In a previous installment, we explored one particular past financial crisis which resembles the current tensions in the Euro Zone in key aspects—specifically, the 2001 collapse of Argentina’s currency board. Taking history as our guide, we discuss the lessons that can be learned from past crises and potential steps policymakers can take.

Implications for the euro zone

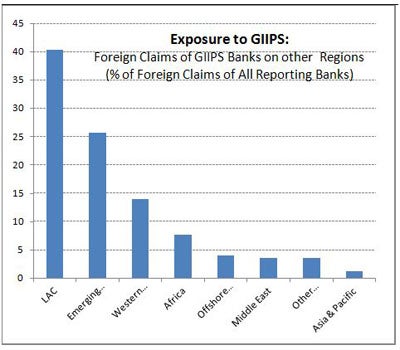

Until even as short as a month ago, the possibility of a breakdown of the European monetary union triggered by an exit of one or more of its members had been considered no more than a tail risk scenario. The odds of such an outcome are now seen to have grown, as market concerns continue to focus on economic and financial fundamentals of the peripheral Euro Area members that, similar to Argentina, failed to satisfy the preconditions of a sustainable membership in the currency union. Given the significant economic and financial interlinkages within the Euro Area, and the key role of Europe in the global economy (Figure 1), potential fallout from such a breakdown would be much more profound for the region as a whole and the rest of the world, compared to any crisis experienced in the past.

Figure 1. Exposure to Peripheral European Countries

If the history is any guide, an exit of a country could have far reaching implications along several dimensions, and would likely be associated with:

• Introduction of a new currency, accompanied by possible use of multiple exchange rates, and additional administrative measures (bank holidays, deposit freezes, exchange/capital controls), to limit accompanying capital and deposit flight (in particular, with short maturity).

• Possible melt-down and credit crunch in the domestic banking sector, following loss of access to ECB, market liquidity, and recapitalization funds, asset write-downs, and a sharp rise in nonperforming loans. The government would likely nationalize and restructure the banks. The observed deposit outflows are a source of concern, not the least because European deposit insurance schemes are weakly funded and do not protect against redenomination risk.

• Massive defaults in the corporate sector with large (unhedged) euro-denominated liabilities following a sharp depreciation of the new currency, loss of access to funding markets, and debt redenomination. While deprecation might boost competitiveness, high inflation (with inflexible labor and product markets) and low demand would limit sustained gains.

• Increased macro imbalances with rising debt-to-GDP levels in the absence of a further debt restructuring, followed by sharply higher inflation and drop in output, as experienced during past crises (Figure 2). The ongoing decline in growth, credit, and capital inflows to peripheral countries (particularly from non-European banks) would likely accelerate.

Figure 2. Evolution of Key Macroeconomic Variables Around Past Crisis Episodes

• Intensifying social unrest as a result of an erosion of purchasing power for households, loss of savings through a sharply depreciated currency, and rising import prices; tougher fiscal measures needed to regain access to funding official and market funding would heighten the unrest.

Moreover, a disorderly contagion to the periphery could spread to the core and the rest of the world. Contagion would propagate through:

• Banking systems (with bank runs and haircuts on sovereign and private exposures reigniting new rounds of credit-rating actions, and acceleration of bank deleveraging and home bias);

• Sovereign debt markets (with higher funding costs and further deterioration of fiscal positions);

• Political turmoil (jeopardizing support for fiscal and economic convergence); and

• Foreign investors pulling out of the region.

The implications of departure by one or more peripheral countries would have profound implications for Europe and EMDEs. Aggregate exposure to all peripheral countries is substantial in terms of banking system assets or respective countries’ GDP for the euro zone, Central and Eastern Europe (through Italian and Greek banks) and Latin America (through trade/finance linkages with Spain and Portugal). EMDEs could also be affected through a slowdown in remittance/capital flows and acceleration of European bank deleveraging. Funding costs of local banks and sovereigns could also rise as a result of a tightening of global funding conditions.

Options for policy makers

Past experience suggests that there is no easy way to resolve a crisis of this magnitude with significant economic and financial imbalances between member states, compounded by biting effects of austerity measures. Policymakers of an exiting country would need to adopt a comprehensive set of measures to restore confidence and revitalize the economy, including: expenditure and revenue measures to strengthen fiscal balances and put the public debt to a sustainable path; a credible nominal anchor and monetary policy framework to contain inflation expectations and stabilize the new currency; resolution and restructuring of ailing banks; structural measures to improve competitiveness by raising the flexibility of product and labor markets; and corporate, household and sovereign debt restructuring. Cut off from the market and official life-support, the authorities would likely need restrictions on bank, capital and FX-outflows to support these efforts.

For the rest of the world, the ability to contain disorderly fallout will largely depend on policy actions of European policymakers. Reactive and piecemeal policy responses will further feed doubts about the future of the euro zone, while adding to the size of the problem and leaving very limited time to implement the policies that could bring a durable end to the Euro Area crisis. In our view, among the menu of options discussed, the key components of a comprehensive strategy to contain messy fallout should include decisive and clear policy steps to:

• continue forceful ECB support, so as to boost confidence in European banks and prevent a funding freeze and bank runs;

• move toward an appropriately-designed European banking union, where supervision, regulation, and resolution of the closely-integrated European banks are carried out by a single European agency, along with a recapitalization scheme and euro-wide risk-based deposit insurance;

• resolve weak banks and fiscal problems to limit long-term distortions of bank and sovereign behavior and risk of building future imbalances;

• introduce growth and competitiveness-enhancing tools to help mitigate resistance to austerity measures and to enable fiscal debts to converge to more sustainable levels; and

• increase cooperation between home-host authorities to limit the risk of mutually-harming policy responses (including disorderly pullout by European parents from host countries and ring-fencing of subsidiaries to protect local banking systems).

Photo sources: World Bank World Development Indicators; Bank for International Settlements; authors’ computations.

Join the Conversation