This blog is the eighth in a series of 11 blogs on commodity market developments, elaborating on themes discussed in the October 2022 edition of the World Bank’s Commodity Markets Outlook.

Precious metal prices recovered slightly in December but remain well below their March 2022 highs. Rising interest rates along with a strong U.S. dollar continue to outweigh safe-haven demand and high inflation concerns. Gold prices have been weighed down by soft consumer and investment demand, but robust central bank purchases provided some support. Silver prices have been hampered by weak industrial demand, whereas platinum prices have rebounded more strongly, reflecting a recovery in autocatalyst demand and supply challenges. Precious metal prices face both headwinds and tailwinds in 2023. A more aggressive tightening of monetary policy in response to elevated inflation would dampen prices, while an end or a reversal of interest rate hikes and an intensification of geopolitical tensions could provide support for prices.

Gold prices hit an 18-month low in October. The U.S. Federal Reserve raised its key policy interest rate seven times in 2022 by a combined 4.25 percentage points, reaching its highest level in 15 years. The U.S. dollar has also appreciated sharply, with the dollar index rising to its highest level in two decades. Investment demand for gold has therefore weakened considerably, with continued net outflows in gold-backed exchange traded funds (ETFs). Soft jewelry demand, most notably in China due to on-and-off pandemic restrictions, also weighed on gold prices. These factors have more than offset robust central bank purchases.

Silver prices have been hampered by a slowdown in global economic activity. Industrial demand, which makes up more than half of silver’s demand, has slumped. Although photovoltaic demand (e.g., from the solar industry) continues to grow, consumer electronics demand has weakened considerably. Global electronics output in November fell to its lowest level since June 2020. New export orders of manufactured goods have also fallen markedly in both advanced economies and emerging markets and developing economies.

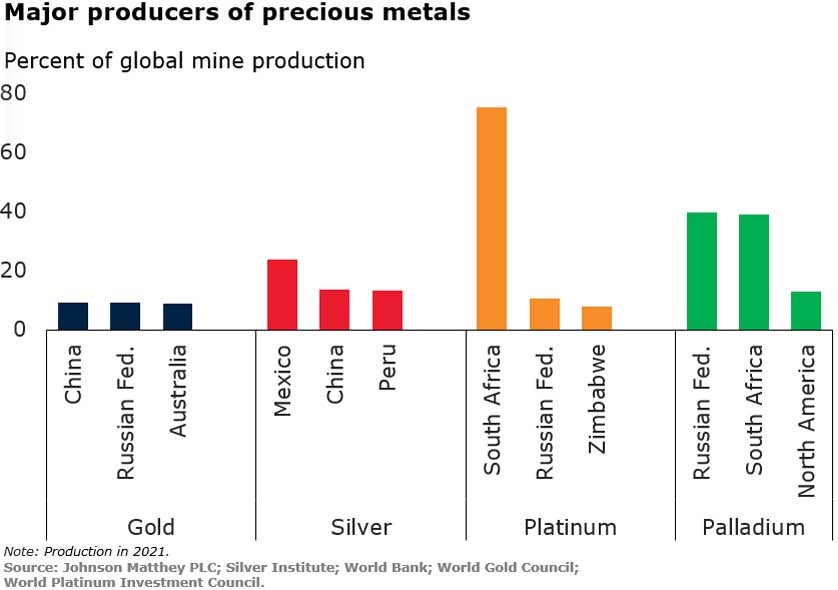

Platinum prices have rebounded in recent months owing to a recovery in autocatalyst demand and supply concerns. The demand for automotive platinum, which is used in catalytic converters, is on the rise again with a 25 percent (y/y) growth in 2022Q3 as supply chain constraints eased. Prices have been supported by supply disruptions in South Africa, which is responsible for over 70 percent of global mine supply, due to maintenance and power outages. However, palladium prices have fallen due to concerns about supply availability following sanctions on Russia over its invasion of Ukraine. These concerns have not materialized as Russia’s Norlisk Nickel, the world’s largest producer of palladium, has continued to supply the market despite logistic obstacles.

Join the Conversation