The original version of this blog appeared on the GI Hub's website

To close the infrastructure gap in a sustainable recovery, we need more greenfield infrastructure, with environmental sustainability at its core. This requires innovative funding models and PPPs particularly in emerging economies where private investors are more reluctant to invest and greenfield infrastructure need is greatest. In fact, according to the IEA, “The world’s energy and climate future increasingly hinges on decisions made in emerging and developing economies.”

Last year, debt reached a record $860 billion in emerging economies. Consequently, development banks, export credit agencies, and development finance institutions (DFIs) must mobilize and blend public and private capital to attract more private investment.

Below, we highlight key actions needed to deliver sustainable greenfield infrastructure that follow commitments made at COP26 and reach toward a net-zero future.

To reach net zero by 2050, we must spend $1 trillion annually on clean energy in emerging economies by 2030

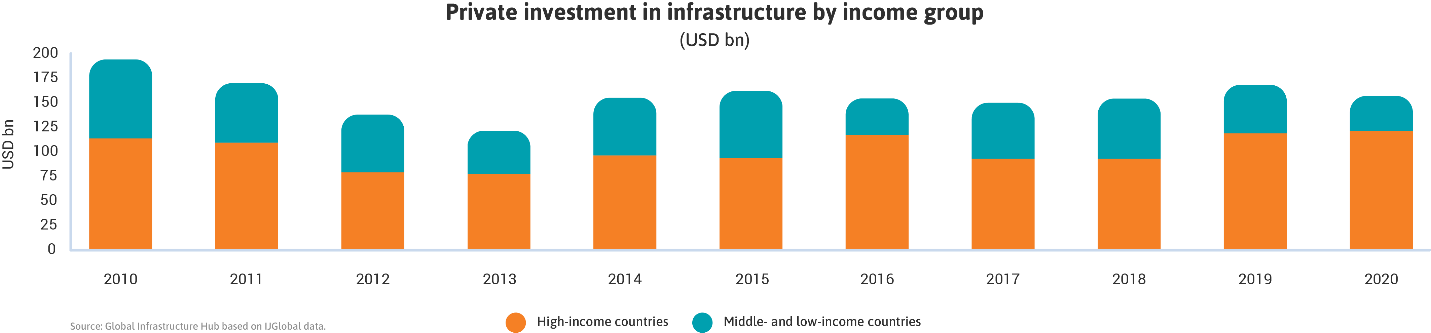

Last week, the GI Hub reported in Infrastructure Monitor that private sector investment in infrastructure in emerging countries declined 28% in 2020, continuing a pre-pandemic trend. Only 21% of this investment went to renewable energy generation.

To meet net-zero objectives and decarbonization goals, significant power sector investments must be re-directed toward sustainable infrastructure. We need to add to the steady growth in sustainable finance debt issuances (from $26 billion in 2013 to $732 billion in 2020), and invest $1 trillion annually in clean energy in emerging economies—a seven-fold increase. In many countries, the power sector must completely transform to limit CO2 emissions. These changes need to be implemented while expanding reach to the 770 million people who lack access to electricity.

New funding structures help scale up bankable greenfield projects

Technological advancements continue to drive down renewable energy costs. Solar and wind power are now as affordable as fossil fuel sources, or even cheaper. As a result, there are more opportunities for financial and contractual innovations that can mobilize private capital for large-scale, equitable, affordable deployments of renewable energy.

India is the world’s third-largest emitter of greenhouse gases. Until recently, it incentivized renewable electricity projects with subsidies, generous tariffs, and tax holidays. For the REWA Solar project, which generates 750MW of solar power, the State of Madhya Pradesh sought a different path, adopting a PPP with innovations that were the first of their kind in India. The project addressed several common barriers to private investment in renewable energy:

- Off-taker risk: Private investors can be disincentivized when the primary off-taker is a public company in a poor financial state—a high credit risk. On the REWA project, this risk was reduced with guaranteed energy off-take and innovations that enabled a large institution (Delhi Metro) to be a long-term power purchaser alongside the state utility. The approach operationalized inter-state open access, enabled by regulation in 2003.

- Lack of proper transmission and evacuation infrastructure, as well as long periods to receive clearances and permits for such infrastructure: These issues can delay asset operation and compromise the steady returns investors require. The REWA project included compensation for curtailment of power off-take resulting from disruptions in the transmission grid. Madhya Pradesh also invested heavily in transmission infrastructure, reducing losses by 17% in seven years.

- Unstable subsidies and support regimes: REWA used a transparent auction process that resulted in a renewable energy tariff lower than the cost of electricity from fossil fuels. It also incorporated a three-tiered payment security mechanism, including bankability features like an enhanced payment security mechanism, guaranteed energy off-take, and termination compensation.

IFC’s PPP team was engaged on the project to introduce best practices in project preparation, provide transaction advisory support, and help develop a robust project structure that addressed commercial, legal, regulatory, technical, and system operations issues. It also created bankable project agreements, addressed environmental and social risks, and designed a transparent auction process.

Public and private sector collaboration remains a reliable route to bankability

Investors often favor operational brownfield investments, which are perceived as more secure than greenfield projects. However, when the risks of greenfield projects are effectively identified, structured, and managed, these investments can be highly attractive, given their resilient and favorable returns.

Scaling a pipeline of bankable greenfield projects to attract investors means implementing enabling measures like policy and tariff regulations and mechanisms that optimize revenue, risk structuring, and risk mitigation. Sound decision making on these assures investors by creating conditions for cost-effective, affordable, and accessible energy.

The case of the Asia Pacific region illustrates the challenges and opportunities in creating a pipeline of energy projects in emerging markets. Despite significant growth in renewable energy investment over the last decade, the region remains heavily dependent on fossil fuels and struggles to put forward bankable projects. The reasons for this are complex, encompassing both economic and geographic factors. Lack of expertise and a focus on energy supply (i.e., fossil fuels) over power generation are viewed askance by ESG-focused investors. The small size and geographically dispersed nature of much of the region’s population are also perceived as risk factors, as they limit economies of scale and increase transport costs.

In the Solomon Islands, a public-private sector coalition combatted these challenges. The government partnered with World Bank Group to develop the Tina River Hydropower Project. IFC advised on project preparation, investor selection, agreement negotiation, and the final financing agreement. The $200 million financing package includes loans and grants from six institutions in a unique on-lending structure that incorporates all DFI requirements. The Tina River project is the first large-scale infrastructure project in the Solomon Islands developed as a PPP and is expected to reduce the country’s reliance on diesel fuel for electricity generation from 97% to around 30%. The project also shares royalties with more than 4,000 people in surrounding communities. The project and financing structures achieved through coalition were key to securing private financing.

Impact investing, which aims to generate social and environmental benefits while delivering financial returns, holds significant promise to mobilize capital to support emerging markets’ sustainability goals. IFC is a founder and leading signatory of the Operating Principles for Impact Management—signed by 149 private and institutional impact investors and 37 countries. These are becoming a global framework for designing and implementing impact management systems for private investors.

Seek to leverage the potential of new funding structures and the capacity of public-private coalitions

Infrastructure development in emerging markets is a significant opportunity for investors, especially institutional investors, yet the majority of investment goes to high-income countries. Governments, DFIs, and private investors need to join forces, adopt new funding structures, and collaborate on risk mitigation measures that overcome market barriers to scale up investment and meet net-zero objectives.

As these approaches fall into place on more projects, momentum will build to deploy more blended finance and mobilize additional private capital. Widescale standardization of contract templates and project documents should facilitate investment in smaller projects, by enabling better risk assessment. Risk mitigation facilities can create enabling environments that allow mobilization of investment on a scale that may feel unrealistic currently. The key is to start now, building on successful project approaches.

The following colleagues contributed to this blog: Elcin Akcura, Senior Infrastructure Economist at IFC and Daniel del Rio, Infrastructure Specialist at GI Hub.

Click here to view the recording of the IFC and GI Hub joint webinar Infrastructure for recovery: Innovation for de-risking greenfield investment. To register for future webinars, click here.

Disclaimer: The content of this blog does not necessarily reflect the views of the World Bank Group, its Board of Executive Directors, staff or the governments it represents. The World Bank Group does not guarantee the accuracy of the data, findings, or analysis in this post.

We’ve launched a new Massive Online Open Course! Learn how Quality Infrastructure Investment can help countries lay the foundations for green, resilient, and inclusive development and assist in a robust recovery from the economic impacts of the COVID-19 crisis. The free, one-month course starts on January 24, 2022. Register here.

Related Posts

Delivering climate resilient infrastructure through the private sector

Rightly done PPPs can be the right tool for green and resilient infrastructure

Institutional investors: time to get involved in development and blended finance

Private sector financing can accelerate a green recovery for cities

If you issue it, they will come: Lessons from recent infrastructure bonds

Join the Conversation