The 2014 Global Financial Development Report, released today by the World Bank Group, presents the most comprehensive review to date of research findings on an increasingly prominent issue in international economic policy: financial inclusion. It also highlights several key topics that are linked to the growing interest in this topic – advances in technology, product design innovations and the role of financial education in financial inclusion.

It’s easy to understand the focus on technology in this kind of report. Mobile phones and other telecommunications and digital technologies offer potential opportunities for the cost-effective expansion of financial services into previously overlooked or under-served markets. Technology is only part of the reason, however, for increased attention to financial inclusion. There is also a new appreciation for the role of financial services in the lives of the poor – an appreciation gained through a pioneering research effort using “financial diaries” methodology. This includes an awareness that even the best supply-side responses – often powered by new technologies – need to understand the demand side of the equation to be commercially successful and to offer value to consumers.

People typically prefer to spend today than save for tomorrow, as evidenced by the very low savings rates in many countries documented by data in the Global Financial Inclusion Database (“Findex”) ).. The promise of winning a large lottery payout, even when the likelihood is infinitesimally small, can prompt stampedes for tickets – yet persuading people to invest in assets with guaranteed, albeit much lower nominal returns, can be a much harder sell.

The psychological biases behind these phenomena (hyperbolic discounting, difficulty evaluating small probability events, social network aspects of decisions –like buying lottery tickets among a group at work) all affect the success of financial inclusion efforts. Product designs can either take advantage of these factors to the detriment of the consumer – such as aggressively marketed credit products or lottery tickets – or can use these insights to create more attractive financial products and services. For example, commitment savings products have been shown to help people visualize a goal and stick to savings plans. They sometimes also involve social support for the commitment. And savings lotteries are now being tested: They would entice people to save, while at the same time would give them the thrill of a possible cash windfall through a lottery-type mechanism.

Education is critical for enabling consumers to take advantage of financial opportunities while avoiding unnecessary risks. This is another finding from Findex that is highlighted in the report. Consumers who have limited education (0 to 8 years) are 12 percent less likely to have an account at a formal financial institution. This is close in magnitude to being at the bottom of the economic pyramid, and is four times as significant a factor as living in a rural area, where financial services are often difficult to access.

Correlates of Financial Inclusion

Source: Based on Allen, Demirgüç-Kunt and others, 2012.

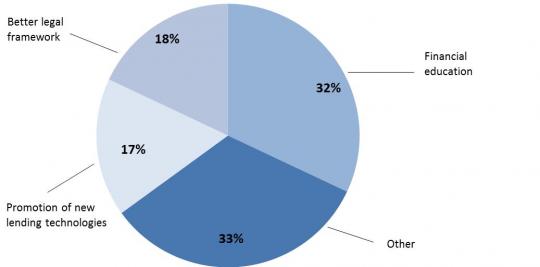

Financial sector regulators are not educators, but they have embraced the concept of the importance of education for strengthening financial inclusion by focusing on financial education, which addresses specific knowledge gaps thought to improve responsible access to finance. A recent informal global poll of country officials and financial sector experts – the Financial Development Barometer – was undertaken for the 2014 Global Financial Development Report. It identified financial education as the leading response to the question, “What is the most effective policy to improve access to finance among low-income borrowers?”

Answers to the question: What is the most effective policy to improve access to finance among low-income borrowers?

Responses from the 2012 Survey of the Financial Development Barometer

Source: 2014 Global Financial Development Report

What still remains to be proven is whether this faith in financial education is substantiated by evidence of impact. Are there approaches to teaching financial skills or modifying financial behaviors through educational programs, training or other outreach activities that have reliable, positive results?

Before we answer that question, let’s look at what we know about the role of financial literacy in financial markets. We know that, just as general education has an impact on financial behavior, so does financial literacy. Research has linked financial literacy or knowledge to a number of positive financial behaviors, including financial inclusion. For example, research by Cole, Sampson and Zia, 2011 find that the use of insurance in India and having a bank account in Indonesia are both linked to higher levels of financial literacy. Unfortunately, new data from national surveys of financial capability (see http://responsiblefinance.worldbank.org/) presented in the Global Financial Development Report show that financial knowledge and skills are sorely lacking worldwide, with consumers in the poorest countries often the least well equipped. For example, a common question on compound interest was answered correctly an average of 65.5 percent of the time in OECD countries, but only 44.5 percent of the time in lower-income countries.

A background paper for the report, “Can You Help Someone to become Financially Capable? A Meta-Analysis of the Literature” by Miller, Reichelstein, Salas and Zia 2013, performs a systematic literature review of studies that evaluate the impact of a wide variety of financial education programs and outreach initiatives. In my next blog post, I’ll discuss their findings, including the role of psychology – as discussed above in the context of financial product design – in the development of financial education interventions.

Join the Conversation