, after two seasons of drought, improved crop growing conditions. Similarly, favorable weather conditions in North America spurred fertilizer use, following three consecutive poor application seasons.

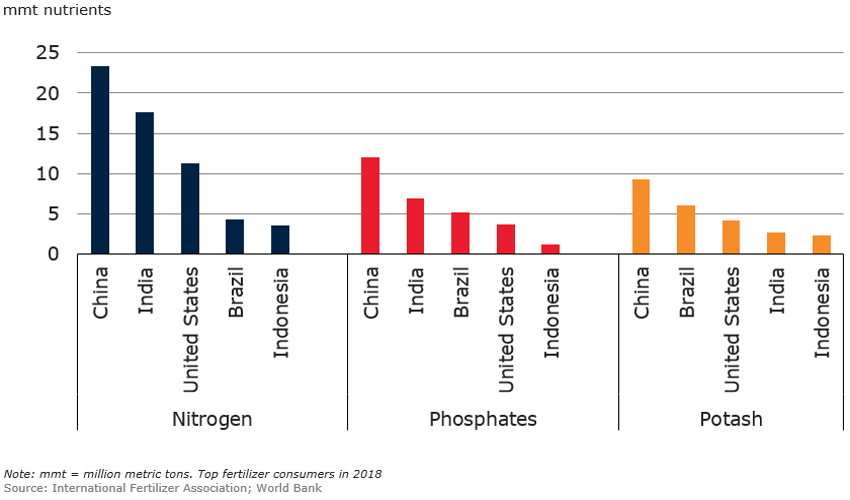

Key producers of fertilizers

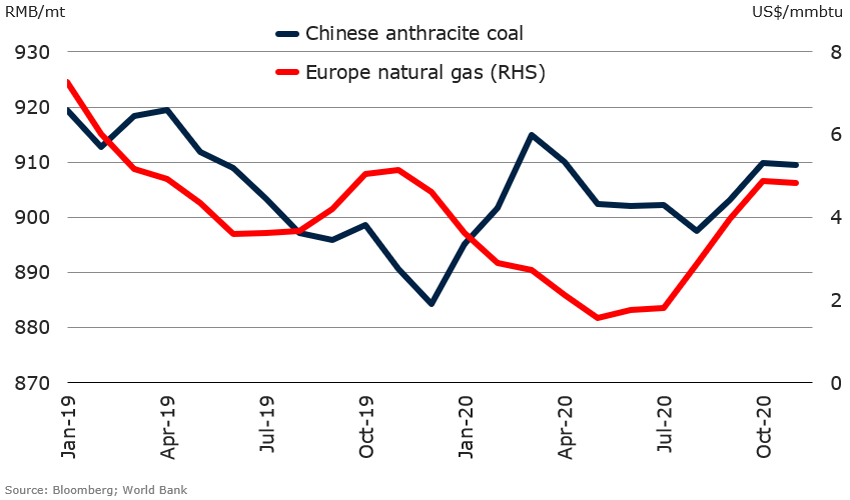

Urea prices increased nearly 12% in 3rd quarter of 2020, recovering from a near three-year low in May. The price increase partly reflected higher input costs, especially energy, as prices of several energy benchmarks have doubled since May. Prices of anthracite and bituminous coal, the main urea feedstock in China, have risen in recent months. Prices of natural gas, the feedstock used outside China, have recovered to pre-pandemic levels.

Input costs for urea

Contrary to phosphates and urea, potash prices weakened further in 3rd quarter of 2020 following declines in the first half of the year. Prices have been under pressure since mid-2019 due to oversupply, with the Vancouver f.o.b. benchmark falling to a 13-year low in June. Demand from China has also been lower in 2020 compared to a year ago. Supply uncertainties, following the August labor strikes at Belaruskali, the world’s second largest potash producer (located in Belarus), failed to lift prices.

China’s potash fertilizer imports are projected to have declined in 2020

Join the Conversation