It takes an entrepreneur 28 days to start a business in Spain but only 1 day to do so in New Zealand. The total business tax rate (including profit tax and labor tax) is 28.1% in Bulgaria but 68.5% in Italy. And, fixed-term labor contracts are prohibited for permanent tasks in France and Portugal but not in Germany and Sweden.

The World Bank has been publishing the annual Doing Business reports since 2004 to investigate the scope and manner of regulations that enhance business activity and those that constrain it. In a new research paper (Haidar 2012), we investigate the link between business regulatory reforms and economic growth in 172 countries.

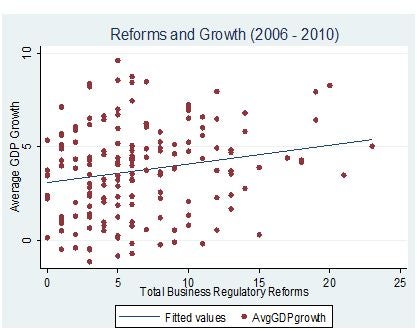

In the course of our research, we created a five year dataset on business regulatory reforms from the World Bank’s Doing Business project. Then, we tested the hypothesis that business regulatory reforms increase economic growth, using data on micro-economic reforms. The results provide robust support for the claim that business regulatory reforms are good for economic growth. We establish that, on average, each business regulatory reform is associated with a 0.15 percent increase in growth rate of GDP. The below figure provides a visual illustration of the main empirical finding.

Source: Haidar (2012)

The data does not suffer the endogeneity issues associated with other datasets on changes in economic institutions. We focus on one independent variable: business regulatory reforms. We identify business regulatory reforms by Doing Business reforms1 in the areas of starting a business, paying taxes, obtaining licenses, getting credit, protecting investors, employing workers, international trade, property registration, closing a business and enforcement of private contracts. The annual Doing Business report includes information on important reforms in each of these areas. We code this information as a dummy variable which equals 1 if a country implemented a positive reform during the year on a given indicator and 0 otherwise. A positive reform is one that makes it faster, cheaper or administratively easier for local businesses to start and run operations; or a reform that defines and increases the protection of property rights. An example is reducing the number of days to get an industry license, eliminating the minimum capital requirement for start-ups, or increasing the legal rights of creditors and minority shareholders.

Using this dataset, we define the main independent variable, Reform, as the total number of reforms happening in a country during a certain period of time. In addition, we ran 10 separate regressions using the main independent variable as the total number of reforms in each of the above mentioned 10 business regulatory areas. The result that business regulatory reforms enhance economic growth holds.

Our work contributes to the recent policy and academic debate on institutions. On the academic front, we extend Djankov et al. (2006), Haidar (2009), Amin and Haidar (2011), and Amin and Haidar (2012) in 2 different ways. First, while they focus on one year, less countries, a lower number of indicators, and a narrower geographic scope, we look at a five-year period, a larger regulatory scope, and a broader set of countries. Second, the main independent variable in their study is different. The authors look at regulatory status for one year but we consider a more interesting and important variable, regulatory reform (not status) during a given year and over time. They consider growth as a function of the existing regulatory framework. We argue that level of income can be a function of the existing regulatory framework, but that a change in income level is more a function of how a regulatory framework changes and improves.

On the policy front, at a more micro level, our work is related to Djankov et al. (2010) who established evidence for the impact of time delays on international trade. They estimated a difference gravity equation that controls for remoteness, and find that each additional day that a product is delayed prior to being shipped reduces trade by more than one percent. In our paper, we look at reforms within 10 different areas of business regulations, including within the area of ease of trading across borders. For example, we look at reforms that aim to reduce time, documents, and costs needed to export or import a shipment. Our analysis shows that each positive reform in trading-across-borders regulations is associated with a 0.88% increase in average economic growth rate. Thus, this paper also highlights the importance of reducing trade costs to stimulate economic growth. And, there is fairly robust evidence of the positive impacts of regulatory reforms in each of the other 9 business regulatory areas - and these estimated impacts are sizeable and plausibly large.

Business regulatory indicators are important. First, they can motivate reforms through country benchmarking. Second, they try to inform the design of reforms. The data can highlight specifically what needs to be changed when reforms are designed, because indicators are backed by an extensive description of regulations. Reformers can also benefit from reviewing the experience of countries that perform well according to the indicators.

With business regulatory reforms expanding significantly within countries and being used as benchmark measures for the success of policy makers, the study confirms that an expansion of micro-economic reforms is likely to increase growth.

1Governments around the world reported 1140 business regulatory reforms over the five years up to 2010 , according to Doing Business dataset. We look at these 5 specific years for (i) data consistency and (ii) broader country coverage.

Join the Conversation