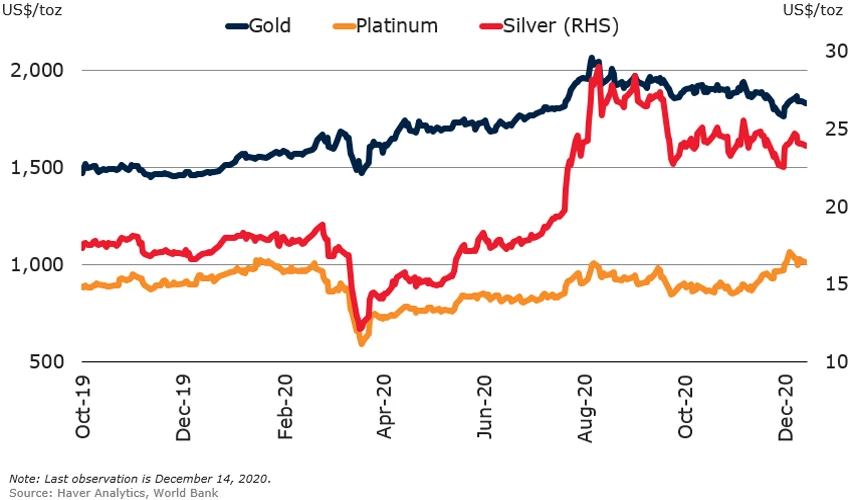

Precious metal prices have stabilized recently as the improving prospects for the global economy has reduced demand for safe-haven assets. Some precious metal prices surged early in the pandemic as uncertainty overshadowed the global economy. Prices are projected to be lower in 2021 as the global economy recovers, according to the October 2020 edition of the World Bank’s Commodity Markets Outlook.

Precious metals prices have fallen recently, but remain higher than end-2019

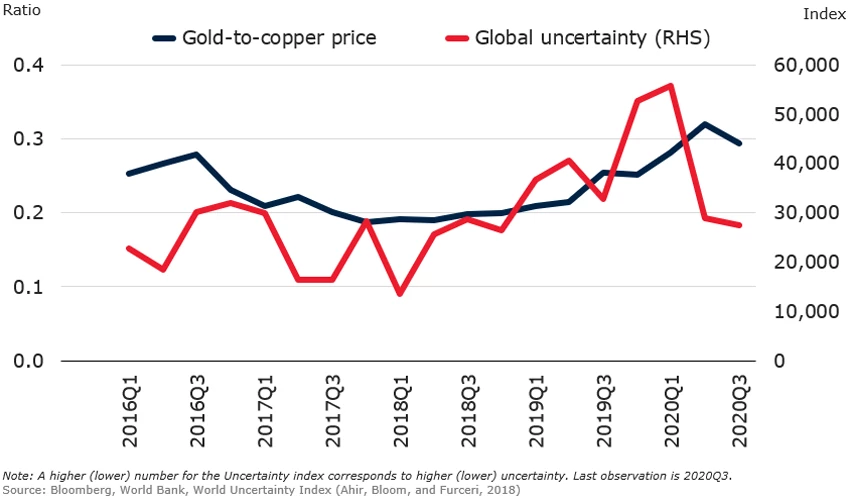

Gold prices eased during 4th quarter of 2020, after reaching an all-time high of US$2,067 per ounce on August 6. Demand for safe-haven assets has declined following improving economic conditions. The appetite for exchange-traded funds (ETFs) fell as well in 3rd quarter of 2020 while central bank gold purchases reversed. The gold-to-copper price ratio—a barometer of global risk sentiment—also declined, after reaching a 40-year high in April.

Global uncertainty improved in 2020 Q3

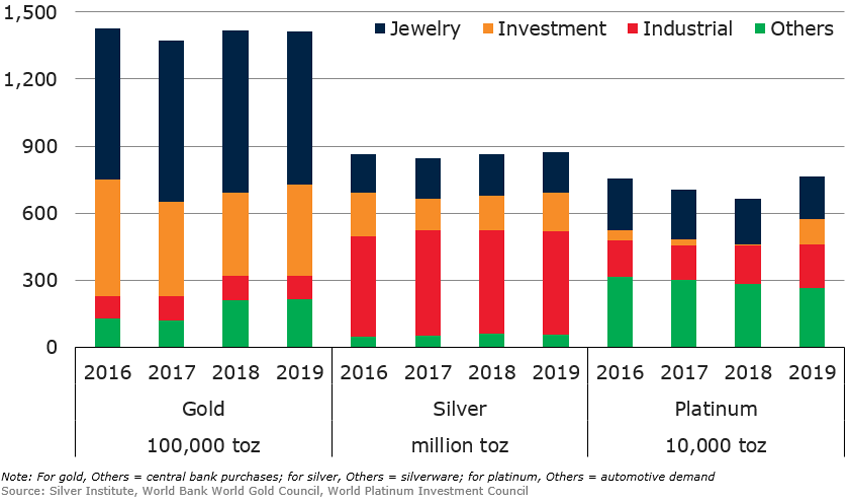

Silver prices have declined after reaching a seven-year high of US$29 per ounce on August 10, but remain substantially higher than in January. Platinum prices, which plunged in April, have held up much better in recent months on the back of a recovery in global auto sales. Both silver and platinum prices are supported by robust industrial demand. More than half of silver’s demand comes from industrial applications, such as in electrical and electronics, while a quarter of platinum’s supplies are used by the automotive industry (each catalytic converter uses 0.10 to 0.25 troy ounces of platinum, equivalent to $100-230 per vehicle at current prices).

Demand for precious metals

Join the Conversation