The diagram of a horizontally sliced triangle, with its wide base and pointy tip, has been used to represent socio-economic data for decades. The lowest and largest portion represents the poorest and most populous segment of society - living "at the bottom of the pyramid." In the context of mobile innovation, we prefer the alternate term, "base of the pyramid," which is closer to signifying the foundational, fundamental role of this demographic group in the health of an economy.

Regardless of semantics, the phrase has been widely used by researchers to consider the effects of various phenomena on this group of people (see select references related to digital entrepreneurship here). While many of these studies have produced insights for the development community, few have contributed practical knowledge for the entrepreneurs who live among and serve this critical group.

In 2012, infoDev commissioned country case studies on the use of mobile devices (then still mostly simple phones) at the base of the pyramid in Kenya and South Africa, with funding from the Ministry for Foreign Affairs of Finland and DFID (UK). Relying in part on a diary methodology and household surveys, the team was able to collect a rich set of qualitative and quantitative data to describe how mobile technologies were being used by the poor in their daily lives, as well as recording a series of videos with users.

They showed, for instance, that users in Kenya were willing to forego basic necessities such as food, transport or toiletries to pay for mobile credit in the knowledge that this would give them better opportunities to find work. In other words, we found that mobile phones are highly valued by and influential in the lives of people at the “base of the pyramid,” and decided to deepen our knowledge further in a way that would benefit entrepreneurs who create applications that serve this population.

The results led us to pose more specific questions, and this time we targeted mobile developers and entrepreneurs who either belong to the "BOP" group or aim their products at this market segment. In 2013-2014, with funding from Sweden, we followed up with a more practical set of questions:

- What are the challenges that mobile entrepreneurs face in making mobile apps work for the poorest?

- How have some entrepreneurs managed to overcome these challenges?

- How can policy-makers and other actors in the mobile innovation ecosystem encourage the growth of market opportunities at the base of the pyramid?

2) Distribution channels: What is the best way to get mobile applications into the hands of users?

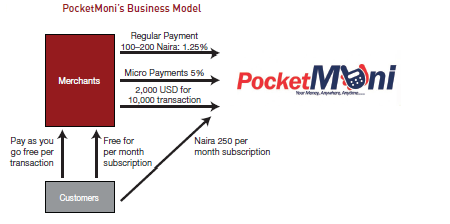

3) Revenue streams: What options are theoretically available and how many of those are practically feasible?

The study presents a set of conclusions and recommendations for mobile software entrepreneurs, which are also informative for other actors in the mobile technology ecosystem:

- Premium SMS provides more reach in terms of subscribers than any other payment facility; however, revenue sharing terms are often unattractive to mobile software entrepreneurs. Recommendation: negotiate premium SMS rates with MNOs; there is often room for negotiation despite MNO claims that they are “fixed.”

- Mobile money is not widely used at this stage, however, adoption is on the rise and expected to continue to increase. Recommendation: ensure mobile app can be adapted to take advantage of mobile money where and when available and consider initiating discussions with financial institutions to develop payments gateways where possible.

- Mobile Network Operator app stores give mobile software entrepreneurs the ability to target local populations and ensure reliable distribution; however, the potential is under-exploited due to lack of communication between operators and entrepreneurs. Recommendation: assertively pursue negotiations with MNO to identify a workable business model for the operator and the entrepreneur.

- Global app stores (e.g. Google Play) often allow more limited access to the local population and lack appropriate payment facilities. Recommendation: organize community and engage policy-makers to advocate for app stakeholders.

- Incubators such as the East Africa mLab, Southern Africa mLab, or CTIC, can positively impact the app environment. Recommendation: use incubator and tech hub resources for education, advocacy and gathering place.

Are you an entrepreneur developing mobile apps for the BOP, a policy-maker working to expand this promising market, or a researcher interested in these issues? Let us know your thoughts in the comments. You can find further references, and add your own, on this page.

Additional contributors: Steve Esselaar, Christoph Stork, Tim Kelly, Kaaze Mutoni Karasanyi

Join the Conversation