Along with the rest of world, emerging capital markets have suffered much turbulence in the wake of the COVID-19 pandemic. But the Issuer Driven Exchange Traded Fund (ID ETF) recently launched in Brazil as part of the World Bank’s ID ETF program to support the development of the domestic bond market and ultimately enhance financial stability, seems to have weathered the initial storm.

In many emerging markets typically centered in traditional banking practices, the range of capital market investment options is limited. This is a challenge that stands in the way of long-term planning and financing for major investment and development needs by the government and the private sector. The World Bank’s Issuer Driven Exchange Traded Fund (ID ETF) program aims to provide access to cost-effective savings products and improves competition in financial services.

ETFs provide a low-cost way to invest in a basket of assets by tracking an index.

A physicist and former submariner called Nate Most is credited with originating the idea of ETFs in the late 1980s. Working at an Asian commodities exchange, he observed how traders bought and sold warehouse receipts rather than actual commodities held in those warehouses. ETFs were seen as an insignificant niche before the 2007/08 financial crisis. But the failure of most traditional active managers to avoid damaging losses during that crisis prompted many investors to seek less volatile strategies built with ETFs.

Prior to the onslaught of the COVID-19 pandemic, global ETFs accumulated a record $6 trillion in assets under management, having doubled in size during the previous four years. As of June 30, 2020, fixed-income ETFs represented 15 percent of the global fund market, with nearly $1 trillion in assets. Yet fixed-income ETFs in emerging market economies still amounted to less than 1 percent of global ETF assets. This is because it is often difficult and costly to purchase the full basket of underlying securities that make up the referenced index. In addition, many developing countries are unable to address the need for broader enabling reforms in domestic capital markets—whether it is supporting regulatory and tax framework, sound market infrastructure, and policies to support primary markets and liquidity in secondary markets.

Where is the innovation?

The key innovation of the ID ETF program is the direct involvement of the government debt management office as a supporting entity. This entity’s role is to ensure the issuance of a pre-agreed amount of underlying securities in the primary market, so the fund manager of the ID ETF can purchase the full basket of underlying securities in large volumes at the outset, ensuring access to a diverse set of investors.

A few key features of an ID ETF:

-

Contemplates only government bonds at the current stage (with possible expansion to other asset classes in the future)

-

Priced daily on stock exchanges, a major benefit considering that price dissemination and liquidity are still a hurdle in many emerging markets

-

Tend to have a low tracking error because it is fully backed by the basket of government bonds deposited with a custodian

-

Tend to be larger and more liquid than traditional ETFs. The issuer’s support permits the ID ETF to be launched through a public offer process while traditional ETFs usually grow slowly and depend on seed capital

-

Contemplates secondary market support by the “issuer” if assessed as required in our feasibility analysis, including through periodic buybacks and exchanges promoted by the government or by aligning market-making rules of government primary dealers to support liquidity of underlying instruments

-

Aligned with development goals. For example, in Brazil, an inflation linked index was chosen, which is aligned with the objective of reducing indexation to overnight rates, improving liquidity and price discovery of inflation-linked instruments, and extending the maturity profile

-

Uses in-kind (as opposed to cash) creation and redemption, which mitigates some potential risks such as the “first-mover advantage” and ETF price volatility

The inaugural ID ETF in Brazil—and beyond

Brazil's Issuer-Driven Exchange Traded Fund, called IMAB-11, was launched on the Brazilian stock exchange on May 20, 2019. It reached a total size at launch of approximately $500 million, making it the first of its kind and the largest fixed-income ETF in Latin America. Managed by Brazil's Itau Asset Management, the inaugural ID ETF was distributed to 2,100 institutional and retail investors. For approximately 700 investors, this was the first time ever investing in the Brazilian stock exchange.

The IMAB-11 ID ETF was the first fixed-income ETF in Brazil and has provided the impetus for the launch of other fixed-income ETFs. Six months after its launch, two ETFs were launched in India that use some inspiration from the ID ETF program. The Bharat bond ETFs comprise ETFs that invest in the constituents of the Nifty BHARAT Bond Index. The index contains debt securities of several government organizations, expanding on the single issuer structure in Brazil.

While it is still too early to evaluate all aspects of the Brazil ID ETF, it has already provided clear indications of supporting industry growth, investor access, lower costs, and greater competition in the asset management industry.

Weathering the COVID-19 storm

The March 2020 financial market selloff across assets was an extreme test of ETFs in general. Even though it is too early for a comprehensive assessment of how the COVID-19 crisis affected trading patterns of ETFs and underlying securities, bond ETFs have provided investors a measure of protection in the market turmoil by enabling liquidity and transparent pricing in the markets. Another testament to the importance of bond ETFs to capital markets infrastructure is how central banks have been using ETFs as a tool of their capital market management. This includes the US Federal Reserve purchasing almost $7 billion of US listed fixed-income ETFs as of June 2020.

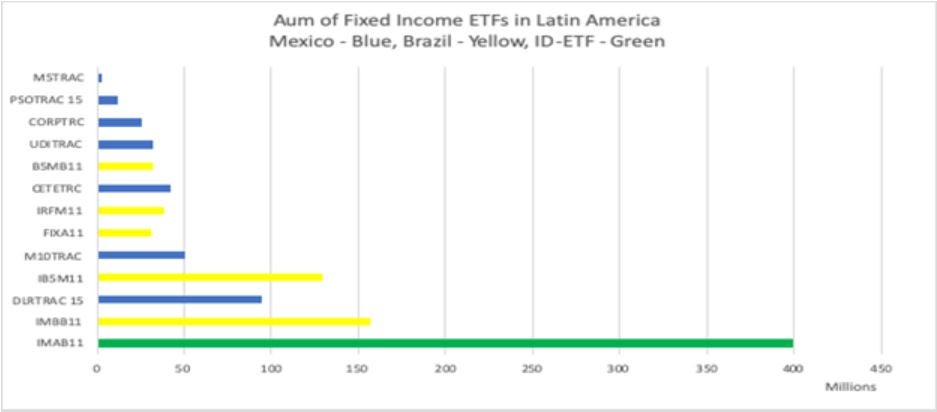

As of June 30, the IMAB11 ID ETF in Brazil had weathered the COVID-19 storm well when compared to similar products in the region (Figure 1). While the largest fund in the category typically suffers the greatest losses in times of market volatility, the ID ETF is still the largest fixed-income ETF in Latin America by a large measure.

Figure 1 - Fixed Income ETF in Latin America – by Assets under Management (AuM) in USD

The successful launch of the first ID ETF in Brazil in 2019 was in and of itself an encouraging sign of the superior attributes of the ID ETF approach in facilitating growth of ETFs in emerging markets. Its robust performance despite the turbulent markets in the wake of the COVID-19 pandemic further highlights the resilience of the ID ETF structure. The World Bank is currently working on a strategy to replicate the ID ETF in other markets, with programs already taking place in two more countries.

Join the Conversation