Metal prices surged 8.4% in June 2020, following a 3.7% rise in May, driven by a confluence of demand recovery in China and supply concerns in Latin America. However, prices are still 5.2% lower than at the start of the year due to the impact of COVID-19 containment measures. The World Bank Metals and Minerals Price Index is projected to average 13% lower in 2020 relative to 2019 on expectations of a subdued global economic recovery. This outlook is subject to several downside risks. Fears of a second wave of COVID-19 may force governments to re-impose stringent measures that could hamper metal demand. New stimulus measures in China—the world’s largest consumer of metals—may be less effective than expected because they include “new” infrastructure (such as 5G networks and electric vehicle charging stations), which are less metal-intensive than “traditional” infrastructure (such as rails and bridges).

Source: World Bank

Note: Last observation is June 2020.

Rebound in metals demand, led by China

Metals demand in China rebounded in Q2, largely driven by infrastructure and property, after a steep decline in Q1. Fixed asset investment continued to recover, increasing almost 6% in May, after a collapse of more than 20% in February. Car auto sales in China also rose in May, following an increase in April for the first time in almost two years. Demand for metals has also started to pick up outside of China after lockdown measures eased in Europe and the United States. The improving sentiment for metals demand has been reflected in a recovery of copper prices—a barometer of the health of the global economy.

Source: World Bank, Haver Analytics

Note: Last observation is June 2020.

Supply disruptions, concentrated in Latin America

Copper and zinc

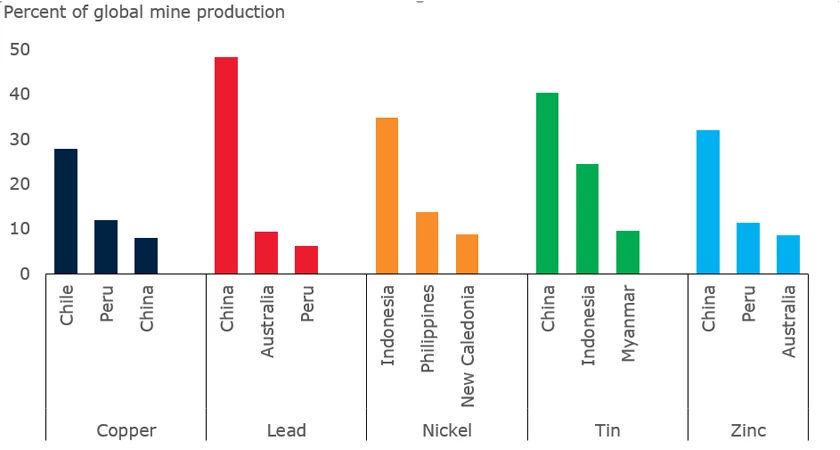

Copper and zinc prices have been supported by mine closures in Peru, the world’s second largest producer of both metals. In April, Peru’s zinc production plunged 86% and copper production fell 35%. Although Peruvian mines have started to reopen, supply concerns remain elevated due to the possibility of abrupt production stoppages as COVID-19 cases have yet to subside. Supply in Chile, the world’s largest producer of copper, has held up relatively well as quarantines and movement restrictions have been less stringent and mines have largely maintained operational continuity. However, copper mine worker unions are demanding more transparency from the government on the COVID-19 outbreak following an alarming rise in COVID-19 cases among miners. At end-June, state operator Codelco suspended its Chuquicamata smelting and refinery operation after recording three fatalities.

Top metal ore producers in 2019

Source: British Geological Survey, U.S. Geological Survey, World Bank, World Bureau of Metal Statistics

Tin

Among base metals, tin has been the least affected by the pandemic. Tin prices in June averaged only 1.1% lower than at the start of the year. Global tin supply concerns had been brewing for some time, particularly after Indonesia tightened export regulations and amid declining mine production in Myanmar. COVID-19 lockdowns in Bolivia, Malaysia, and Peru further added to supply pressures, which have supported tin prices. Tin inventories at the London Metal Exchange and Shanghai Futures Exchange declined sharply during the pandemic.

Tin inventories fell during the COVID-19 pandemic

Source: Bloomberg, Shanghai Futures Exchange, London Metal Exchange, World Bank

Iron ore

Unlike base metals, iron ore prices have remained resilient during the pandemic. Prices in June were higher than at the start of the year. Global supply concerns have re-emerged despite the restart of operations at Vale’s iron ore Itabira complex in Brazil. Vale’s iron ore production had struggled to recover following a tailings dam accident in early 2019.

Source: World Bank

Note: Last observation is June 2020.

Join the Conversation