Woman shopkeeper in Ghana

Woman shopkeeper in Ghana

This blog is Part I in a two-part series on informality and investment climate.

Part II - Supporting informal businesses amid COVID-19 without formalization

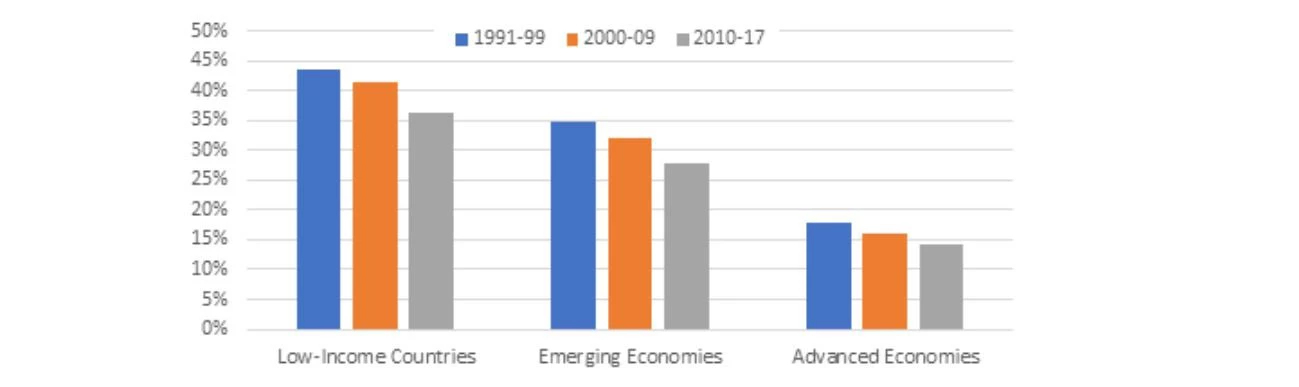

From small-scale farmers to waste pickers to street vendors, more than 60 percent of the global workforce and 90 percent of small and medium-sized enterprises operate informally. The informal economy—also referred to as the shadow, or grey economy—encompasses firms, workers, and activities that operate outside legal and regulatory systems. In most developing countries, it is far bigger than the formal economy and a way of livelihood for many people (Figure 1). In Sub-Saharan Africa and South Asia, for example, informal workers are estimated to account for 90 percent of the labor force.

Figure 1. Size of informal economy by income group, 1991-2017

In most cases, informality consists of a single worker or a subsistence small business, often characterized by low productivity, low wages, and stagnant growth. These informal businesses are a crucial source of income to people who otherwise might not find employment in the formal, regulated sector. They are especially important to women, who in more than half of the countries (55.5 percent) are present in higher numbers than men in the informal sector.

Why informality persisted and grew during COVID-19?

While the informal economy can provide a temporary, imperfect social safety net, benefits of formalization are clear advantages for informal businesses to move out of operating in the shadow economy. These benefits include access to finance, link to value chains, and access to government relief measures in times of crisis.

Yet informality further grew during the COVID-19 pandemic, aggravating its impact. Economic contraction—due to the decline in demand for goods and services, a liquidity crunch, and disruption of global supply chains and investment flows—has increased instability and the risk of closure for smaller firms, pushing them into informality. Moreover, economic players are likely to be forced to pursue income sources from unregistered economic activities, increasing the scale of the informal sector.

Understanding the challenge—and tackling it

A growing informal sector accentuates the need for strategic and appropriate policy responses. But to address informality, one must first understand it—as well as the factors driving it.

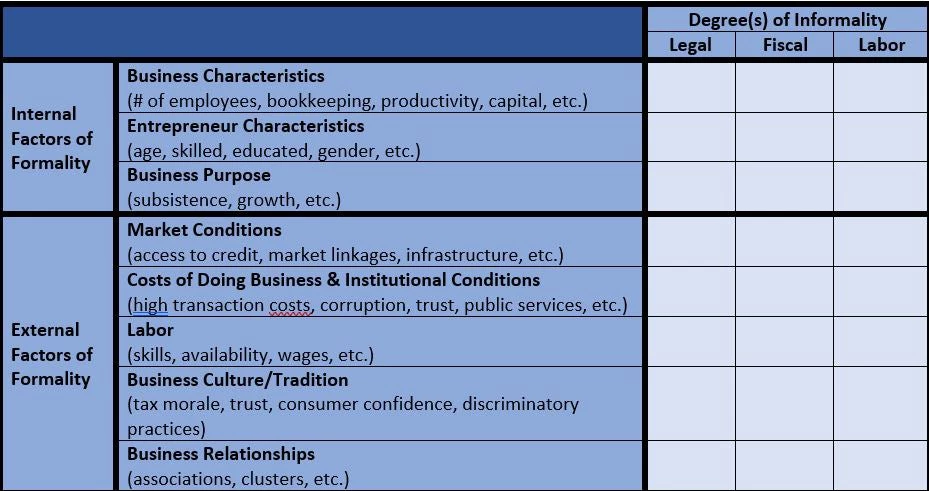

First, the informal sector is heterogenous, with different dimensions of informality. They include legal (whether the business is registered or not), fiscal (whether the businesses pay taxes and maintain bookkeeping), and labor (whether it offers contracts and benefits to employees). There is little available research on how the three different types of informality interact, or whether and how firms choose which informality to exercise. Degrees of informality are not mutually exclusive. A firm that operates without registering is unlikely to abide by fiscal requirements.

At the same time, there are many factors that influence a business’s decision to formalize. These range from internal factors, such as individual business purpose and characteristics, to external factors, including market conditions, costs of doing business, and business cultures and relationships. Government interventions that aim to formalize businesses should be guided by the cost-benefit analysis of formalization trade-offs, drawing from a clear understanding of where the prominent weaknesses lie that would curtail movement toward formalization and maximization of the benefits generated from an intervention.

Figure 2 presents a matrix of degrees of informality and factors driving formality. It can help us understand the relationship between different factors that may be at the root of informal behavior, identify, and predict a business’s willingness and/or capacity to formalize.

Figure 2. Business differentiation matrix

Based on a recent literature and operational review using this matrix, four approaches could help governments address informality:

- Interventions targeting clusters of firms, rather than informal individual businesses, could foster greater rates of formalization. Clustering generates benefits such as market linkages and productivity spillovers, which are associated with formalization and can ultimately lead to profit and income growth.

- Support informal firms for them to become more productive, without necessarily targeting formalization. Understanding the kind of support an informal business needs most may help incentivize formalization and increase productivity. This approach, which could center on providing a holistic, multi-faceted approach, could improve outcomes.

- Grant informal firms a simplified or intermediate legal or tax status could be a steppingstone for informal businesses to transition to full formal status. Legalizing the ‘status quo’ might help businesses access government support, especially for businesses who operate on middle ground between fully formal and fully informal. The government would also gain from collecting data on these businesses.

- Businesses on the edge of survival may place a higher value on income earned today, regardless of its size, than on the medium to long-term benefits of formalization. Integrating behavioral insights into the research can help shape a financial cost-benefit analysis.

Together, these approaches could shed light on how we view informality and how we go about addressing it. The current pandemic has made it more urgent to seize the opportunity for unlocking the potential of the informal sector.

Join the Conversation