Using SME lines of credit and other SME support operations for long-term development or a quick term countercyclical fix?

I recently attended an interesting presentation about a truly impressive credit guarantee agency, the Korean Credit Guarantee Agency (KODIT), established 40 years ago with $44 billion in outstanding guarantees and 220,000 SMEs guaranteed annually. A truly impressive institution which has opened up bank lending to more and more SMEs, which otherwise would have gone unfunded and unserved. As one of the larger Partial Credit Guarantee (PCG) schemes in the world, the Koreans have clearly achieved remarkable results at an impressive scale.

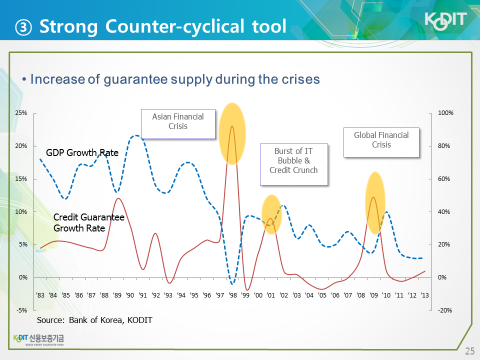

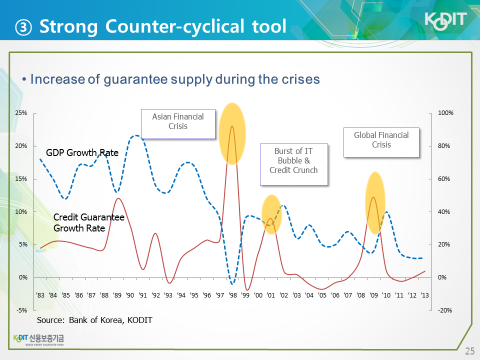

The one thing that struck me most, however, was the slide reproduced below. KODIT explicitly uses a guarantee instrument on SME loans as a tool of countercyclical policy. So, when the economy enters a down turn, guarantees are more liberally applied to ensure that SMEs don’t go out of business and adversely impact the generally negative economic scenario. “Job Preservation” becomes more important than “Job Creation.” With 99% of registered firms in Korea being SMEs, and with 87% of Korean employment coming from SMEs,supporting this sector in a down turn is clearly very important.

Korea is not unique. During the early days of the Great Recession in 2008, the Small Business Administration of the United States of America increased SME guarantees in the face of an economic down turn. Since the summer of 2015, the Chinese government has begun to offer subsidized loans to SMEs to counteract the effects of the Chinese slow down. Countries such as Turkey, Ecuador, Nigeria, Kazakhstan, Myanmar and Egypt are increasingly seeking World Bank support for SME lines of credit, SME guarantee programs, and other forms of SME support. Supporting SMEs is clearly a well-recognized and frequently applied tool of economic policy.

Yet our own World Bank guidelines stipulate that SME-support interventions are meant to help achieve longer-term developmental goals – broadening and deepening financial markets so that financial systems can ultimately take on these types of lending without the need for outside intervention. In fact, a 2014 IEG Report on “The Big Business of Small Enterprise” criticized the World Bank, the International Finance Corporation, and MIGA for undertaking SME I, followed by SME II, followed by SME III, followed by SME IV, with no visible increase in the capacity of the underlying financial sector to sustain such lending on its own account, very little lengthening of the tenors of SME lending, and seemingly very little increase in the commercial banking sector’s comfort levels in dealing with a clientele which all too frequently is perceived by private lenders as being unduly risky.

It would actually seem, however, that SME Lines of Credit and other forms of SME support, are undertaken for several reasons but within two broad categorizations:

Category 1:

It would appear that SME support mechanisms can be a legitimate tool of countercyclical economic policy in an economic down turn. However, because speed is generally a prime pre-requisite in such an environment, these types of operations will not necessarily promote the pre-conditions for longer term market development for SME funding, an enhanced appetite for banks to lend to SMEs, or even increased support for “employment-generating” SMEs that may well be the desired target …………. and consequently, the criticism that we are not having a real lasting developmental impact.

Maybe the time has come start thinking about SME lending in two distinct ways:

I recently attended an interesting presentation about a truly impressive credit guarantee agency, the Korean Credit Guarantee Agency (KODIT), established 40 years ago with $44 billion in outstanding guarantees and 220,000 SMEs guaranteed annually. A truly impressive institution which has opened up bank lending to more and more SMEs, which otherwise would have gone unfunded and unserved. As one of the larger Partial Credit Guarantee (PCG) schemes in the world, the Koreans have clearly achieved remarkable results at an impressive scale.

The one thing that struck me most, however, was the slide reproduced below. KODIT explicitly uses a guarantee instrument on SME loans as a tool of countercyclical policy. So, when the economy enters a down turn, guarantees are more liberally applied to ensure that SMEs don’t go out of business and adversely impact the generally negative economic scenario. “Job Preservation” becomes more important than “Job Creation.” With 99% of registered firms in Korea being SMEs, and with 87% of Korean employment coming from SMEs,supporting this sector in a down turn is clearly very important.

Korea is not unique. During the early days of the Great Recession in 2008, the Small Business Administration of the United States of America increased SME guarantees in the face of an economic down turn. Since the summer of 2015, the Chinese government has begun to offer subsidized loans to SMEs to counteract the effects of the Chinese slow down. Countries such as Turkey, Ecuador, Nigeria, Kazakhstan, Myanmar and Egypt are increasingly seeking World Bank support for SME lines of credit, SME guarantee programs, and other forms of SME support. Supporting SMEs is clearly a well-recognized and frequently applied tool of economic policy.

Yet our own World Bank guidelines stipulate that SME-support interventions are meant to help achieve longer-term developmental goals – broadening and deepening financial markets so that financial systems can ultimately take on these types of lending without the need for outside intervention. In fact, a 2014 IEG Report on “The Big Business of Small Enterprise” criticized the World Bank, the International Finance Corporation, and MIGA for undertaking SME I, followed by SME II, followed by SME III, followed by SME IV, with no visible increase in the capacity of the underlying financial sector to sustain such lending on its own account, very little lengthening of the tenors of SME lending, and seemingly very little increase in the commercial banking sector’s comfort levels in dealing with a clientele which all too frequently is perceived by private lenders as being unduly risky.

It would actually seem, however, that SME Lines of Credit and other forms of SME support, are undertaken for several reasons but within two broad categorizations:

Category 1:

- To help catalyze the market in the development of longer term financing instruments (an output, not an outcome)

- Support employment generation (which is a prime motivation in the current global environment) or other “SME-related” objectives (such as diversification, innovation, geographic dispersion of economic activities, value chain inclusion, women’s employment, youth employment, etc)

- As a tool of countercyclical economic policy.

It would appear that SME support mechanisms can be a legitimate tool of countercyclical economic policy in an economic down turn. However, because speed is generally a prime pre-requisite in such an environment, these types of operations will not necessarily promote the pre-conditions for longer term market development for SME funding, an enhanced appetite for banks to lend to SMEs, or even increased support for “employment-generating” SMEs that may well be the desired target …………. and consequently, the criticism that we are not having a real lasting developmental impact.

Maybe the time has come start thinking about SME lending in two distinct ways:

- As a tool of countercyclical economic policy (much like fiscal support through a DPL, but directed at the private sector) and

- As a more developmental instrument (catalyzing longer term lending markets, developing instruments more attuned to “employment generating” SMEs, supporting a more robust financial infrastructure – including payments system and PCG support schemes, etc).

Join the Conversation