The potential for mobilizing diaspora savings for financing education, healthcare and infrastructure in countries of origin is massive. Some 170 million international migrants from developing countries send over $400 billion in remittances to their countries of origin. At the same time, migrants also save a part of their incomes in the country of origin, mostly as bank deposits. Migrant savings can be mobilized, through diaspora bonds or non-resident deposits, for financing development efforts in countries of origin.

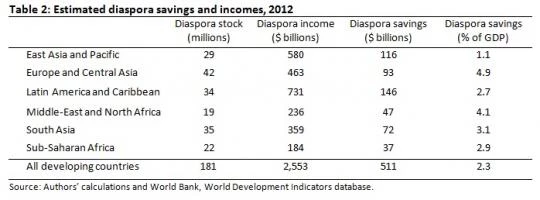

We make some back-of-the-envelope calculations of diaspora savings using data on migrant stocks, skill composition, and assumptions about migrant earnings. We assume that the high-skilled migrants earn the same as the native workers in destination countries, but that the low-skilled migrants earn less – one-third in the OECD countries, one-fifth in the GCC countries, and one-half in other destination countries.

For developing countries, diaspora savings are estimated to be $511 billion or 2.3 percent of GDP in 2012. The share of diaspora savings in GDP is around 9.3 percent for low-income countries, over four times that for middle-income countries. This share is even higher for Fragile and Conflict Affected States. For Eritrea, Liberia and Haiti, for instance, it could be as high as 27 percent, 44 percent and 65 percent respectively. Diaspora incomes for developing countries are estimated to be nearly $2.6 trillion in 2012. At this level of income, the migrant nation—a hypothetical economy comprising entirely of the current international migrants from developing countries—would lie between the GDP of France (the fifth largest economy in the world) and that of the United Kingdom (the sixth largest economy, see Table 1).1 According to these estimates, Latin America and the Caribbean (LAC) has the largest pool of diaspora savings ($146 billion), followed by East Asia and the Pacific (EAP) ($116 billion) (Table 2).

For details please see linked PDF file.

Join the Conversation