To sustain its impressive growth rates, the Government of India is looking for new sources of growth. Last year, the Cabinet approved an ambitious new National Manufacturing Policy (NMP). The policy, which is awaiting ratification, aims to create 100 million jobs and to increase the share of manufacturing in GDP from 16 percent to 25 percent within a decade. At the center of the policy are National Investment and Manufacturing Zones (NIMZs), large industrial townships that offer special incentives and infrastructure to attract businesses.

This is not the first time the Indian government has turned to zones to deliver on its economic goals. India’s Special Economic Zones (SEZ) Act of 2005 was launched amid hopes that it would help boost exports, FDI, and job creation. However, the SEZ Act met with mixed results and widespread controversy.

Today, we are kicking off a 2-part blog series that explores the possibilities—and potential pitfalls—of industrial zones. In this installment, we answer: Why did the SEZ Act fall short? On Thursday, we will assess the prospects of the proposed NIMZs.

Reviewing the Results

When the SEZ Act of 2005 was announced, there was an outpouring of interest from developers. Yet, as seen in the chart, by 2010 only twenty percent of all approved SEZs had become operational. Targets for jobs were not met. What happened? No single factor explains it in full, but several, from a lack of connecting infrastructure to the political economy of land, came together to prevent the Act’s original goals being met.

One of the key reasons so few zones moved from ‘formal approval’ to ‘operational’ was the difficulty of acquiring land in a fair, efficient, and cost-effective manner. Another reason so few zones became operational was the lack of infrastructure connecting the zones to export markets—from energy to roads and ports. In a number of zones the private sector did build internal infrastructure, but without good roads to good ports: as a result internal improvements would not create demand for units. Without confidence in the demand from tenants, developers would not build.

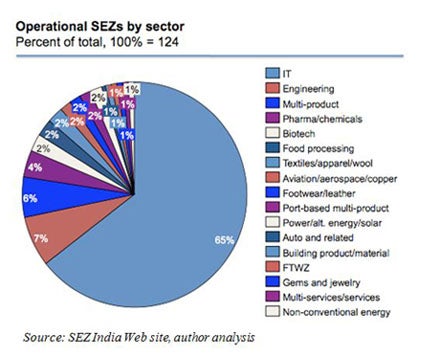

Yet another reason was the incentive that existed to acquire land, and sit on it to allow it to appreciate without developing it. To be provocative, one could say that the SEZ Act had become a way to speculate on land value, which for a country of more than 1 billion people could be a profitable proposal. One point of evidence for this argument is that while 380 SEZs were officially notified—a step requiring proof of ownership of the land in question—only 124 actually became operational. While it is difficult to determine which of two possible causes for this – land speculation, or failure of rental demand to materialize – was primarily responsible, there is a widespread belief among researchers and officials alike that both were significant.

The only sector that seems to have benefitted from the SEZ developments is the IT sector. As seen in the chart below, nearly two thirds of all SEZs that became operational under the SEZ Act of 2005—80 in total—are in IT or related sectors. A regional review also shows that the zones in the South developed more than in the North, for reasons that are complex but involve the weight of the IT sector there, the extent to which state governments promoted the use of SEZs, the degree to which state industrial development agencies supported land acquisition, and the quality of infrastructure connecting the zones to exports.

In addition, 90 percent of all operational SEZs are in the South or West regions of the country: four states alone—Andhra Pradesh, Tamil Nadu, Karnataka, and Maharashtra—account for 77 percent of all operational SEZs in India.

Most of these zones are very small—they average less than a square kilometer in size—limiting their ability to create jobs and attract investment. In reality, most SEZs created under the SEZ Act aren’t sprawling zones full of manufacturing activity, but rather normal office buildings filled with IT workers. Since IT activities would not require much physical infrastructure, such zones did not deliver the infrastructure improvements or provide the benefits of agglomeration and clustering that the Indian government was hoping to achieve through the zones.

This has led to disappointing performance against the GoI’s stated goals. Through the end of 2009, the SEZ Act had created less than 50 percent of the jobs that had been projected. While export growth was strong overall, 80 percent of exports from Indian SEZs came from existing SEZs rather than SEZs created under the new law. And these export levels do not necessarily generate additional jobs or economic activity in line with the incentives received. A third of all exports came from a single SEZ in Gujarat with an oil refinery—which, like IT SEZs, requires little labor relative to export value.

Join the Conversation