Rows of solar panels. Ain Beni Mathar Integrated Combined Cycle Thermo-Solar Power Plant | Photo: Dana Smillie, World Bank

Rows of solar panels. Ain Beni Mathar Integrated Combined Cycle Thermo-Solar Power Plant | Photo: Dana Smillie, World Bank

Achieving the United Nations Sustainable Development Goals will require massive investment in developing countries. Blended finance, which combines concessional public funds with commercial funds, can be a powerful means to direct more commercial finance toward impactful investments that are unable to proceed on strictly commercial terms.

Blended finance has grown in the past decade. In 2021 it represented an aggregated financing of over $160 billion, with annual capital flows averaging approximately $9 billion since 2015. One of the most compelling aspects of blended finance is that it uses relatively small amounts of donor funding to rebalance a project’s risk profile. With this small infusion of concessional funding, pioneering investments become attractive to private investors.

Private investment can be unlocked with blended finance

In emerging markets, the flow of private capital is constrained by investors’ perceptions of high risks and low returns. When investors perceive a high risk, either because of the pioneering nature of a project or a challenging environment, they tend to expect commensurately high returns. The desire for high returns can result in products or services being priced too high for consumers.

The strategic addition of blended finance to project financing structures can ease investor concerns. Successful projects include the right combination of debt, equity or grant financing, the right seniority of investors in terms of absorbing losses and earning returns, and appropriate risk-mitigation products.

Blended finance has achieved notable success in Sub-Saharan Africa, attracting 61% of global concessional financing in 2020. Most of this financing supported climate-smart agribusiness and energy investments.

Blended finance is a tool for scaling up African energy infrastructure investments

Africa urgently needs to increase investment in electricity infrastructure. About 570 million people in Sub-Saharan Africa lack access to electricity. Existing infrastructure cannot meet demand. Yet, the region currently accounts for just 4% of global power sector investments. Achieving universal access to electricity by 2030 will require tripling annual customer increases. Catalytic instruments like blended finance are critical for scaling up electricity investments in Africa.

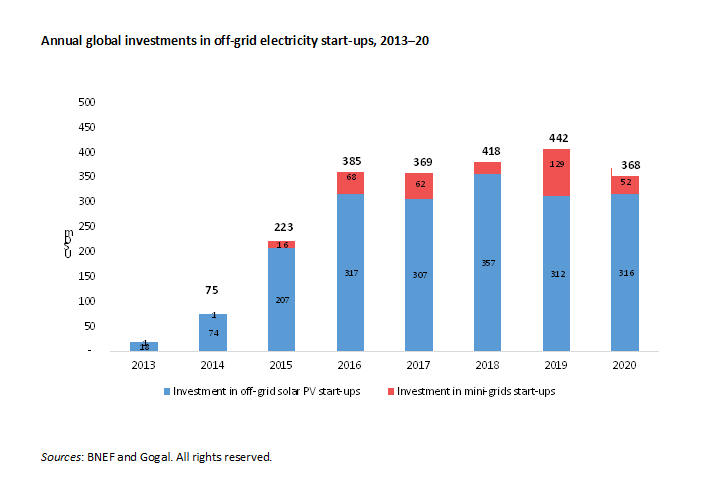

The construction of off-grid solar-powered electric facilities can expand African access to affordable clean energy. In Nigeria, a large off-grid market has developed to cope with chronic electricity reliability issues and currently provides about 80% of energy demand. Nigeria plans to develop 13GW of off-grid solar PV capacity by 2030. Other countries will follow suit. The Energy Sector Management Assistance Program (ESMAP) projects that by 2030, nearly half a billion people could be using electricity from mini-grids.

The structure of the off-grid market and its nascence offers challenges and opportunities for private sector investments. Unlike grid electrification, where large utilities typically operate under robust regulatory frameworks, off-grid systems must often operate under incomplete or ill-designed regulations. Off-grid developers serve a fragmented customer base. Risk mitigation measures, such as long-term power purchase agreements, are generally lacking.

In Nigeria and elsewhere, off-grid solar energy providers face competition from a well-established diesel generator industry. Diesel suppliers typically enjoy longstanding customer relationships and easy access to capital. In contrast, off-grid solar projects often experience financing gaps, even in sun-rich locations. Financing barriers for pioneering solar projects can range from lack of credit history to investors’ unfamiliarity with solar and battery solutions.

Strategic use of blended finance can help smooth the transition to renewable energy. Daybreak, a pioneer provider of off-grid and distributed solar and battery solutions to commercial and industrial customers in Nigeria, offers lessons on how to achieve a bankable financing structure and competitive tariffs for customers.

Daybreak’s financing plan sought to leverage long-term subordinated debt, a portion of which was provided at concessional terms, to de-risk the investment and crowd-in commercial senior debt at more competitive terms. A cost-effective financing structure ensured the project’s competitiveness as an alternative to diesel. A successful pioneering of the model will provide comfort to commercial lenders supporting the market’s scaling phase. Market projections show that the off-grid and distributed solar market in Nigeria could grow tenfold by 2025.

The Democratic Republic of Congo (DRC), home to the world’s second-largest population in need of electricity access, is launching an ambitious mini-grid expansion. DRC is pioneering implementation of the World Bank Group’s new Scaling Mini-Grid initiative. IFC expects the blended finance guarantee provided to mitigate demand risk to help mobilize $400 million in capital investment into mini-grids. The investment will develop 180 MW of installed solar PV capacity in DRC, providing renewable energy for more than 1.5 million new users.

Scaling Mini-Grid seeks to increase private investment in mini-grid services based on renewable energy by working with governments, private sector investors, and donors in Africa and the Middle East. Like Scaling Solar, the initiative provides a semi-standardized set of project preparation activities, transaction documents, risk mitigation instruments, as well as a financing package offer to scale up the deployment of mini-grids. Blended finance can be leveraged in pioneering investments to de-risk commercial investments and improve power affordability.

Mobilization is key to achieving sustainable investment at scale

Despite its potential, blended finance remains volatile and has not yet reached its full potential. To attract consistently large volumes of commercial financing, governments, development partners, and development practitioners must work together to make private capital mobilization a core part of their strategies . Each stakeholder must prioritize scalable and replicable approaches. By employing blended finance through a platform approach, IFC’s Scaling Mini-Grid and similar initiatives can catalyze increased investment in renewable energy in low-income countries.

The original version of this blog appeared on the Global Infrastructure (GI) Hub.

Disclaimer: The content of this blog does not necessarily reflect the views of the World Bank Group, its Board of Executive Directors, staff or the governments it represents. The World Bank Group does not guarantee the accuracy of the data, findings, or analysis in this post.

Related Posts

Institutional investors: time to get involved in development and blended finance

The developing world is crying out for greater private investment in sustainable infrastructure

Now is the time to mobilize blended finance instruments

What is the Public Sector’s Role in Mobilizing Private Finance for Solar Energy?

Join the Conversation