Remittances

Remittances

We have just released a new report highlighting the impacts of COVID-19 on migration and remittance flows. The economic crisis induced by COVID-19 could be long, deep, and pervasive when viewed through a migration lens. Lockdowns, travel bans, and social distancing have brought global economic activity to a near standstill. Host countries face additional challenges in many sectors, such as health and agriculture, that depend on the availability of migrant workers. Migrants face the risk of contagion and also the possible loss of employment, wages, and health insurance coverage. This edition of the Migration and Development Brief provides a prognosis of how these events might affect global trends in international economic migration and remittances in 2020 and 2021.

Efforts to curb the spread of the coronavirus need to include migrants, who face risks unique to their living and working situations. Low-wage migrant workers, especially those in non-essential sectors, are vulnerable to the loss of employment and wages. Lockdowns in crowded worker dormitories increase the risk of contagion among migrant workers. Further, migrants who wish to return home have been stranded due to the suspension of transport services, though host countries that have granted visa extensions and temporary amnesty to migrant workers have provided some measure of relief.

The report is largely focused on international migrants, but governments should not ignore the plight of internal migrants. The magnitude of internal migration is about two-and-a-half times that of international migration. Lockdowns and loss of employment prompted a chaotic and painful process of mass return for internal migrants in many countries. Governments need to address the challenges facing internal migrants by including them in health services and cash transfer and other social programs, and protecting them from discrimination.

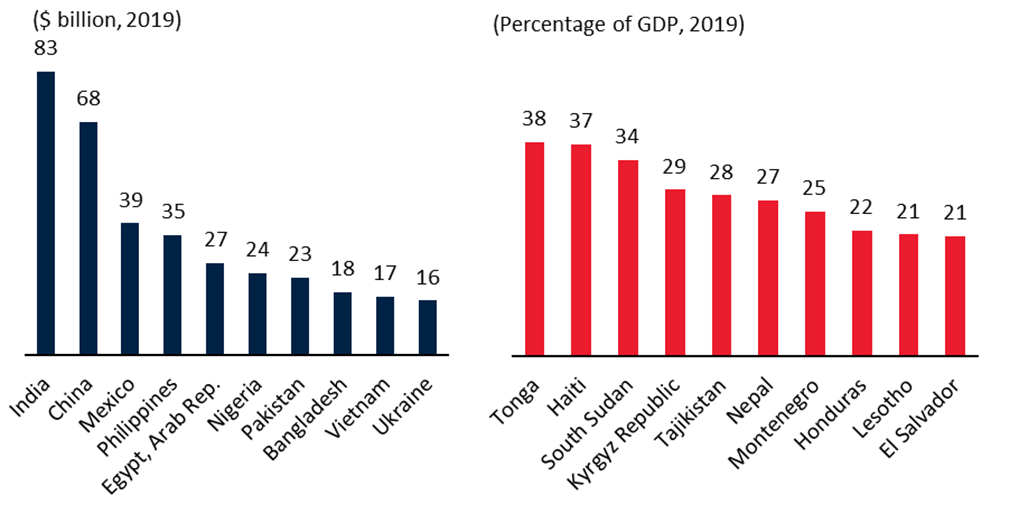

In 2020, due to the global economic contraction, remittance flows to low and middle-income countries (LMICs) are expected to drop by around 20 percent to $445 billion, from $554 billion in 2019. Migrant remittances provide an economic lifeline to poor households in many countries; a reduction in remittance flows could increase poverty and reduce households’ access to much-needed health services. Remittance-dependent countries could see households at risk as remittance incomes decline over this period (Figure 1).

Figure 1: Top recipients of remittances in 2019

In the midst of this sharp decline, the relative importance of remittance flows as a source of external financing for LMICs is expected to rise. This is because foreign direct investment (FDI) is expected to decline by even more, due to travel bans, disruption of international trade, and declines in private equity flow.Our report estimates that FDI to LMICs could fall by more than 35 percent. Private portfolio flows through stock and bond markets could fall by over 80 percent.

The global average cost of remittances posted a small decline to 6.8 percent in the first quarter of 2020, from 6.9 percent a year ago. This remains far above the Sustainable Development Goal target of 3 percent. Remittance service providers have been facing store closures and disruption of services.While this has increased the relative importance of electronic transfers, poorer and irregular migrants often lack access to online services. They require the origination and distribution of funds through banks, payment cards, or mobile money. Online transactions (like cash-based services) require remittance service providers to exercise vigilance against fraud and financial crime, to comply with anti-money laundering and countering the financing of terrorism (AML/CFT) regulations. However, such due diligence has become difficult amid staff shortages.

As countries respond to the COVID-19 crisis, there is a strong case for supporting the migrant workforce, which is vital to many economies. There are several interventions governments should consider. First, supporting stranded migrants and their access to health, housing, and other social services. Second, supporting the remittance infrastructure by recognizing remittance service providers as essential services, and offering incentives to reduce the cost of remittance services. In the medium to long-term, policies should encourage the interoperability of online remittance systems and support efforts to reduce remittance costs, which remain far too high for some of the poorest regions.

The latest Migration and Development Brief, data and a press release are available at www.knomad.org

Related Links:

Migration and Development Brief 32 / Press Release / Data on Remittance Inflows / Data on Outward Remittance Flows / World Bank Migration and Remittances Website

Join the Conversation