Women working in factory in Rwanda 2019

Women working in factory in Rwanda 2019

Firms and workers continue to be deeply impacted by the COVID-19 pandemic as it enters its eleventh month. Building on insights from COVID-19 Business Pulse Surveys, the first blog post in this series described the implications of the crisis for firm sales, employment, and financial performance, while the second discussed record levels of uncertainty and firms’ coping strategies, including adoption of digital technology. This third and final part of the series focuses on public policy responses.

While developing countries acted rapidly to support firms, their response is a small fraction of what has been provided in high income countries. Since the onset of the crisis, governments in 135 countries have implemented 1,600 measures directly aimed at supporting firms and SMEs, of which 995 were in developing countries. More than three quarters of these measures have been concentrated in three categories: debt finance support, employment cost support, and tax relief. Developing country governments have allocated between 1% and 3% of GDP, with about a quarter dedicated to supporting businesses. In high-income countries, the size of the stimulus has reached 10% of GDP or more, with around 40% going to firm support.

Early evidence from Europe (e.g., Denmark, Italy, Portugal) shows that policy support has often gone to the more vulnerable firms and may have helped businesses stay afloat during the crisis. However, in developing countries, little is known about the reach of policies, the alignment of measures with firm needs, and their targeting and effectiveness. Our recent research fills this gap, highlighting four key findings:

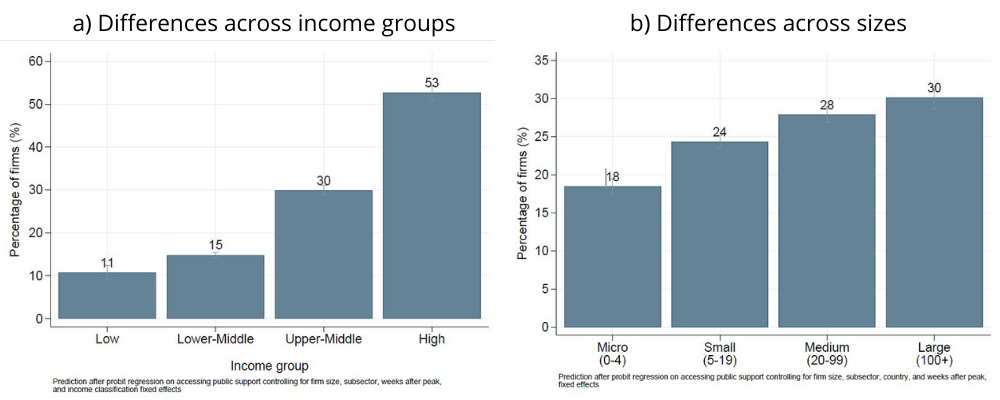

1. Policy reach has been limited, with smaller firms and firms in poorer countries at a particular disadvantage. Across 120,000 firms surveyed in 60 countries, only one in four firms surveyed has received any type of public support. This share varies from more than half of all businesses in high-income countries to just over 10 percent among low-income economies. There are also substantial disparities by firm size, with the probability of accessing policy support ranging from 19 percent for micro firms to 30 percent among large firms. This means that the businesses most affected by the shock – small firms and those in poorer countries – were also the least likely to receive government support. As our second blog highlighted, these firms also had the lowest likelihood of adapting to the crisis through digital, underscoring the vulnerabilities they face.

2. There is no one-size-fits-all approach for policy instruments. Demand for policy support varies across different countries and firms. Demand for wage subsidies and tax reductions increases with income level, likely driven by higher degree of formalization and larger average firm size. The opposite is observed for monetary transfers, which are more demanded by smaller firms. In many instances there is some mismatch between policies demanded and offered: for example, access to credit is the most preferred policy for firms in lower-middle income countries, but tax relief is the main mechanism of support offered in these economies. For upper-middle income countries, there is a mismatch for tax deductions and access to credit, which rank high in firms’ preferences but low in terms of policy utilization or access.

3. Targeting was better at the sector level than the firm level. Similar to evidence from Denmark, firms in sectors more affected by the shock (e.g., those in the hospitality industries) were more likely to receive public support. But within sectors, funds did not always flow to the most affected firms, implying that scarce public resources could have been used more efficiently. On average, just over one quarter of firms that experienced a COVID-related demand or supply shock received support; while one-fifth of firms that did not experience any shock or sales drop due to COVID-19 also received public support. Targeting was especially limited in low income countries, where the probability of receiving support was weakly or even inversely correlated with revenue loss – and the same was true in countries with weaker governance.

Correlation between change in sales and access to public support across sectors

4. Several instruments may have been effective in helping firms weather the shock. While it is premature to draw firm conclusions, descriptive evidence suggests that policies such as access to credit and monetary transfers have helped to ease firms’ liquidity constraints by reducing the likelihood that they fall into arrears and increased expectations for future sales growth. Wage subsidies are associated with a reduced probability of firing workers, consistent with them having served their intended purpose of helping workers to maintain their jobs. Tax support is correlated with a smaller reduction in sales and a lower likelihood of falling into arrears. In contrast, payments’ deferrals are not correlated with the likelihood of falling into arrears or laying off workers, suggesting that they have been less effective. Firms that received this type of support also are not more optimistic about future sales growth than otherwise similar firms.

The economic impact of COVID-19 on businesses has been unprecedented. While some lessons from previous crises proved useful in the initial response phase, policymakers and development practitioners were faced with an acute lack of data and evidence on how to design and implement support policies.

Efforts such as the Business Pulse Surveys aim to fill this gap, although much more research will be needed to answer the more complex, challenging questions. Still, the collection and monitoring of data during the pandemic bodes well not only for the recovery phase of the current crisis but also for preparedness to respond to future challenges.

Furthermore, as the crisis continues and puts pressure on limited fiscal resources, three elements will be critical for policymakers: (i) better and more careful targeting of beneficiaries; (ii) monitoring access to policy support and how resources are used; and (iii) measuring effectiveness and results of the policy measures enacted. The newly launched COVID-19 Business Pulse Survey Dashboard now makes these data widely available to support these efforts.

This is the third of a three-part blog series sharing insights generated by the COVID-19 Business Pulse Surveys. Part 1 discussed the impact of the crisis on sales, employment, and firm finances, while part 2 discussed the record levels of uncertainty facing firms and use of technology to cope.

Join the Conversation