Sending remittances is unnecessarily confusing. As a result, consumers are often overcharged. However, that could soon change if governments adopt the price transparency recommendation published last year by the international community.

Despite improvements over the last decade, consumers largely still do not understand how much it costs to send money abroad. That’s because there are several variables that make up prices, including upfront fees and foreign exchange (FX) margins.

FX margins are one-third of the price on $200 remittances, and more than half the price in the broader cross-border payments market.

Alarmingly, recent research showed that while 55% of American consumers said they understood the costs of sending money abroad, only 18% correctly identified exchange rates as one of the costs. As the World Bank has previously stated, “the single most important factor leading to high remittance prices is a lack of transparency in the market.”

The global average cost of a remittance remains a painfully high 6.5%. That’s more than double the 3% target identified as a Sustainable Development Goal by the United Nations. The world can achieve this target by eliminating hidden remittance fees, which keep prices unnecessarily high for the one billion people making international payments.

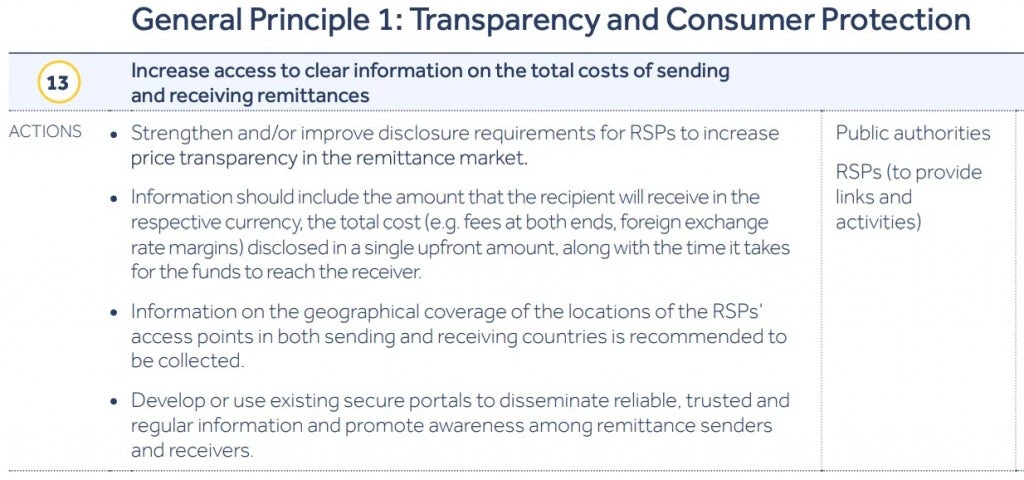

That’s why I was encouraged to see the international community come together recently to call for improved price transparency. The Global Remittance Task Force, formed at the start of the COVID-19 pandemic following a call to action from the UN Secretary-General, published its Blueprint for Action in November 2020 with concrete policy recommendations for the G20 and remittance providers.

The report included transparent pricing as a key recommendation, calling for “the total cost (e.g. fees at both ends, foreign exchange rate margins) disclosed in a single upfront amount” as an industry best practice and a suggested requirement for governments.

Transparent pricing holds the promise of lower costs for the entire industry. Previous research from the United Kingdom Government found that once fully transparent pricing was introduced, with upfront fees and FX margins disclosed in a single amount (“total cost”), the percentage of first time consumers choosing the best option doubled from 34.3% to 68.9%.

While not quite watertight, the European Union took a big step towards price transparency last year. New rules require online and card providers to show the total costs of sending money upfront, including the exact amount of any exchange rate margins, on transfers within the E.U.

The future of affordable remittances depends on transparency. “Total cost” pricing allows consumers to understand the costs of sending money abroad and conduct apples-to-apples comparison shopping.

Governments around the world should heed the recommendations of the international community and eliminate hidden remittance fees. The resulting increase in competition would drive down prices across the market, helping deliver the UN Sustainable Development Goal of lower remittance costs.

As we head towards the annual G20 summit, in Italy this fall, we hope governments will commit to tangible action to deliver on this goal.

Join the Conversation