The individual-level microdata includes around 120 variables measuring how adults use bank accounts, mobile money, digital payments, savings, and credit, and their level of financial resilience, all based on nationally representative surveys conducted in more than 120 economies. Collected by Gallup, Inc. during the COVID-19 pandemic, the Global Findex 2021 is the world’s most comprehensive database on financial inclusion and the only demand-side data source for global and regional cross-country analysis. The 2021 edition follows earlier editions from 2011, 2014 and 2017. It introduces several new series measuring financial health and resilience and contains more granular data on digital payment adoption during the COVID-19 pandemic, including merchant and government payments. In June 2022, we released country-level indicators on account ownership, digital payments, savings, credit, and financial resilience (watch our video for a quick overview of the findings). But there are endless ways to splice the data—and we covered only a few of them. That is where microdata comes in.

Consider this small example of the different ways stakeholders in financial inclusion can use the Global Findex data: Suppose you are a policymaker working on women’s financial inclusion in Sub-Saharan Africa and you want to know how many women opened an account at a financial institution since 2017. Looking at the main Global Findex data, you can easily find the share of women with new accounts by country in Sub-Saharan Africa. But if you want to analyze the reasons why women opened these accounts, you could look at the data on the share of women who opened their first account to receive a wage payment or money from the government. Digging still deeper, you could reveal the share of these women that belong to the poorest 40 percent of households. All this is possible using the microdata to define the demographic categories and produce these numbers. Don't get too carried away, though—you should only trust numbers for which you have at least 100 observations.

How to download the data?

Find the microdata here, along with documentation such as the variable list, questionnaire, and information on sampling procedures and data weighting.

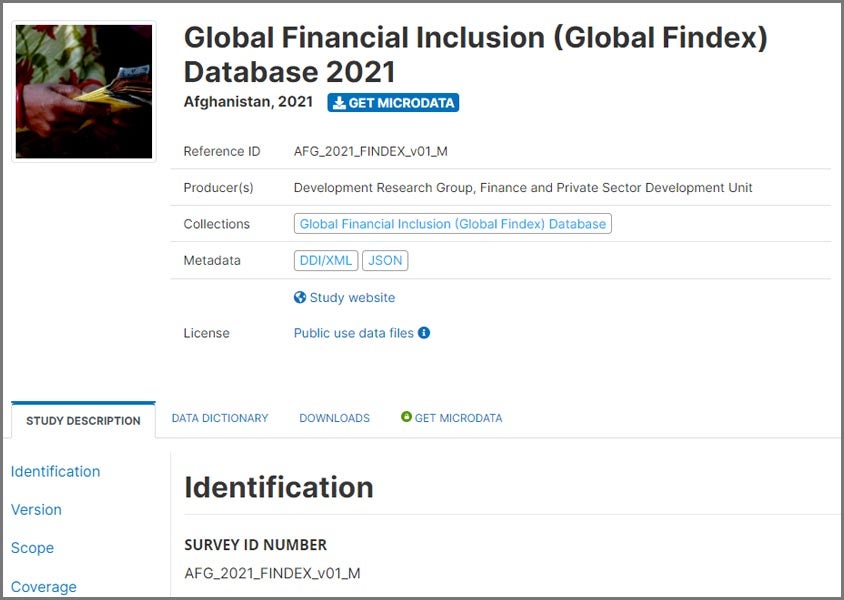

Downloading the data is easy. At the microdata library, you'll see a screen that looks like this:

Click on the global or individual country dataset you want. Next, you will see the following screen. Click on the ‘get microdata’ tab.

You must register with the World Bank's microdata library to complete the download, but registration is quick and easy.

Additionally, for a quick pocket-sized summary of the Global Findex 2021 and easy access to key financial inclusion indicators, check out the Little Data Book on Financial Inclusion 2021 launched by H.M. Queen Máxima of the Netherlands, the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA).

The microdata cannot capture every type of transaction or definitively explain financial inclusion trends in every country. But we hope policymakers and researchers will use it to uncover new insights into the world's financial inclusion challenges and opportunities.

Visit the Global Findex homepage here to read our report or look at the country-level indicators. Share your findings with us on Twitter @GlobalFindex, and don't hesitate to get in touch if you have any questions.

Join the Conversation