This blog is the tenth in a series of 11 blogs on commodity market developments, elaborating on themes discussed in the April 2022 edition of the World Bank’s Commodity Markets Outlook.

Precious metals prices have softened after their March 2022 highs. The recent weakness reflects rising interest rates and the strengthening of the U.S. dollar, which have outweighed inflation risks. Gold prices have been relatively more resilient, supported by robust central bank purchases, but were weighed down by soft consumer and investment demand. Silver prices slumped on waning industrial demand. Platinum prices plunged due to weak autocatalyst demand, while palladium prices have been particularly volatile reflecting the impact of the war in Ukraine. Precious metal prices are anticipated to face headwinds throughout the rest of 2022, driven by monetary policy tightening and further economic weakness. But resurfacing geopolitical tensions and persistently high inflation could provide some reprieve.

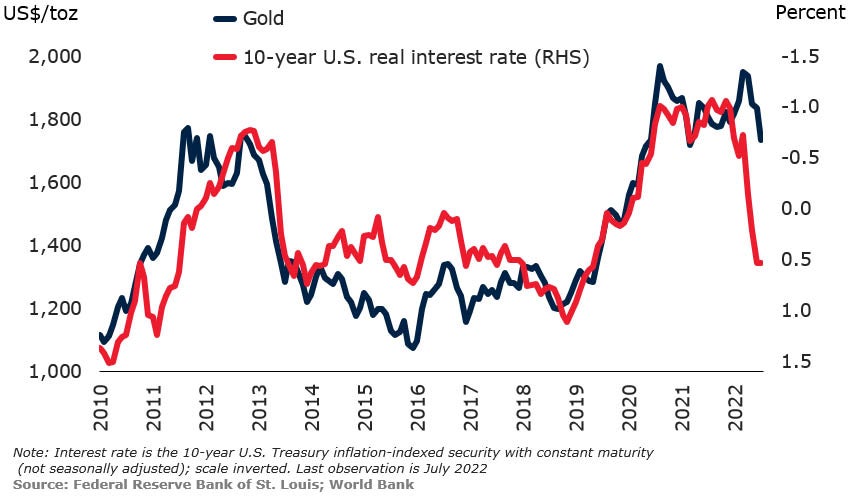

Gold prices have been falling since mid-April, driven largely by higher interest rates and a strong U.S. dollar. With inflation well above target, the U.S. Federal Reserve raised policy interest rates in March-July by a cumulative 2.25 percentage points. The U.S. dollar has also appreciated against most currencies—the dollar index rose to its highest level in two decades. Consequently, investment demand has softened, with net outflows in gold-backed exchange traded funds (ETFs) during 2022Q2. Feeble jewelry demand, most notably in China due to lockdowns, as well as weak demand for consumer electronics, also weighed on gold prices.

Gold prices and interest rates

Silver prices have declined markedly due to heightened concerns about global economic activity. Industrial consumption, which makes up more than half of silver’s demand, has slumped. China’s manufacturing Purchasing Managers’ Index (PMI) dipped to 46.0 in April—its lowest level since February 2020—while United States’ PMI reading fell sharply in June. Both countries are major users of products containing silver, such as electronics, solar panels, and photographic equipment. The larger decline in the prices of silver relative to gold reflects the latter’s stronger safe-haven attributes, as investment demand for silver has fallen more sharply.

Top consumers of silver in 2021

Platinum and palladium prices have retreated as supply fears caused by the war in Ukraine have eased amid a slump in demand. Palladium prices jumped to an all-time high of $3,430 per troy ounce in early March amid concerns about supply availability following widespread sanctions on Russia. However, prices have since retreated as supply from Russia’s Norlisk Nickel—the world’s largest producer of palladium—continued to reach the market despite logistic obstacles. The war has also affected vehicle production, which has yet to recover from the semiconductor shortage, as European carmakers cut production due to the lack of wiring harness supply from Ukraine. This in turn caused a decline in autocatalyst demand which has put downward pressure on palladium and platinum prices. High inflation along with the global slowdown of the economic activity are also creating headwinds for platinum prices.

Join the Conversation