According to the latest issue of the Economist, diaspora bonds an idea worth trying. Ethiopia recently announced the launch of its second diaspora bond: “Renaissance Dam Bond”.

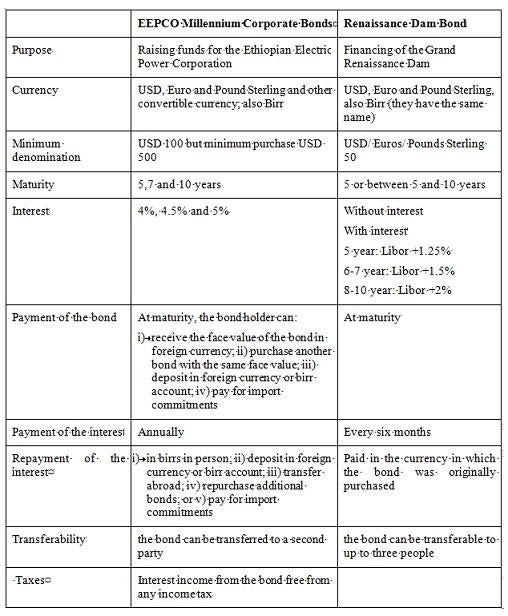

The proceeds of the bond will be used to fund the construction of the Grand Renaissance Dam. This dam will be the largest hydroelectric power plant in Africa when completed (5,250 Mega Watts). The first one was called the Millennium Corporate bond, and was for raising funds for the Ethiopian Electric Power Corporation (EEPCO) . The first diaspora bond issuance did not meet the expectations. Sales were slow during the first months of offering despite the efforts of the Commercial Bank of Ethiopia and the embassies and consulates to sell them. Some risks that the diaspora faced were: i) risk perceptions on the payment ability of EEPCO on its future earnings from the operations of the hydroelectric power; ii) lack of trust in the government as a guarantor; and iii) political risks.

The second bond has some new features that probably can make it work this time: i) the Renaissance bond is being consolidated with the Millenium bond; ii) the government is taking considerable marketing and awareness-raising campaigns to encourage the diaspora to buy it; iii) the bond is being offered in minimum denominations of USD 50 so many Ethiopians can have access; iv) the bond can be transferable to up to three people. It can also be used as collateral in Ethiopia; v) the Commercial Bank of Ethiopia is also covering any remittance fees associated with the purchase of these bonds. The table below shows a comparison between the two diaspora bonds.

Join the Conversation