This blog is the fifth in a series of 11 blogs on commodity market developments, elaborating on themes discussed in the April 2022 edition of the World Bank’s Commodity Markets Outlook.

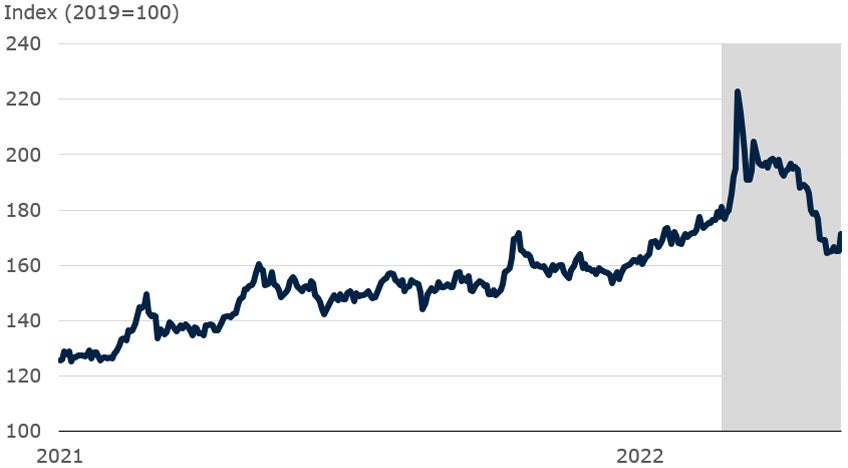

Metal prices retreated in April and May as strict pandemic containment measures dampened demand in China. The easing follows record high prices in March due to supply fears after Russia’s invasion of Ukraine. Prices are expected to stay elevated in the near term, however, amid the uncertainty around supply and historically low stocks, but weaker global economic growth is likely to weigh on prices later this year. In the longer term, the energy transition could give a renewed lift to the prices of some metals, notably aluminum, copper, and nickel.

Base metals price index

Note: The World Bank’s base metals price index is a weighted index of the prices of aluminum, copper, lead, nickel, tin, and zinc. Shaded area denotes the start of the war in Ukraine (February 24, 2022). Last observation is May 20, 2022.

Demand for metals has softened primarily due to a slowdown in economic activity in China as lockdowns in major cities have clouded the growth outlook. Copper prices—the bellwether of the global economy—retraced markedly in May after reaching an all-time nominal high of $10,845/mt in early March. China’s manufacturing PMI dipped to 46 in April, its lowest reading since February 2020. Global auto production also fell sharply in April, largely due to the slump in China, while demand for electronics has slowed since late 2021.

Lead prices and car production in major markets

Note: Car production data are seasonally adjusted. Major markets are China, Japan, Germany, and the United States. Last observation is April 2022.

Tin prices and global electronics PMI

Note: PMI (purchasing managers’ index) is a survey-based measure of economic health. Readings reading greater than 50 indicate an improvement over the previous month. Last observation is April 2022.

The surge in energy costs, however, has led to concerns around the supply of aluminum and zinc due to the energy-intensive nature of smelting. Aluminum prices surpassed $4,000/mt in early March—an all-time high—while zinc prices reached a 15-year high of $4,500/mt in mid-April. High energy costs have forced aluminum smelters in Europe to reduce output by an estimated 17% in 2022. Several zinc smelters have shuttered, including those in Italy and France owned by Glencore and Nyrstar, respectively—among the world’s largest zinc producers.

Aluminum and Europe natural gas prices

Note: Last observation is April 2022.

Sanctions on Russia could lead to further supply disruptions. Russia, which accounts for 6% of global aluminum production, has lost access to key inputs due to sanctions. This includes 2/3 of its supply of alumina—a key input to aluminum production—due to Australia’s ban on alumina exports to Russia. Russia also accounts for 6% of global nickel supplies, and 20% of high-grade nickel for batteries. Russian mining giant Nornickel has been incurring supply disruptions following sanctions.

Russia and Ukraine metal production

Note: Based on 2021 production, except for iron ore (2019) and steel (2020).

Inventories for most metals have reached historically low levels. Inventories at exchanges have declined to historically low levels as elevated energy costs have choked the supply of refined metals. Aluminum and nickel stocks have fallen the most this year as they are among the most exposed metals to disruptions in Russian supply.

Inventories at metal exchanges

Note: Average of combined daily inventories at COMEX, LME, and ShFE. Data for 2022 is through May 20, 2022.

Ongoing mine supply disruptions pose further risks. Almost 20% of Peru’s copper mine capacity has been taken offline recently due to labor disputes, while water shortages hampered output in Chile. Tin supply has been affected by issues with export permit allocations in Indonesia, as well as sporadic closures along the border of Myanmar and the Yunnan province of China. Pandemic-related labor shortages in Australia have disrupted iron ore production, while adverse weather significantly curbed output and exports from Brazil.

Top metal ore producers

Note: Based on 2021 production, except for iron ore (2019).

Join the Conversation