Four hundred years ago in Japan, a wave of merchants known as Omi Shonin traveled the countryside, bringing goods from the Ōmi Province into the outer regions of the country. They became an influential presence, expanding their businesses like franchises and making roots in other regions than their own. The Omi Shonin practiced what’s called Sanpo-yoshi (三方よし), a commerce philosophy based on the belief that beneficiaries to a transaction should always be three-fold: the seller, the buyer, and society as a whole. This, they felt, created better and longer business relationships, and ultimately better returns.

Sanpo-yoshi is one of the earliest displays of an industry operating under the concept of shared value. Since then, questions surrounding the ethics of corporations and investors have certainly evolved. Fast forward to the present day and we’re witnessing a significant change in the way investors and corporations are reflecting on their own interactions with society, the environment, shareholders, and employees. The boom of “ESG” investing is an example of this sea change. Environmental, social and governance investing may be the investment buzzword of the year, and for good reason. The ESG investment market has increased by 34 percent in the past two years to an estimated $30.7 trillion today.

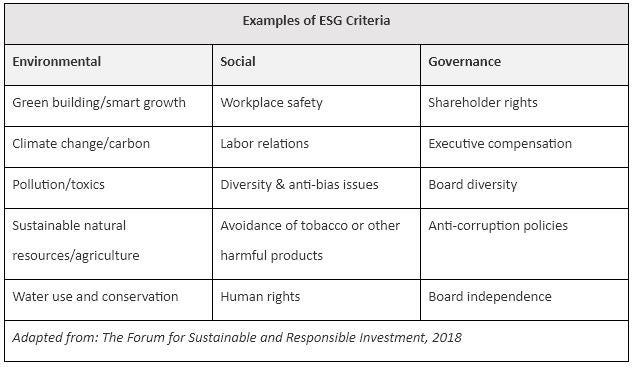

This kind of investing integrates environmental, social, and governance factors into the investment decision-making process—to evaluate risk and opportunity. It’s the belief that these issues have a material impact on corporate performance or pose a systemic material risk to an investment.

Whereas traditional investors take a passive approach to screening ESG criteria, active ESG investors focus on negative (exclusionary) screening, and engagement and positive (best-in-class) screening. ESG is considered a multidimensional assessment system that can be applied to any asset class.

At MIGA, we work creatively to help our clients achieve returns and secure their ESG objectives. Take, for instance, recent projects with private equity investor Actis and Lekela Wind. We knew that we shared Actis’s ESG objective to expand renewable energy and make it more affordable in developing countries. We were able to give them the guarantees they needed in order to feel confident entering new markets or taking on projects with heightened risk.

Last year, we provided guarantees of $149.8 million for the Taiba N’Diaye wind farm in Senegal. With 46 turbines, and at 158.7 megawatts, it will be the largest wind farm in West Africa. In addition, the company was expanding and needed additional coverage on a new project—the West Bakr wind farm in Egypt, to which we provided $122 million in financial guarantees. The West Bakr wind farm will operate a considerably low tariff, demonstrating the competitiveness of renewables.

We’re also working with Banco Santander on their objective of increasing climate finance. As part of a guarantee we provided covering Banco Santander Peru's mandatory reserves with the Central Bank of Peru, we were able to help establish a dedicated climate finance component, wherein a portion of the loans issued by local branches, and enabled through the guarantee, will be allocated toward climate finance activities.

Also with MIGA’s support, Banco Santander Peru is establishing a framework for identifying, assessing, and monitoring climate finance. This includes adopting international criteria for climate finance and introducing it into their risk analysis processes as well as developing and delivering training on climate finance and sustainable banking practices to staff.

MIGA integrates ESG into our own operations in five ways:

- All projects in our portfolio are required to meet our development mandate

- We pre-screen projects to ensure they’ll meet development impact objectives

- We gather development effectiveness indicators from our clients

- We ensure all projects are in compliance with E&S Performance Standards

- We verify our ESG impact through ex-post evaluations validated by the World Bank’s Independent Evaluation Group.

Just like the Omi Shonin, who entered external markets, ESG investors looking at emerging economies have the potential to deliver enormous impact, without necessarily sacrificing financial returns. MIGA is a powerful partner for these investors to enter these markets with confidence.

Related Information

2019 Annual Meetings event Catalyzing Environmental, Social and Governance Investment

About MIGA

Related Posts

What’s next for ESG and investment decisions?[SK1]

Incorporating environmental, social and governance (ESG) factors into fixed income investment

This blog is managed by the Infrastructure Finance, PPPs & Guarantees Group of the World Bank. Learn more about our work here.

Join the Conversation