Most food commodity prices are gaining momentum as end-2020 approaches, driven by supply shortfalls and stronger-than-expected demand in some oils and meals as well as depreciation of the U.S. dollar. Concerns of weakening demand and trade restrictions due to the pandemic have faded. Following a projected increase of more than 3% in 2020, the World Bank’s Food Price Index is expected to gain an additional 1.5% in 2021, according to the October 2020 edition of World Bank’s Commodity Markets Outlook. Risks to the forecasts emanate from the path of energy costs, emerging La Niña conditions, and macroeconomic uncertainties.

Downward revisions to 2020-21 global food supplies. Early assessments for the current crop year suggested that supplies (beginning stocks plus production) of the three grains and soybeans, which together provide nearly two-thirds of the world’s calorific requirements, would be 3% higher than in 2019-20. Consistent downward revisions, however, has brought this growth down to 1.4% in November 2020 (the latest assessment). This is marginally lower than the 3-decade average growth of 2.2% (or 57.3 million metric tons).

Grains and soybean supplies

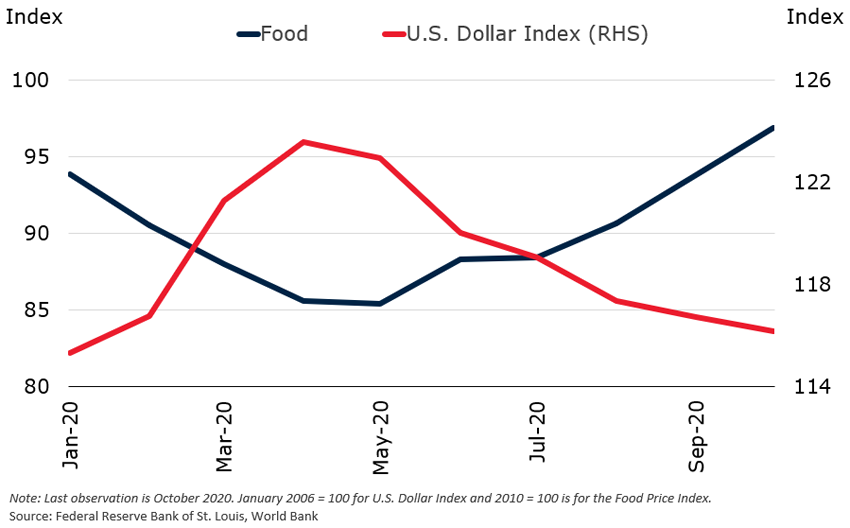

The weakening of the U.S. dollar is partly responsible for the recent uptick in food prices. From April to October 2020, the World Bank’s Food Price Index increased 13%. During this period the U.S. dollar (measured against a broad basket of currencies) depreciated 6%. Research has shown that the elasticity of agricultural commodities prices with respect the U.S. dollar is close to unity. This implies that nearly half of the food price index uptick since May 2020 may be due to U.S. dollar movements.

Food price index and the U.S. dollar

Recent food price volatility falls within the norm of the past six years. Although food prices have been inching up since May 2020 following some declines earlier this year, overall, the recent volatility has been modest and within the norms of the past 6 years, a period characterized by relative price stability , especially compared to early in the decade.

Despite recent downward revisions to the 2020-21 crop outlook, overall food supplies are adequate. Consistent with the relative food price stability of the past six years, the global markets of major food staples have been well-supplied compared to recent history. The aggregate stocks-to-use ratio, a measure of demand relative to supplies (which includes 12 major grains and edible oils) has averaged nearly 30% since 2015. This is up from less than 20% during 2007-11 , a period which includes food price spikes in 2007 and 2011.

The food price outlook is subject to various risks

- Energy costs. Energy is an important cost component to most crops, with direct channels (oil prices) and indirect channels (chemical and fertilizer prices). Prices for both energy and fertilizers are expected to rise in 2021 (by 9% and 3%, respectively), following projected declines in 2020 (by 33% and 10%, respectively). A slower-than-expected recovery in energy and fertilizer prices could push production costs down for grains and oilseeds, thus dragging their prices downward.

- Macroeconomic conditions. Prices for agricultural commodities, especially the ones that are highly traded (such as wheat, rice, and edible oils), may come under more upward pressure if the U.S. dollar continues to weaken. Furthermore, currency movements of countries that account for a large share of global trade of particular commodities could also affect the price outlook.

- La Niña. The El Niño-Southern Oscillation climate phenomena is currently in the La Niña phase. According to the National Oceanic Atmospheric Administration, La Niña conditions began earlier in the year and are expected to continue through the Northern Hemisphere winter (95% chance) and into spring 2021 (65% chance). It could increase yields of some crops in the Northern Hemisphere, such as maize and wheat, but also reduce yields of these crops grown in the Southern Hemisphere due to added dryness.

World’s top grain and soybean producers

For more information on recent developments and outlook of commodity markets and price updates, visit the Commodity Markets website.

Join the Conversation