One of the prevailing notions about PPPs is that upfront costs are wholly paid for by the private sector, allowing the public to spread their costs (whether as users or through taxes) throughout the life of the project. However, this is a myth – governments, multilateral development banks (MDBs), and bilateral financing institutions all play strong roles in the various stages of financing PPPs. Just what kind of role, and how big, requires looking at the data.

Fortunately, now for the first time, it is possible to view the breakdown of financing sources for PPPs in low- and middle-income countries on the PPI Database. Accompanying the data is a recently released note that analyzes the sources of financing for 2015 PPP projects in these countries. The findings indicate that, in fact, financing for PPPs comes from a diverse mix of sources.

The Sources of Financing Note, available on the PPI Database website, breaks down the data on how upfront capital costs in PPPs in the dataset are financed globally, and by region and sector.

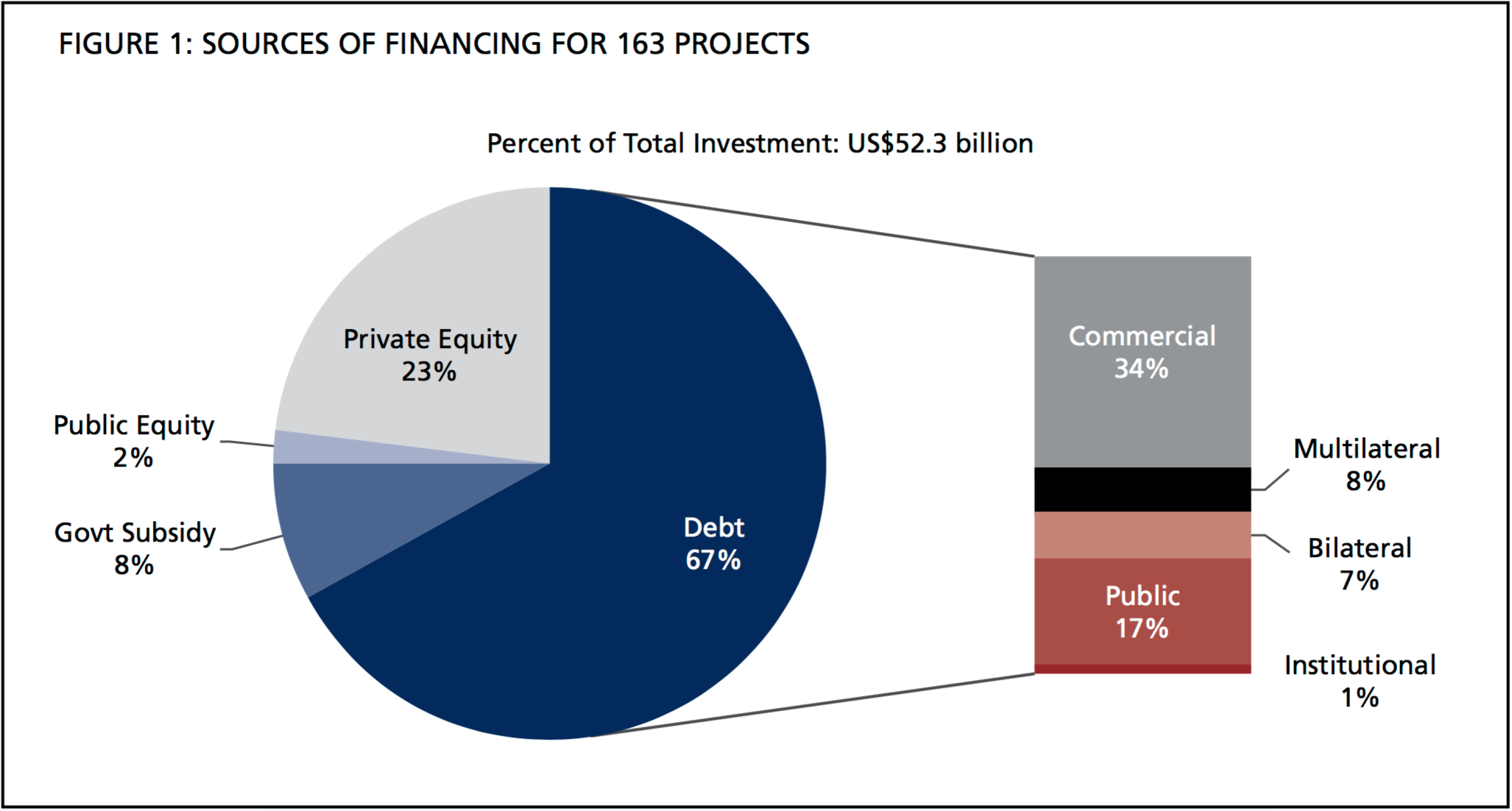

The findings indicate that in fact, only about 60% of the investment in PPPs are financed through the private sector, which in this case includes sponsor equity and commercial bank debt, as well as investment from institutional investors. Not surprisingly, commercial lenders tend to be the most active in what they perceive to be more “bankable” deals, such as projects in stable, upper-middle-income countries and in more profitable sectors like power and transport. Moreover, within the private sector, costs are financed through various types of debt and equity, each with its own risk profile (and corresponding required return on investment), which affects the way the project is structured.

The remaining 40% are financed through either the public sector (including upfront capital subsidies, equity from state-owned enterprises, and loans from state-owned banks) or through multilateral and bilateral development banks. The public sector accounts for about a quarter of total investment, and multilateral and bilateral development banks combined account for about 15%.

Clearly, this indicates that governments and multilateral banks such as the World Bank and the International Finance Corporation (IFC) play an important role, particularly in places where commercial sponsors and lenders are hesitant to invest otherwise. For instance, multilateral development banks contribute a larger share of financing to PPPs in International Development Association (IDA) countries (19%) than in non-IDA countries (7%). IDA is the part of the World Bank that provides the largest sources of assistance to the world’s 77 poorest countries.

Other key findings include:

- Institutional investors account for only 1% of PPP investment in low-to-middle income countries.

- Public sector financing of transport projects (41%) tends to be higher than that of energy projects (16%). The reverse is also true, that the share of private sector funding in energy (65%) was higher than that in transport (49%)

- Bilateral institutions are as active as MDBs, financing about 7% of the overall investment and about 30% of investment in IDA countries.

- The East Asia and Pacific region received the highest financing for PPPs from the private sector (83%); whereas, Latin America and the Caribbean had the highest portions of public spending on PPPs (39%).

- Local private financiers are the most active in Turkey and India.

We are planning to make similar data available for PPP projects from the past five years in the PPI Database. Armed with this data, we can have a more nuanced and informed discussion about how PPPs are financed.

Join the Conversation