Ensuring that the world economy and its citizens have sufficient infrastructure—from transport systems to electricity grids and water pipelines—is an increasingly pressing issue. It’s also a subject matter surrounded by misconceptions. Five are worth noting:

1) Lack of investment is not always to blame.

The first is a common assumption that when infrastructure is too inadequate, congested, or old, the culprit is always a lack of investment. The truth is more complex. Globally on average, infrastructure stock --which includes transport (road, rail, ports and airports), power, water and telecommunications--accounts for about 70 percent of a country’s GDP. Brazil, whose infrastructure stock is less than 20 percent of GDP, under-spends chronically compared with its economic size and growth. It seems no coincidence that the country’s airports are 122nd out of 142 in the World Economic Forum’s rankings. Other under-investors include the United Kingdom, Canada, India, and the United States. But other countries over-invest for the size of their economies. China, Poland, Italy, South Africa, and Japan are among them. Japan’s stock of infrastructure is equivalent to nearly 180 percent of its GDP. Over the past 18 years, growth would have “justified” investment of around 3 percent of GDP, but Japan spent 5 percent.

2) It’s not what you spend. It’s how you spend it.

A second misconception is that finance is the overwhelming issue for the infrastructure sector. Concerns about how to find money to fill deep infrastructure needs remain the linchpin of current discussion. According to a new report from the McKinsey Global Institute and McKinsey & Company’s Infrastructure Practice, Infrastructure productivity: How to save $1 trillion a year, the world needs to spend $57 trillion on infrastructure over the next 18 years, nearly 60 percent more than it has spent over the past 18. That’s more than the value of the entire stock of infrastructure on the ground today, a prohibitive figure at a time when many governments are highly indebted, and capital is tight.

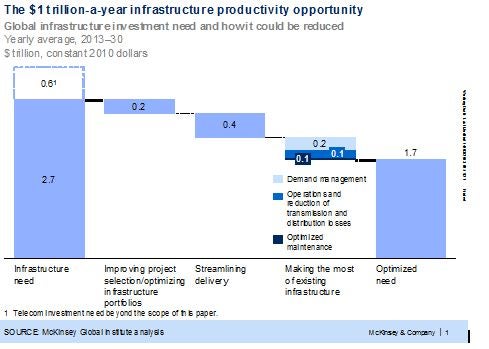

But this makes it even more vital to look beyond money and focus on boosting infrastructure productivity. Doing so could save $1 trillion, or 40 percent, a year. (figure1)

Figure 1

3) It’s not all about private money.

A third misreading of the facts is that private money is the answer to the world’s infrastructure needs. There is certainly some pent-up demand for infrastructure investment from pension funds, insurance companies, and sovereign wealth funds. Such investors have expressed frustration that they can’t find enough suitable projects to meet their target allocations—one problem being that many projects are in the developing world, which private capital regards as riskier. Global infrastructure spending’s “center of gravity” has already shifted to developing economies (figure 2). But even if these investors reached their targets, this would only result in an additional $2.5 trillion of investment through 2030. Of the $57 trillion needed, this is less than 5 percent. Compare that with the 40 percent that could come from higher productivity.

Figure 2

4) More is not always better.

A fourth misconception is that new, and more, infrastructure is always the best option. Actually, making the most of what is already there could save $400 billion a year. Intelligent transportation systems for roads can double or triple the use of an asset—typically at a fraction of the cost of adding the equivalent in physical capacity. More efficient use of rolling stock can boost the capacity of rail freight operations by 10 to 20 percent. And raising the efficiency of sea port terminals can increase their capacity to handle traffic by 20 to 30 percent. Governments need to manage demand to increase the shelf life of existing infrastructure. Congestion charging is a proven tool. Seoul has dealt with congestion through an integrated traffic-management system that includes improved bus operations, access restrictions, and the electronic collection of fares. Maintenance also needs to be better planned to increase capacity and prevent infrastructure from deteriorating to the point at which repairs become prohibitively expensive. In Africa, for instance, spending $12 billion on road maintenance during the 1990s would have saved an estimated $45 billion on reconstruction.

5) The infrastructure sector is not averse to change

A fifth fallacy is that there is really nothing much that can be done to improve infrastructure investment and delivery—after all, this is a sector that has performed poorly for 100 years or more. The truth is that the $1 trillion that the world could save each year on its infrastructure bill does not require a technological revolution. The steps that need to be taken—doing more with existing infrastructure, improving planning, and streamlining delivery—are all practical solutions drawn from 400 real-life case studies. Change can come quickly. In Australia, the state of New South Wales cut approval times by 11 percent in just one year by clarifying decision rights, harmonizing processes across agencies, and measuring performance.

To spur change programs and capture potential savings, governments must move beyond a project-by-project view and upgrade systems for planning, operating, and delivering infrastructure. A well-functioning system entails close coordination between the authorities responsible for different asset classes, clear separation of political and technical responsibilities, and clarity about the roles of (and effective engagement between) the public and private sectors. Other requirements include improved stakeholder management, better operational and financial information to guide decisions, and upgraded capabilities across the infrastructure value chain.

The private sector, too, has a role to play: it can drive productivity within its own operations, engage in a productive dialogue with public-sector stakeholders, and develop business and contracting models that promote the productivity opportunities outlined above. If the world stops focusing exclusively on what it needs to invest and starts paying attention to how it invests, delivers, and operates infrastructure, pessimism over today’s infrastructure challenge will give way to a renewed belief in what’s possible and kick-start concrete action.

Join the Conversation