The Climate Imperative

COP26 has once again thrown a spotlight on the threat climate change poses to global growth, poverty and geo-political stability. Without effective action, more violent storms, droughts, rising sea levels and other climate-related events could push over 130 million people into poverty by 2030 and cause over 200 million to migrate by 2050. The battle to contain global warming to manageable limits is not one that we can confidently say we are on track to win.

While the world is still working out how it will conquer this threat, COP26 has made abundantly clear that every part of the global economy is going to be affected. Financial Institutions now know that they will need to look through the climate lens at every investment they make (and have made) – to articulate how their money is being leveraged and to demonstrate they are aware of the risks climate poses to their business.

Many are stepping up to the challenge. At COP26, the Glasgow Financial Alliance for Net Zero (GFANZ), a global coalition of 450 financial institutions from 45 countries, with over $130 trillion of private capital, committed to accelerating the decarbonization of the global economy. This is an important step. The GFANZ institutions know they will need to follow up on their commitment. Civil Society will require proof that their capital is being used appropriately. And the world’s other financial institutions will be pressured to follow suit.

Walking the Talk

Confirming, measuring and quantifying the impact of IFC’s investments through financial institutions (nearly $3 billion last year) is increasingly important for both IFC and our partners. It allows us to monitor our progress toward the goals set out by the Paris Agreement and eliminate “green washing,” a term for when an investment or project is misleadingly labeled as green, or climate friendly.

Eight years ago, IFC’s Financial Institutions Group recognized the need to report transparently on the financing we provide for climate-related activities. To that end, we developed the Climate Assessment for Financial Institutions (CAFI) tool and platform.

CAFI, which is accessible to staff and external clients, enables us to check whether a project is climate relevant. Once confirmed, it also quantifies the development impact of the project.

As the need for clear and robust reporting on climate finance has become clear, IFC has fielded increasing interest from clients and non-clients, including other development finance institutions, to leverage CAFI rather than reinvent the wheel by creating their own platform.

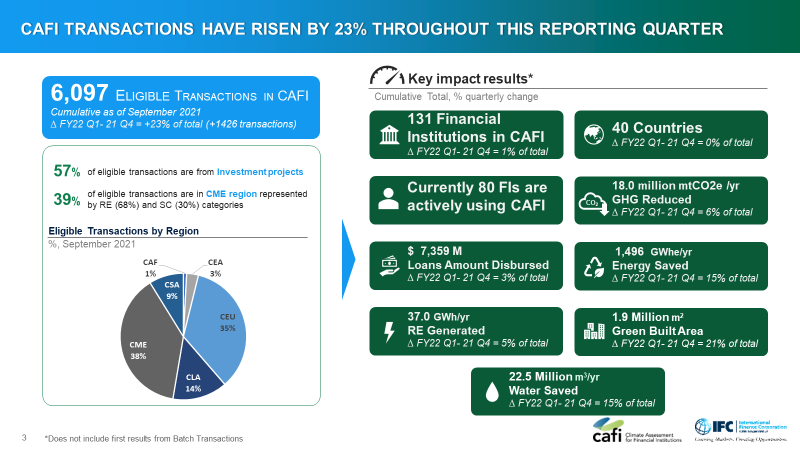

CAFI, which is accessed online, now has over $7.3 billion of climate-related projects through 6,097 transactions recorded from over 130 financial institutions across 40 countries, resulting in 18.0 million mtCO2e/yr being reduced, the equivalent to taking close to 4 million passenger vehicles off the road every year.

CAFI is frequently updated as the definitions for climate finance evolve. CAFI currently covers eight climate investment categories: renewable energy, energy efficiency, special climate, green buildings, transport, water efficiency, blue finance, and adaptation. It is a user-friendly tool that offers analytics functionality, in addition to portfolio monitoring. CAFI follows methodology and approaches that are publicly available and harmonized across multilateral development banks.

Call to Arms

Financial Institutions using CAFI now can clearly identify climate projects within their pipeline. They can report confidently to management, regulators, their partners and clients on how they are delivering on their climate commitments.

Andrii Kravets, Chairman of the Board for Ukrgasbank in Ukraine says, “We have now been using the CAFI platform for five years. Our loan officers and clients have found it to be an extremely valuable tool to better understand what qualifies as climate projects. And, perhaps more importantly, it is instrumental in helping us quantify and promote the impact of our climate finance portfolio to our key stakeholders, both within the bank and beyond. Climate Finance is now an area in which we are a clear leader in our chosen markets.”

Like all key participants in the bid to put the World’s economic growth onto a sustainable path, the financial sector is going to have to prove that its money is being used appropriately. CAFI has been specifically designed for financial institutions – with their high number of transactions – to use. The tool is robust, built on transparent, globally agreed climate metrics, and simple enough for loan officers (not engineers) to be able to use.

IFC is sharing CAFI beyond our own clients—with other multilateral development banks, international financial institutions, private institutions, fund managers—anyone who invests at scale in climate friendly projects. We encourage all financial institutions that recognize their need to accurately report on climate finance activities in emerging markets to review the tool to see how it can help them. Join us in the effort to expand and improve climate reporting as we move towards a Net Zero pathway. Contact the CAFI team at IFC_CAFI_Team@ifc.org, to learn more.

Join the Conversation