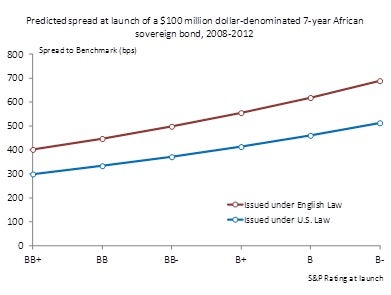

It seems it does. During 2008-2012, post-crisis, launching under English law increased spreads by more than a third on average. In other words, by choosing the UK law, a nation rated B+ (for example, Ecuador, Ghana, Greece, Pakistan and Zambia) apparently paid 7.7% interest rate per annum instead of 6 percent, and a nation rated BB (for example, Bangladesh, Nigeria, Serbia or Vietnam) paid nearly 5.7% instead of 4.5% (figure 1). Such an increase in spread is equivalent to a rating downgrade of 3 notches or more.

Figure 1: Pay more if you don’t have US SEC registration

These results are from a comparison of spreads at launch for dollar-denominated sovereign bonds issued under English law and U.S. law during 1990-2012. Central Government bonds denominated in US dollar under English or U.S. jurisdiction represented a large component of emerging market debt during 1990-2012 (figure 2). After the crisis in 2008, there was a surge in emerging market sovereign bonds registered under the English law – indeed, such bonds overtook those listed under the US law in 2012. Most of the bonds under English law relied on Regulation S and were listed in Luxembourg. (Regulation S securities cannot be sold in the United State.)

Figure 2: In perspective – emerging market sovereign US-dollar denominated bonds

The higher-spread effect of the English law seems to be a post-crisis phenomenon, and is contrary to the conventional belief that bond markets are very efficient. It is rather disconcerting that the higher spread persists in the secondary market even after 180 days after the launch of the bond.

The jurisdiction effect holds after controlling for bond characteristics (rating, maturity, size), and a host of factors that affect bond spreads (such as volatility index, global liquidity, growth). English law is normally associated with collective action clauses (CACs); but according to the data at the individual security level, bonds under U.S. law are now just as likely to contain CACs. Thus CAC is not the reason behind the higher-spread in the post-crisis period. We also checked if first time issuance of bonds might explain the higher spread, but that does not seem to be the case either.

The jurisdiction effect of a higher bond spread seems to be a result of the difference between the size of the investor base available to securities under the US law and that under the UK law – the latter is a lot smaller and perhaps of a different kind, one that is seeking shorter-term yield instead of long-term value.

U.S. SEC registration, considered the gold standard for securities registration, is perceived as costly and cumbersome, but the alternative seems too costly for a developing nation trying to access the international bond market.

What are the factors discouraging emerging market sovereigns from benefitting from SEC registration? Has the American investor become wary of buying bonds without SEC registration, and if so, why? What could be other explanations for the higher-spread effect of the choice of legal jurisdiction?

Please take a look at this presentation that has more data and regression results. We will greatly appreciate your comments and suggestions before we finalize this paper.

(Oops, I have just given away a trading secret!)

The above post appeared first in Let's Talk Development.

Join the Conversation