As actuaries working in development, my colleagues and I in the Disaster Risk Financing and Insurance Program ( DRFIP) are constantly looking for innovative ways to apply actuarial science in the fight against poverty. Because the DRFIP is a fairly new initiative — it was established in 2010 to improve the financial resilience of governments, businesses and households against natural disasters — a lot of questions are still to be asked, and lessons to be learned, about helping client countries better calculate financial risk and improve programs that change lives.

That said, exciting advancements are under way, as we learn through exchanging knowledge with experts across the World Bank and partners from other sectors. For example: Once, while on mission in Nairobi, I passed a local Social Protection colleague in the corridor and struck up a conversation that quickly turned to a challenge she was facing. The government of Kenya was aiming to develop a mechanism that would enable its Hunger Safety Net Program, a cash transfer program, to scale up financial assistance to poor families in the case of drought. However, in order to do this, they needed a better understanding of the financial costs of such a mechanism. As droughts are, by their very nature, unpredictable, trying to estimate this cost in advance was a challenge.

How can actuaries best contribute to the development agenda?

My colleagues and I thrive on looking for answers to this type of question every day. While there are other actuaries, both in the Bank and across the sector, the role we are developing from a risk-financing perspective is to help client countries quantify the financial value of unknown risks and develop financial strategies to manage them.

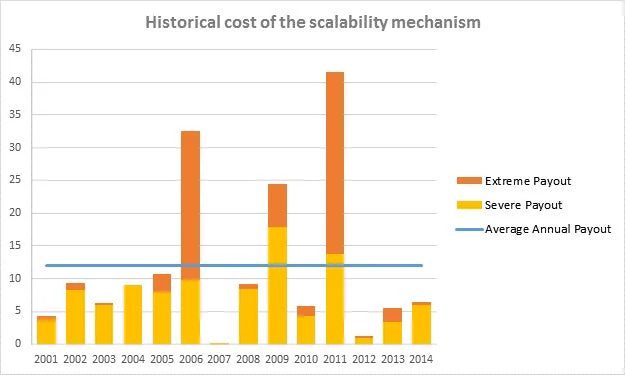

Going back to the Kenya example: We had never ventured into the Social Protection space before in our operational work. Yet, in listening to the challenge, I thought: “The principles of calculating risk are the same, so is there something we could do here?” The first step was to understand what the government wanted, so our team spent an intensive month and many teleconferences discussing exactly that point with government staff. Then, two months later, we delivered our first “social protection” analytics tool, designed to help the government quantify and manage the unknown financial cost of the scalability mechanism (see graph below). In April 2015, our work supported Kenya’s program to scale up and reach more families in need during a drought in northern Kenya: About 165,000 households received cash transfers directly into their bank accounts — 90,000 more than those who already receive regular cash assistance. Again in May, the program was able to deliver emergency cash transfers to an additional 40,000 households.

This effort built extensively on the work that our team had carried out in the Pacific, where we developed analytical tools to help Pacific Island Countries (PICs) select their insurance protection from the Pacific Catastrophe Risk Assessment and Financing Initiative (PCRAFI). (Regarding the Pacific tools, we are now four years into the program and still refining the approach!) One key challenge we faced in the Pacific was that PICs didn’t gain enough understanding of the tool for it to really add value. To overcome this challenge in the case of Kenya, we spent a complete day training government staff in how to use the tool, developing mock tests to see if they really understood it, and setting them questions to answer with the tool. And they loved it! We got great feedback from the workshop, and what the participants enjoyed most was being tested in how to use the tool. That said, our discussions with the client during the course of the workshop made us realize that there were many improvements that we could make. So we asked the client, “How can we improve the interface? Is there a question important to you that the tool doesn’t address? Have we missed a key way to present the information?”

On a quest to convert

It’s an exciting time to be a World Bank actuary. We are seeing our clients become more sophisticated in their financial management of disaster risk and, with increased sophistication, comes higher demand for information and tools to make more evidence-based decisions. To meet this demand, the DRFIP has launched an Analytics workstream.

To develop needed tools, expertise in economics, finance and statistics is required, and we’ve found that the actuarial skill set lends itself well to this agenda.

However, there’s a catch: Trying to pull more actuaries out of their comfort zone and into the world of development has always been a challenge. Yet the professional experience can be great: Actuaries can be genuine innovators in our field. While the work is often challenging, in part because DRFI is a practice area we are continually developing, it’s also very interesting, and it’s exciting to be part of an effort to push the actuarial frontier in the area of development. I also get to work with people from many walks of life with very different skill sets, and I get to travel to interesting, exciting countries to develop and deliver projects. Finally, the mission is one I truly believe in.

To help recruit the next generation into the field, I recently attended the international ASTIN conference on actuarial science in Sydney, where I presented the analytical work my team has been doing, exposed attendees to actuarial work in development, and attempted to convert some to the development sect. I quickly realized that the material I was going to present was very different from the status quo, with its sessions on “Implementing the claims reserving method” and “Guaranteeing valuation in unfunded pensions.” The provocative title of my session, on the other hand, was “Using actuarial science in the fight against poverty.” Yet, undeterred, I launched into the presentation by showcasing the tool that we had developed in Kenya along with a cost-benefit-analysis tool that our team had developed. My initial reaction was that the presentation was well received, but any real test of genuine interest is always in the questions that follow, so I waited to see what would emerge.

As it happened, I had some good conversations with a wide range of actuaries. The more senior actuaries expressed concern about the relevance of the profession, and some junior actuaries had that glint of excitement in their eyes. Looking back at my own career, it’s probably that sense of excitement that pushed me to take the step into a nontraditional field, about which I have not a single regret. Any now I wonder: Will my presentation encourage another actuary to make the leap . . . ?

Join the Conversation