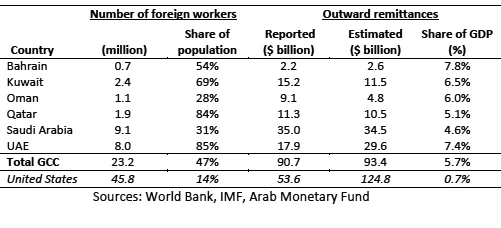

Table 1: Migrants and outward remittances in GCC countries, 2013

South Asian countries receive 52% of their remittances from the GCC countries, while MENA countries receive 43%. The top recipient countries of remittances from the GCC countries in 2013 were India ($36.2 bn), Egypt ($13 bn), Philippines ($10.3 bn), Pakistan ($8.7 bn), and Bangladesh ($7.3 bn). And the countries that depend most on remittances from the GCC countries were Yemen (86% of total remittances), Egypt (73%), Jordan (66%), Sudan (63%), Pakistan (59%), Nepal (57%), and Bangladesh (53%).

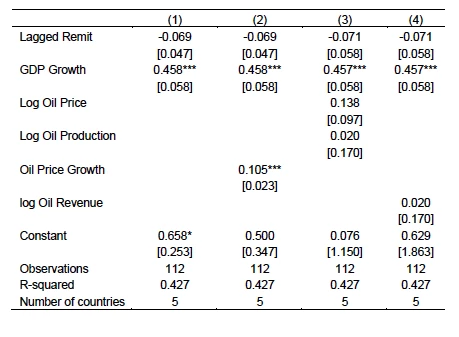

To understand how the recent fall in oil prices might impact remittances from the GCC countries, we ran some regressions (see Table 2). Oil prices seem to have a positive and statistically significant impact on outward remittances. However, the elasticity is small, only around 0.1. This is consistent with the findings by Naufal and Termos (2009) who similarly find no sizeable impact of changes in oil prices on remittance outflows from GCC countries. However, remittances are highly responsive to changes in GDP in the GCC countries, which in turn is sensitive to changes in oil prices.

Table 2: Determinants of remittance outflows from GCC countries

Note: Dependent variable is the growth in remittance outflows. Regressions are based on a panel fixed effects model with annual data controlling for time and country dummies. The sample includes GCC countries except Bahrain for which oil production data was missing. Lagged remittances controls for the convergence effect. Oil price is the average annual oil price per barrel (Brent). Oil production is the average oil production in thousand barrels/day.

Table 3 summarizes the latest projections for outward remittances from GCC, based on a forecast model using migrant stocks and changes in migrant incomes, approximated by the GDP of receiving and sending countries. We still expect remittances to grow at “positive” rates close to the previous projections, only with slight deceleration in growth for some countries in 2016 (but no negative growth). The main reason behind the stability of remittances is that the governments of the GCC countries have significant fiscal capacity to withstand near-term impacts of oil price decline; the impact if any on spending would materialize with a time lag.

Table 3: Projections of outward remittances from GCC countries for 2015 and 2016

One downside risk to the above projections arises from the nationalization policies and a crackdown on visa irregularities, which resulted in a departure of 1.4 mn migrant workers from Saudi Arabia since 2013 (EUI Country Report 01/2015). This might decrease migrant stocks also in other GCC countries. In the short term, however, it might still increase remittances as migrants may perceive risks and send more of their saving home.

For the latest on the economic impact of the decline in oil prices on the GDP and fiscal stance in MENA countries see Devarajan and Mottaghi (2015).

Join the Conversation