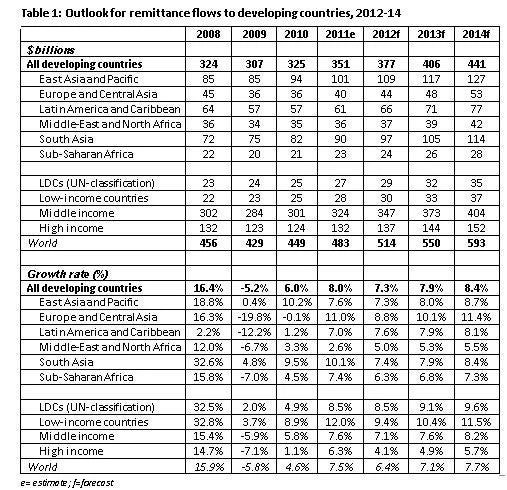

Officially recorded remittance flows to developing countries are estimated to have reached $351 billion in 2011, up 8 percent over 2010 (See brief).

For the first time since the global financial crisis, remittance flows to all six developing regions rose in 2011. Growth of remittances in 2011 exceeded our earlier expectations in four regions, especially in Europe and Central Asia (due to higher outward flows from Russia that benefited from high oil prices) and Sub-Saharan Africa (due to strong south-south flows and weaker currencies in some countries that attracted larger remittances). By contrast, growth in remittance flows to Latin America and Caribbean was lower than previously expected, due to continuing weakness in the U.S. economy and Spain. Flows to Middle East and Africa were also impacted by the “Arab Spring”.

Following this rebound in 2011, the growth of remittance flows to developing countries is expected to continue at a rate of 7-8 percent annually to reach $441 billion by 2014. Worldwide remittance flows, including those to high-income countries, are expected to exceed $590 billion by 2014.

However, there are serious downside risks to this outlook. Persistent unemployment in Europe and the U.S. is affecting employment prospects of existing migrants and hardening political attitudes toward new immigration. Volatile exchange rates and uncertainty about the direction of oil prices also present further risks to the outlook for remittances.

Remittance costs have fallen steadily from 8.8 percent in 2008 to 7.3 percent in the third quarter of 2011. However, remittance costs continue to remain high, especially in Africa and in small nations where remittances provide a life line to the poor.

There is a pressing need to improve data on remittances at the national and bilateral corridor level. This would make it possible to more accurately monitor progress towards the ‘5 by 5’ remittance cost reduction objective.

Join the Conversation