Last week the Financial Sector Advisory Center (FinSAC) co-hosted a Conference on Fintech in Vienna. It brought together regulators, supervisors, donors, standard-setting bodies, and private sector representatives to gain a deeper understanding on some of the more pertinent fintech themes of concern to many developing countries. FinSAC propelled the wave of energy and momentum that many public and private partners and counterparts have been experiencing since the launch of the Bali Fintech Agenda at the joint WB/IMF Annual Meetings in 2018, discussing the new challenges and the associated risks.

There was a clear sense of fascination blended with anxiety among country authorities and stakeholders, with an overall recognition of the unprecedented opportunities and ways to do things differently. The world of finance, for many economies, is rapidly shifting – compounded by high stakes relating to debt, demand for jobs, and gender inequality – which is representing a big challenge for the general public, policy makers and the private sector.

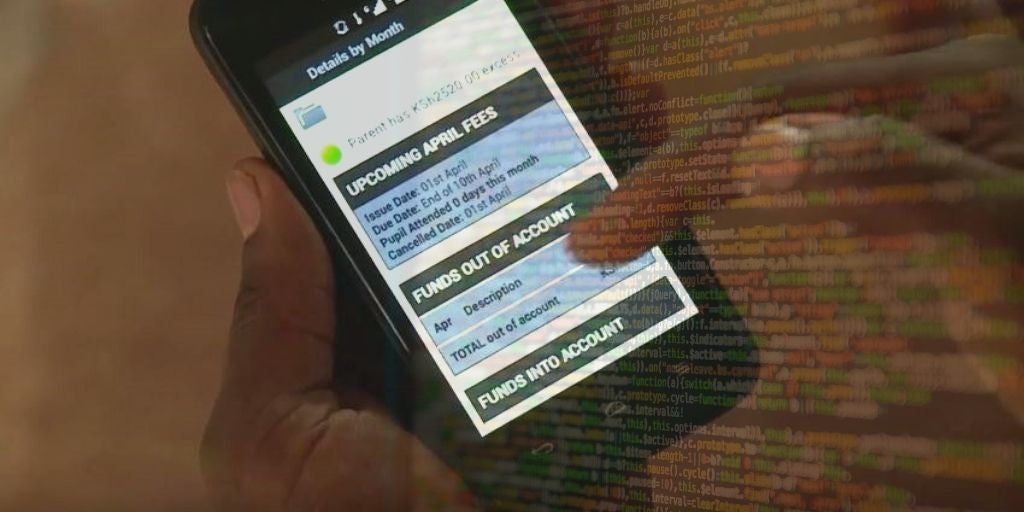

At the World Bank Group, we are helping our clients to address questions and gaps that will define the future and success of fintech solutions as they pursue efforts toward financial inclusion and poverty reduction. Fintech is a reality everywhere. Ranging from Artificial Intelligence or Machine Learning to mobile applications - there is evidence that fintech is about efficiency; fintech is an enabler of new products and services; it is a platform for new players that can operate more competitively in the interest of customers; and it can facilitate a more diverse and deeper financial eco-system. For example, transitioning remittances transfers and cash payments to mobile payments and peer-2-peer applications in many jurisdictions is helping to resolve complaints relating to financial services being slow, costly, hard to track and not always secure. The World Bank’s Remittance Prices Worldwide data shows that the average price for sending $200 is 6.94%, whereas the price to send remittances through mobile operators is 2.9%.

Digital financial services are a gateway for the poor and SMEs to participate in the formal economy. There are an estimated 1.7 billion adults in the world without access to financial services. From the demand side, the poor and SMEs need affordable and tailored financial services that can cross geographical barriers. From the supply side, fintech-enabled automation of business processes (e.g., onboarding, KYC, data analysis) now make low-value (cross-border) transactions commercially viable. Recent evidence of the impact of fintech as well as its potential going forward is encouraging. The World Bank’s Findex shows that in many African and South Asian countries, mobile money and digital payments have pushed financial access to transaction accounts for many adults who were previously unbanked. In developing economies, the share of adults using digital payments rose by 12 percentage points, to 44% in three years. Digital ID accelerated financial access in India by bringing in the undocumented. Globally, there are about 1 billion people who are on the sidelines of the financial system since they lack an official proof of identity. Open banking initiatives such as those in the UK, Mexico, and recently Brazil have the potential to reduce information asymmetries, stimulate innovation, promote competition and push down the cost of financial services. With two-thirds of the 1.7 billion unbanked adults in the world having a mobile phone and 42% of adults -- roughly 1.85 billion adults -- with internet access, fintech’s further potential is significant.

Of course, we need to carefully monitor and mitigate risks. Competition concerns, concentration risks, the potential for “winner takes all” effects and managing Bigtech platform companies are just a few. Add to that, risks related to data governance, data privacy and cyber security. This can make our lives very complicated. We are constantly investing in deepening the sense of awareness and our inventory of evidence, knowledge and best practice. In this dynamic and rapidly evolving context, consumer and investor protection is critical; but also ensuring we have clarity and consistency in the regulatory frameworks, avoiding potential regulatory arbitrage; ensuring the adequacy of existing financial safety nets; as well as avoiding potential threats to financial integrity and ensuring AML/CFT compliance. Countries are taking different actions: in Kenya, for example, the Competition Authority recently imposed requirements on mobile financial service providers to disclose the borrowing costs of digital credit to consumers upfront as well as the cost of mobile money payments prior to initiating and following each transaction.

Fintech is increasingly integrated into the World Bank’s projects, country engagements, global dialogue and diagnostics. Our Fintech work focuses on 3 key pillars: (1) legal and regulatory frameworks for responsible fintech innovation and adoption both for households and firms; (2) financial infrastructure to support digital identification, faster payments, the use of application programming interface and alternative data for credit decisions; (3) access to transaction accounts and financial services, more broadly under the Universal Financial Access agenda. The IFC is also investing in fintech companies; working with existing banks and clients to help them adopt digital financial services into traditional banking platforms; and working with donors and development partners to accelerate the adoption of fintech and achieve responsible financial inclusion.

Beyond financial and banking experts, regulators experimenting with new approaches to facilitate innovation are also fueling this Fintech momentum. In Mexico, Colombia, Indonesia, and Thailand, for example, regulators have passed new laws and regulations to support fintech adoption and innovation while mitigating the risks. Authorities in the UK, US, Singapore, Lithuania, and Australia, and -- with the support of the World Bank Group -- Indonesia, Mexico, Vietnam, Colombia, Jordan, India, and China— have or are introducing more formal ‘test and learn’ approaches called Regulatory Sandboxes to encourage experimentation with new technologies, both for incumbents and new players. Sandboxes allow for small scale, live testing of innovations in a controlled environment under the regulator’s supervision. We estimate that there are currently around 33 sandboxes around the world. In a similar vein, some regulators have established Fintech Innovation Offices or Hubs which sends a pro-innovation signal. Innovation Offices promote information exchange with the market, and reduce regulatory uncertainty – Offices typically provide advice, guidance and even office space. Some regulators are also starting to experiment with the adoption of technology (Regtech /Suptech) to facilitate cost-efficient compliance, more timely risk oversight and more sophisticated supervisory analyses.

Going forward, the Fintech momentum will incentivize policymakers to foster standardization and interoperability given the importance of connectivity and data exchange for fintech. Many countries may have an opportunity to “leap frog” once they are able to address infrastructure gaps like limited penetration of broadband and mobile telephony, particularly in rural areas. A conducive environment for competition and market contestability toward a level playing field is an incentive for new, and non-traditional players such as non-banking financial institutions and telecom operators. A legal framework that is consistent, comprehensive, and predictable is a key incentive to fintech innovation and adoption while building trust among consumers and beneficiaries. Data protection, peer-to-peer lending, mobile money, access to payment infrastructures for non-banks, robo-advisory services, algorithmic/automated trading, and lending activities using artificial intelligence and machine learning offer tremendous opportunities to reducing poverty and promoting shared prosperity; with the appropriate regulatory framework in place.

Join the Conversation