A consensus among infrastructure practitioners is that public-private partnerships (PPPs) help countries to bridge the infrastructure gap. But what kind of infrastructure is required to fill the gap? This is a much harder question to answer.

A consensus among infrastructure practitioners is that public-private partnerships (PPPs) help countries to bridge the infrastructure gap. But what kind of infrastructure is required to fill the gap? This is a much harder question to answer.

While collaborating with Multilateral Development Banks (MDBs), I spent the most recent stage of my professional life traveling around Latin America and Africa. I have seen communities suffering from the lack of several types of services associated with the existence, maintenance, and operation of permanent assets – such as people without regular trash pickup services, schools flooding under tropical rains, and community health centers that are either non-existent or poorly maintained.

The list stretches far beyond the reach of traditional large economic infrastructure projects that we typically think of when undertaking a PPP.

I say this not to disparage large-scale infrastructure projects, which can play a critical role in alleviating poverty and promoting shared prosperity. The problem is that those projects are costly to implement, often take a long time to prepare, and demand a sophisticated set of institutions and capabilities from sponsoring agencies. More to the point, they do not meet all day-to-day needs associated with infrastructure as experienced by most of the communities living in the developing world.

Putting PPPs in the service of smaller projects would extend the reach of the benefits infrastructure generates. In other words, small PPPs could allow poor communities to share in the community riches generated by private investment in infrastructure. This is not a new idea, and in some jurisdictions, it is already happening.

Numbers back up new ideas on small PPPs

Available data shows that the Brazilian PPP market is home to more of these small PPPs every day, most of which are being prepared and procured by subnational governments.Out of the 400 PPP projects which are in the PPP pipeline of Brazilian subnational governments, around 13% are worth less than US$15 million of capital value.

This represents an important shift for PPP initiatives originally only focused on power transmission lines, country-wide turnpikes, and other high profile large infrastructure projects.

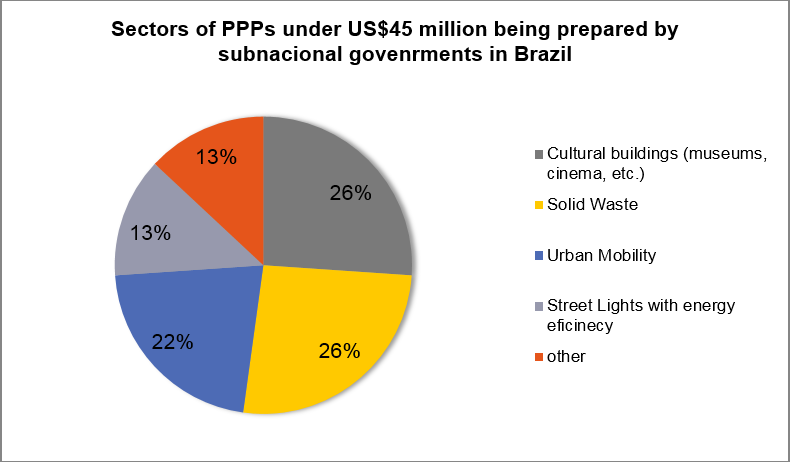

The data available also shows that small PPPs, in contrast to traditional large projects, are designed to address a wide variety of social needs in Brazil.

Small PPPs, big challenges

However, engaging in small PPPs comes with significant obstacles. Two challenges in particular need to be overcome if small PPPs are to proliferate delivering Value for Money:

- High relative transaction costs in identifying, apprising and structuring PPP projects. These costs tend to be easily diluted in large infrastructure projects, but they can be disproportionally high for small projects. The need to hire transaction consultants for $1 million can be a deal breaker for a government intending to implement a $5 million community health center. The answer to this problem is reducing transaction costs. Governments have accomplished this by standardizing documents, bundling initiatives together to dilute preparation costs, and transferring project structuring technology to internal staff.

- Achieving commercial feasibility and a competitive procurement process. Finding investors and securing finance is not a simple issue for small PPPs, given that traditional equity and debt providers might have a minimum investment threshold to justify their high cost of mobilizing teams and conducting their due diligence. One solution is to establish a dialogue with potential players in very early stages of the PPP process. Market sounding exercises, public consultations, and radical approaches to transparency during project preparations are important approaches to consider. All of these can help attract good quality bidders for small PPP projects.

Join the Conversation