This blog is the sixth in a series of 11 blogs on commodity market developments, elaborating on themes discussed in the April 2022 edition of the World Bank’s Commodity Markets Outlook.

The World Bank’s Agricultural Raw Material Index has been relatively stable during the past 12 months. However, the prices of its key components, cotton and rubber, have been diverging due to tight supplies and strong demand (cotton), and weakening demand (natural rubber). The Index is expected to average marginally higher in 2022 compared to 2021 and remain broadly stable next year. The outlook could worsen if new pandemic-related lockdowns are imposed or if demand unexpectedly weakens.

Cotton and natural rubber prices

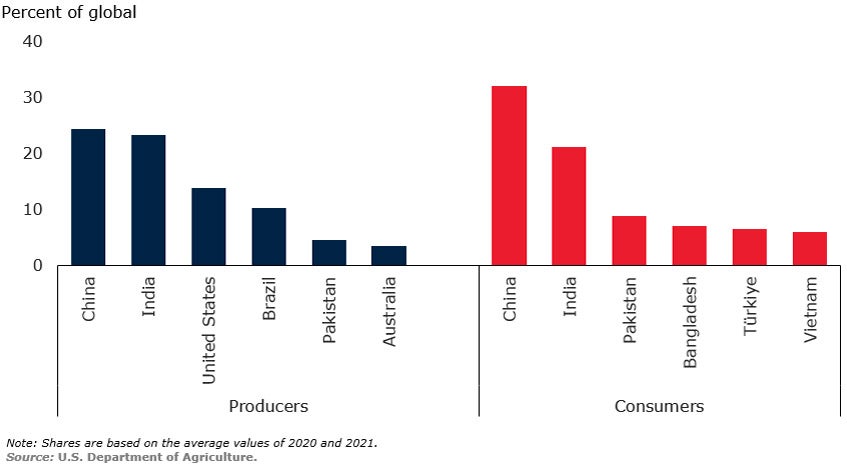

Cotton prices have been supported by strong global demand, but ample supplies are likely to put a cap on prices. Although cotton prices retreated recently, they are up 15% in 2022Q2 (q/q) and 70% higher than a year ago. Global demand for cotton, which exceeded 26 million metric tons (mmt) during the 2021-22 season, is expected to stay at similar levels in the upcoming 2022-23 season, which begins in August. Strong post-pandemic demand exerted some downward pressure on cotton inventories, but they remain high by historical standards. Global production is expected to increase 3.7% next season, on top of the nearly 5% growth during the 2021-22 season, but there are significant regional trends. In the United States, production is projected to decline by nearly 6% as farmers switch to food crops, whereas gains are anticipated in other key suppliers: Brazil (3.9%), China (1.9%), India (12%), and Pakistan (3.3%). Following a projected increase of 40% this year, cotton prices are expected to ease in 2023 as new supplies reach the market.

Cotton inventories

Top producers and consumers of cotton

Rubber prices have remained broadly stable. After recovering from their lows in the early stages of the pandemic, natural rubber prices have been broadly stable during the past 12 months, fluctuating within a narrow band of $1.90-2.10/kg. The auto sector, which accounts for nearly two-thirds of natural rubber consumption, has been plagued by a number of supply chain disruptions, including pandemic-related microchip shortages last year and other car components this year due to the war in Ukraine. (Ukraine and Russia are key manufacturers of car components.) Because the disruption in the supply of car components is expected to persist, natural rubber prices are projected remain broadly stable at current levels in 2022 and 2023. Risks to the outlook include further shortages in the automobile sector and extended lockdowns in China.

Join the Conversation