The World Bank and its partners are preparing to launch a Digital Financial Services Reference (DFS) Guide, a comprehensive resource on the global DFS journey (available here). With the Guide as our compass, let us navigate the fascinating journey through the world of digital financial services, where technology reigns supreme in reshaping the global financial sector.

The Rise of Digital Financial Services

At the turn of the century, internet connectivity and mobile technologies ignited a wave of innovation in the financial services market. Banks refined its operations around core banking software and risk management systems while agent networks emerged as viable extensions to physical infrastructure. The smartphone, a powerful computer in your pocket, became central to this evolution, especially when connected to faster and more reliable wireless or mobile internet.

From Bricks to Clicks – The Transformation of Banking

As adoption of technology continued, banks and other traditional financial providers transformed how they interacted digitally with users. Brick-and-mortar infrastructure gave way to online banking, mobile apps, and contactless payments, expanding digital communication channels. Machine-readable documents, electronic signatures, and online collateral registries streamlined credit delivery. Tiered know-your-customer regulations and digitally enabled ID infrastructure propelled the financial sector into the digital age.

View the full Infographic - The Story of Digital Financial Services.

Fintech Frontier: The Rise of Startups and Innovation

Initially, telecom companies nudged the landscape, leveraging their consumer base and connectivity infrastructure. Fintech startups took it even further, experimenting with non-bank business models powered by data science, blockchain, chatbots, and robo-advisors. They challenged traditional processes, transforming account openings, credit appraisals, cross-border payments, and asset management services. Policymakers and regulators joined the movement, exploring proportionate regulatory frameworks and data-driven supervision approaches.

Disruption to Inclusion: Empowering the Unbanked

Digital Financial Services (DFS) continued to break barriers in unserved and underserved markets. While catalysts like mobile money in East Africa, agent networks in Brazil, and digitally enabled national ID systems in India showcased the potential, newer approaches to financial inclusion opened up. For example, in the Philippines, digital payment solutions, tailored for merchants and customers in remote areas, use low-cost digital infrastructure like QR codes. A holistic approach addresses emerging risks, including market conduct, digital divide, and data protection.

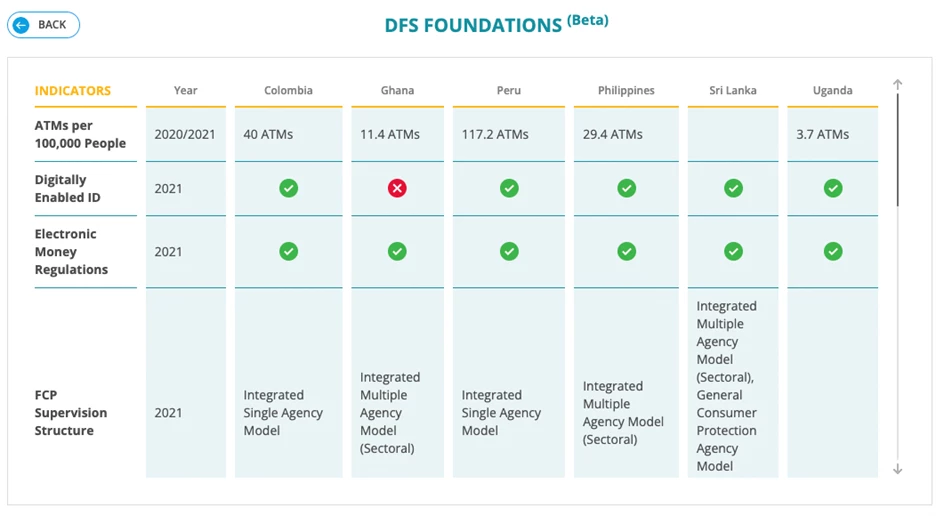

The website allows users to compare, and contrast select indicators on DFS digital economy foundations, DFS foundations, and digital financial inclusion.

Illustrative Comparison of some key DFS indicators

The Future Unveiled: Exploring Cutting-Edge Trends

Cross border payments evolves rapidly with interoperable systems and tokenization. For example, global migration to ISO 20022 for cross-border payments and reporting (CBPR+) is an important milestone.

Open banking, coupled with real-time capabilities, leverages data sharing not just by traditional financial market participants but also by a range of innovative players, thereby democratizing access to financial services.

Data science and quantum computing enable risk-informed decision-making. This is explained in more detail in the section on Data Protection & Privacy

Artificial intelligence, (AI) is transforming user engagement with personalized experiences, chatbots, fraud detection, and risk analysis.

These topics, covered in the DFS Guide, supported by country examples, offer practical tools for policymakers embracing emerging innovations.

Towards a Resilient Future

As markets progress in regulating and supervising DFS, critical areas such as supervisory capacity, agent regulation, competition, and data protection come to the forefront.

Let us embark on this adventure and shape the future of finance in the digital era.

Join the Conversation