In observance of International Migrants Day, Dec 18

The developed world is aging as life expectancy rises and birth rates fall. India has a different problem. With 18 million Indians turning 18 every year and with over 100 million Indians being surplus in the agricultural sector, 20 million Indians will need jobs each year. In contrast, India creates less than two million jobs a year. Can active promotion of emigration of Indians to the developed world be a solution to this problem?

Leaving the political challenges aside, there is a basic problem. India does not have the skills to fill many of these vacancies. In fact, India itself faces a huge skill mismatch with millions of jobs going unfilled if we do not solve this skills crisis.

Changes in technology have been constant over the last few decades. Many of the changes continue to be disruptive and people need new skills to remain relevant and gainfully employed.

Put yourself in the shoes of someone like Gurmeet who works as a lathe operator and wants to become a CNC machine operator. Even if Gurmeet knew from her friends that Aakash Training School is a great place to learn from, she would not have had 50,000 to pay for the training and her family would not have survived three months of the training without her current 10,000 a month salary. Maybe, the local moneylender offers her a loan of 80,000 (covering the cost of the training and the three months’ lost wages) to be repaid with interest. Even then, Gurmeet would be hesitant because there is no guarantee she will get a job as a CNC operator and earn 25,000 a month. What if she does not get the job and is stuck with a huge loan? This would destroy her family. So, she decides to take her chances with her current job and not try to improve her position.

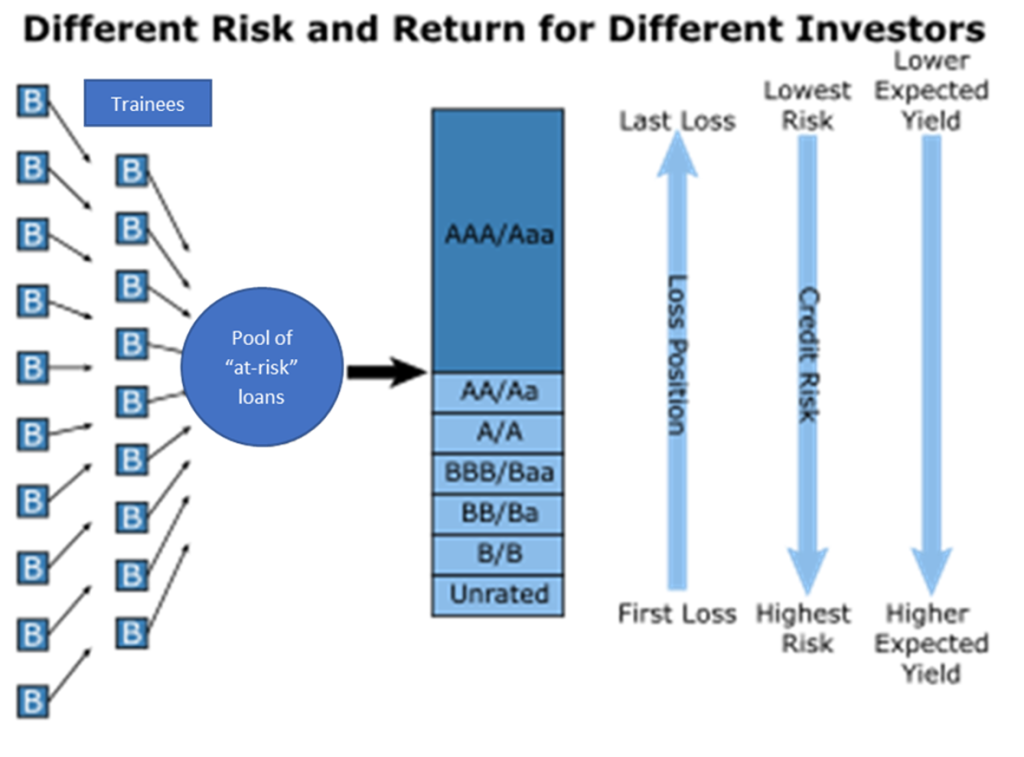

Imagine an alternate universe. Here the training institute does not charge the student an upfront fee and even gives a loan to compensate for lost wages. The notional cost of the training including the money to compensate for lost wages is treated as an “at-risk” loan to be repaid if the trainee gets a job earning above a certain income. The trainee promises to pay a percentage of her future income provided it is above a threshold for a specific duration with a cap on the maximum amount to be paid. The training institute and the trainee now have the same interests at heart, and both try hard to make this successful. Since training institutes do not have unlimited resources, they will need the loans to be refinanced.

Here is where the idea of financing upskilling through career impact bonds (CIB) comes in. CIBs were coined by an organisation called Social Finance. The training institute creates a pool of all the loans they have given to their trainees and sells the future cash flows from these loans to a special purpose vehicle (SPV). The SPV structures bonds which are sold to investors. The coupon on the bonds will depend on the seniority of the bond. The senior bonds get first right to the interest and principal and are more likely to be repaid in full and are less risky. This could attract pure financial investors. The junior tranches are riskier and these bond holders will get paid only after the senior tranches get their money. This can be funded by CSR money from large corporates wanting to invest in upskilling Indians and some impact investors. The equity tranches are the riskiest attracting only philanthropists, the government, and the training institutes which are willing to put skin in the game.

A large number of people can acquire new skills without worrying about the high opportunity cost of the program or how they will repay the loan. Since the training is determined by market forces and the repayment is dependent on outcomes, training institutes and even universities that impart market-relevant skills that translate into efficient workers will thrive and help India build world-class centres of learning. Philanthropists and governments will see a direct impact on their investments in reskilling, allowing them to redirect their funds to the right training institutes. Financial investors have an investment option that generates returns and causes social impact.

[Editor’s note: This idea is applicable to all countries including high-income countries. Dilip Ratha]

Join the Conversation