Imagine you need a car to commute long distances to your workplace or the closest supermarket, to visit your parents and to bring your child to school. Therefore, you want to spend the money you have been able to put aside on a large purchase: a new and reliable car. However, you do n

Also, imagine that everything you have heard so far about car dealers from your family, friends and neighbors is that they have a very bad attitude, do not act in your best interest and try to sell you overpriced vehicles with hidden fees and features you do not need. Given your lack of knowledge of how to choose and use a car and your lack of trust, would you still feel confident about approaching a car dealer? Most probably not.

This analogy also applies to one’s participation in financial markets. Especially in developing economies, where most globally unbanked people live. If you do not have knowledge of features and risks associated with financial products, do not know how to choose and use these products, lack any basic understanding of inflation, interest rates and compound interest, it is unlikely that you will participate in financial markets, or that you will benefit from them if you do. A lack of trust in financial service providers will do the same.

Thanks to the nationally representative Consumer Protection and Financial Capability (CPFC) surveys which have been conducted by the World Bank’s Financial Inclusion Global Practice (and for which I am now responsible), I am able to illustrate what the CPFC data can tell about the association between financial literacy, trust in financial institutions and financial inclusion. So far, published CPFC data is mostly available for countries in the ECA region: Azerbaijan, Bosnia & Herzegovina, Bulgaria, Romania, Russia and further for West Bank and Gaza. To capture financial literacy levels of the population in these countries, randomly selected respondents were requested to answer quiz-like questions regarding basic economic and financial concepts (inflation, compound interest, money illusion, risk diversification), as well as questions to test their basic numeracy skills (e.g. needed to shop around).

Figure 1: Low levels of financial literacy correlate with low financial inclusion levels

I used these questions to calculate a simple financial literacy index, which indicates for each respondent the number of correctly answered quiz questions (out of 6). Respondents were than categorized into 3 groups. The first group comprises the least financially literate with 1 correct answer at most. Those with 2 to 4 correct answers were categorized as being moderately financially literate, while those with 5 and more correct answers were judged as having high levels of financial literacy. Figure 1 displays the average number of formal financial products used, for each of these groups in selected countries (where this information is available). Clearly, the higher the level of financial literacy is, the more formal financial products and services people use.

Figure 2: Low levels of trust in financial institutions correlate with low financial inclusion levels

Respondents were also asked to what extent they trusted in providers of financial services, such as banks or insurance companies. As can be seen in Figure 2, on average, the number of formal products and services used also increases with the level of trust in financial institutions. Those who do not even know if they trust in banks, are unsurprisingly the ones with the least exposure to financial markets.

Though more research is needed to make inferences beyond correlations, these graphs already provide valuable information from a policy perspective:

• In order to foster participation in increasingly sophisticated financial markets, both supply-side and demand-side interventions are likely to be required.

• On the supply side, adequate financial infrastructure must be developed to promote access and to build trust by creating the necessary consumer protection mechanisms.

• On the demand side, consumers need to be financially educated to have a better understanding of main features and to know how to choose and use financial products that best fit their needs.

Nevertheless, it is important to bear in mind, that being financially literate seems to be a necessary, but is most likely not a sufficient, demand side condition to effectively participate in financial markets. To use another analogy: almost every smoker knows about the negative effects of smoking. Does it change their behavior? Not in many cases.

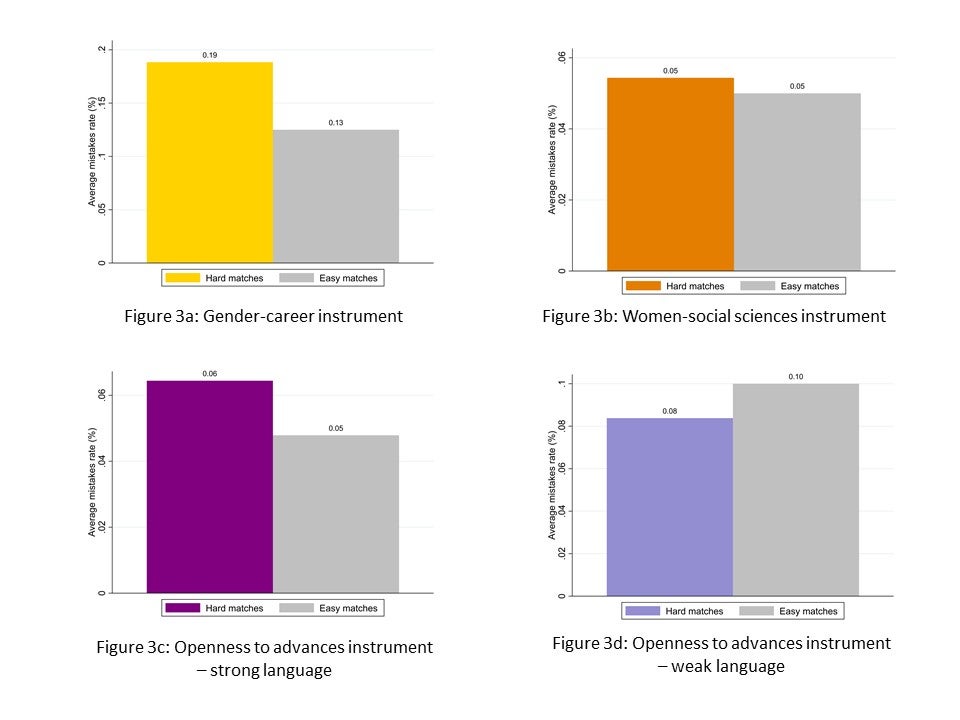

Figure 3: Structure of new CPFC survey instrument

To address the importance of underlying motivations, skills, and behavior, the Russia Financial Literacy and Education Trust Fund managed by the World Bank developed a diagnostic tool to measure people’s financial capability in a way that is relevant for low and middle income environments and that can be used consistently across countries. Leveraging on this extremely valuable work, the World Bank’s Financial Inclusion Global Practice designed a new CPFC survey instrument, which is set to be used soon in 10 additional countries. The structure of this instrument is presented in Figure 3. I am very confident that the data collected with this instrument will help to improve the prevailing understanding of demand sided constraints in the financial inclusion equation.

Join the Conversation